ARTICLE AD

Stabilized ETF inflows clash with hedge funds' arbitrage plays.

Despite the impressive flows registered by spot Bitcoin exchange-traded funds (ETFs) in the US have seen impressive inflows, the expected positive impact on the market prices is being hindered by a strategy called “cash-and-carry.” According to on-chain analysis firm Glassnode, investors are longing Bitcoin through US Spot ETFs and shorting the asset via futures traded in the CME.

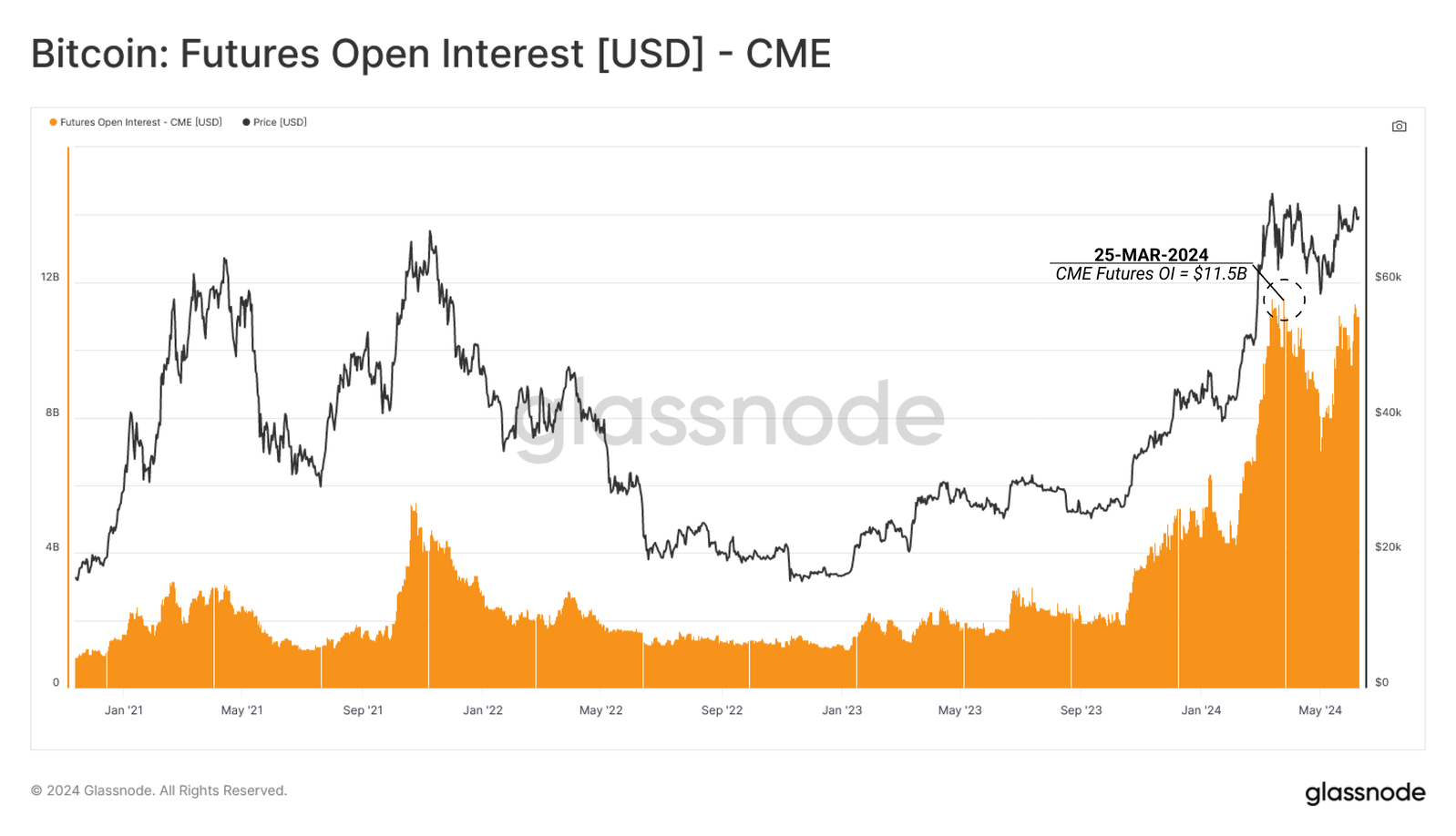

The CME Group futures market’s open interest has stabilized above $8 billion, indicating that traditional market traders are increasingly adopting the cash-and-carry strategy. This involves buying a long spot position and simultaneously shorting a futures contract.

Hedge funds, in particular, are amassing large net short positions in Bitcoin, totaling over $6.3 billion in CME Bitcoin and $97 million in Micro CME Bitcoin markets. This supports the notion that ETFs are being used primarily for longing spot exposure in these arbitrage trades.

