ARTICLE AD

Data shows over $668 million in cryptocurrency long contracts have been squeezed following Bitcoin’s crash under the $68,000 level.

Bitcoin Has Registered A Drop Of 7% In The Last 24 Hours

Right after setting a fresh all-time high (ATH) not too far from the $74,000 level, the Bitcoin price has reversed its trajectory sharply during the past day.

The below chart shows how the digital asset has performed recently.

As is visible in the graph, Bitcoin quickly recovered back towards the $72,400 mark midway through the crash, but the retrace was only temporary, as the coin soon resumed its drawdown and dived under the $67,000 level.

Since this low, BTC has made a slight recovery back to $67,600, meaning that it has experienced a decline of almost 7% in the last 24 hours. As is often the case, Ethereum (ETH) and the altcoins have also followed in the lead of the original cryptocurrency, witnessing crashes of their own.

With all this sharp price action around the market, forceful closure of contracts, or ‘liquidations,’ are bound to have piled up on the derivative side of the sector. Indeed, data confirms this.

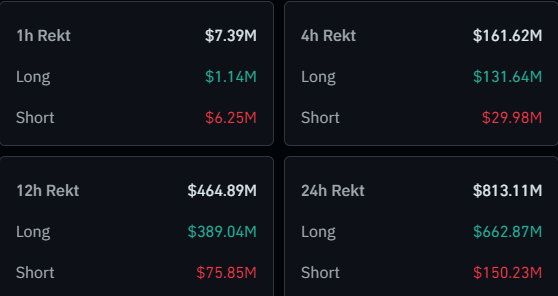

Crypto Derivative Market Has Seen $813 Million In Liquidations Today

According to data from CoinGlass, the cryptocurrency derivative market has observed total liquidations amounting to a whopping $813 million during the past 24 hours.

The table below shows the relevant numbers related to this latest liquidation flush.

As displayed above, around $663 million of these liquidations involved long contracts, meaning that this side of the market contributed an overwhelming 81% of the total flush. This lines up with the price action, as assets across the sector have plunged during this period.

Mass liquidation events like today’s are popularly known as “squeezes.” In these events, liquidations cascade together like a waterfall and amplify the sharp price move that triggered them. As longs took most of the beating in the latest squeeze, it would be categorized as a “long squeeze.”

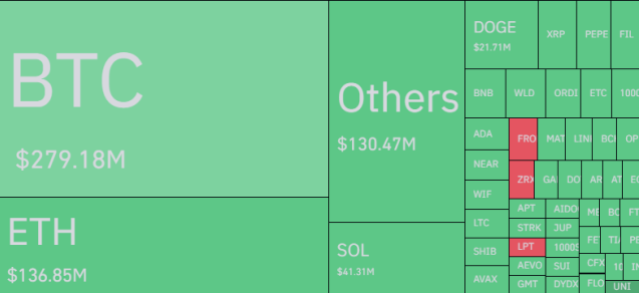

As for how the various individual symbols contributed to this squeeze, the table below shows the data for this breakdown.

Unsurprisingly, Bitcoin and Ethereum, the two largest cryptocurrencies by market cap, are number one and two, respectively. Solana (SOL) is the altcoin with the largest amount of liquidations at $41 million.

SOL is the only coin among the top assets that has managed strong positive returns during the last 24 hours, and it’s also among the best performers for the past week. This strong performance may be why it has more speculative interest behind it than the other alts right now.

Featured image from Shutterstock.com, CoinGlass.com, chart from TradingView.com

9 months ago

44

9 months ago

44