Image: Glassnode

Image: GlassnodeThe cash-and-carry trade between long US Spot ETF products and shorting futures has effectively neutralized the buy-side inflows into ETFs, leading to a neutral impact on market prices and indicating a need for organic buy-side demand to stimulate positive price movement.

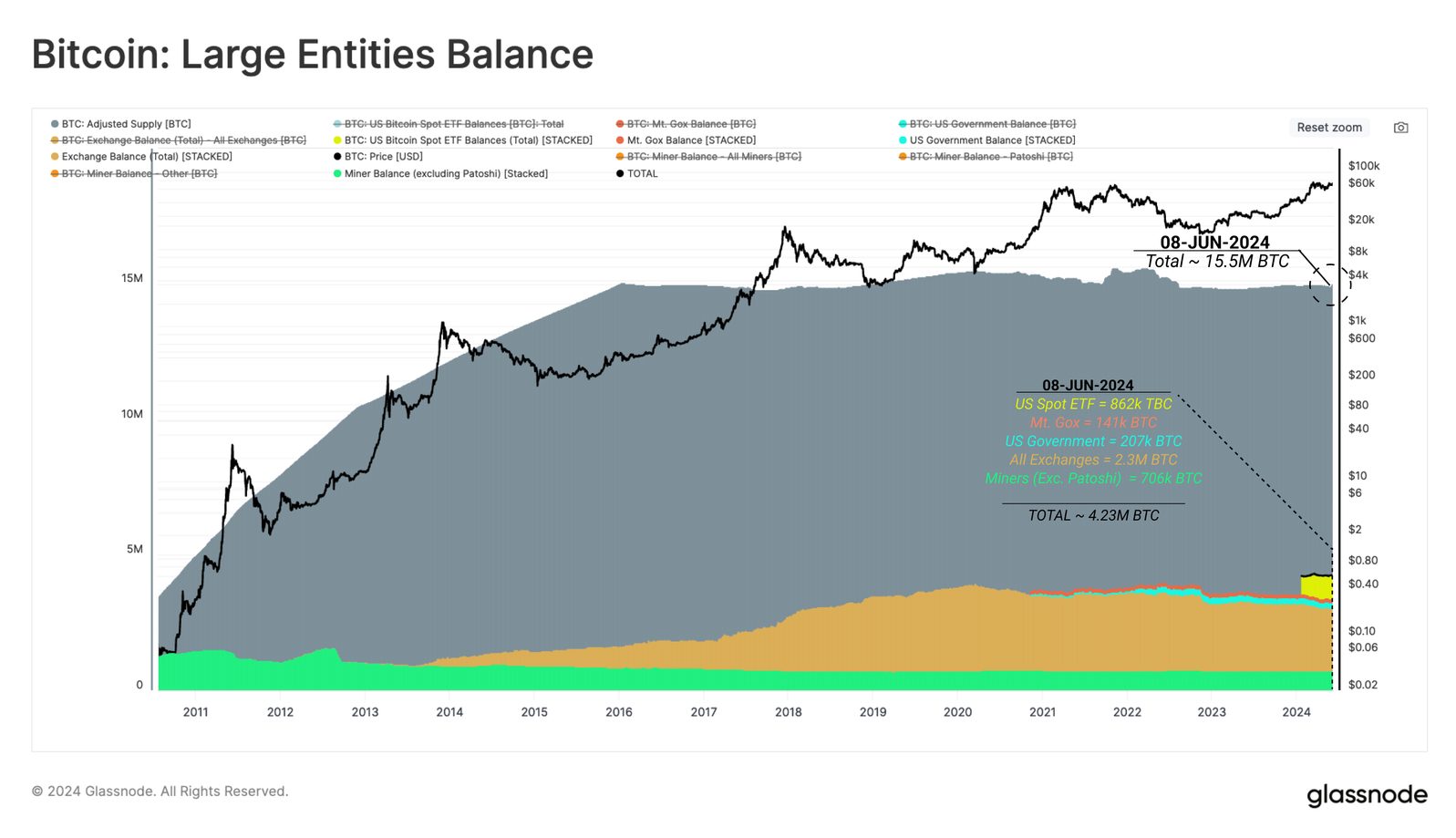

Notably, the amount of BTC funneled into large institutions grows daily with the ETF trading. Mt. Gox Trustee holds 141,00 BTC, the US Government 207,000 BTC, all exchanges combined have 2.3 million BTC, and miners, excluding Patoshi, possess 706,000 BTC. The total balance of these entities is approximately 4.23M BTC, representing 27% of the adjusted circulating supply.

Image: Glassnode

Image: GlassnodeCoinbase, through its exchange and custody services, holds a significant portion of the aggregate exchange and US Spot ETF balances, with 270,000 BTC and 569,000 BTC respectively. The exchange’s role in market pricing has grown, especially with an increase in whale deposits to Coinbase wallets post-ETF launch.

However, a notable part of these deposits correlates with outflows from the GBTC address cluster, which has been exerting selling pressure.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

3 months ago

15

3 months ago

15