ARTICLE AD

Bitcoin surged past the $82,000 mark on Binance, marking a substantial 17% increase since the public announcement of Donald Trump’s victory in the recent US presidential election on Wednesday, November 6. Over the past weekend, the BTC price staged a rare “weekend pump”, rallying by more than 6%. While there are several reasons for this move, one clear main reason stands out: The victory of Donald Trump.

#1 The Bitcoin “Trump Pump”

Donald Trump’s victory has significantly bolstered Bitcoin’s market sentiment, primarily due to his campaign promises and supportive legislative initiatives. During his election campaign, Trump pledged to establish a national Bitcoin reserve by retaining ownership of the 208,000 Bitcoins confiscated through various law enforcement actions over the years.

Senator Cynthia Lummis, a Republican from Wyoming often dubbed the “Bitcoin Senator” for her staunch advocacy, introduced the Bitcoin Act. This legislation aims to acquire 1 million BTC within a five-year timeframe.

As Bitcoinist reported, the Bitcoin reserve could become a reality quite fast. BTC Inc. David Bailey, who is a key Bitcoin advisor to Trump, said recently that it could be done within the “first 100 days” of Trump’s term.

In light of this, crypto research firm Matrixport writes in their latest investor note: “With expectations that Trump will transform US regulatory policies into a more pro-crypto environment, the bullish momentum appears difficult to halt. With his inauguration set for January 20, 2025, the market has several weeks to sustain this rally.

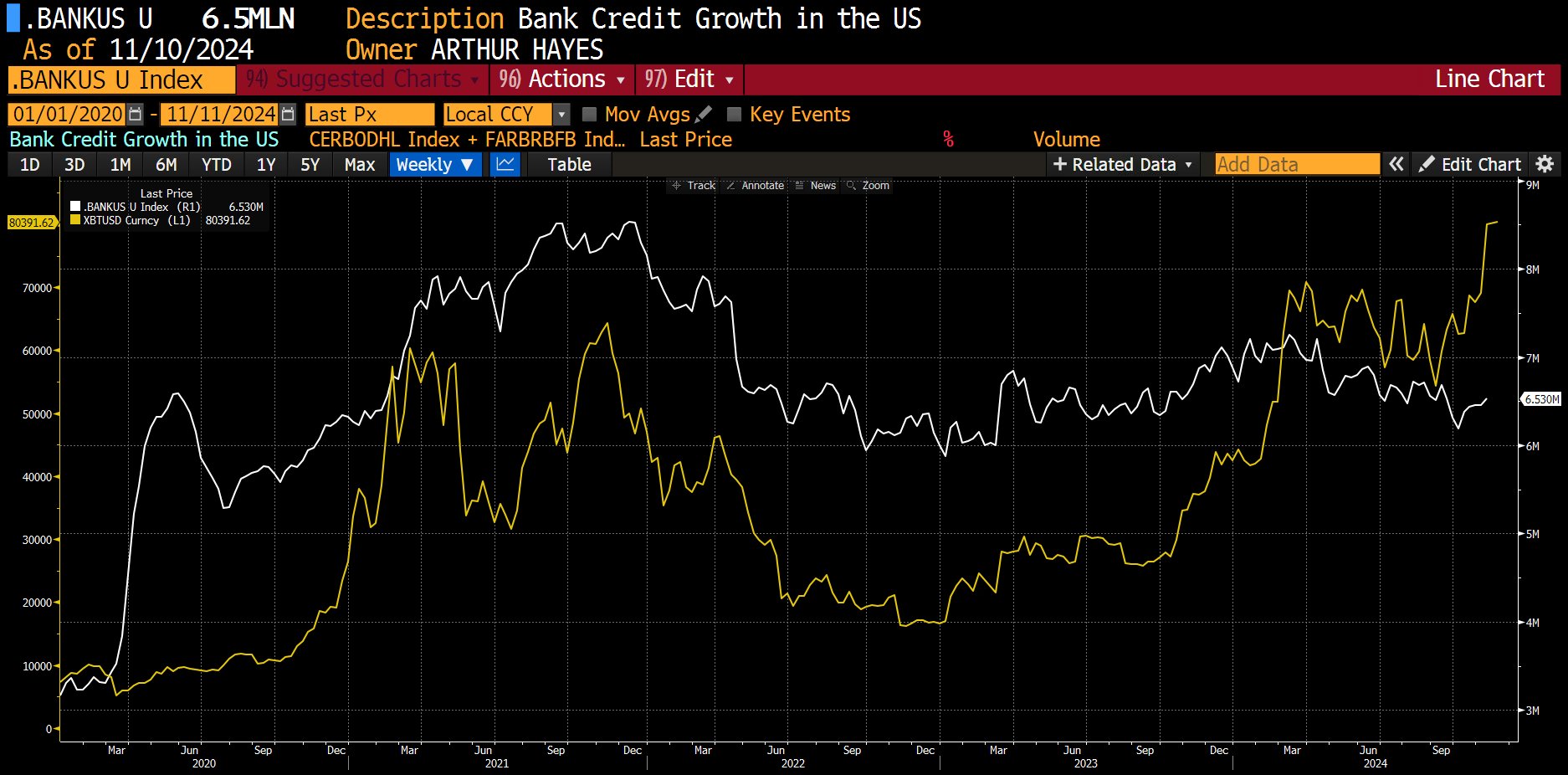

Arthur Hayes, founder of BitMEX, echoed this optimism on X: “Some of y’all don’t believe Trump is about to trash the $ and print money. BTC disagrees. Here is Bitcoin leading vs. my new money supply indicator US Bank Credit. The market is speaking, listen up.”

Bitcoin vs. my new money supply | Source: X @CryptoHayes

Bitcoin vs. my new money supply | Source: X @CryptoHayes

Renowned crypto analyst MacroScope (@MacroScope17) further elaborated on the implications for institutional investors: “Very important for BTC traders to understand how the game has changed since the election. In the institutional world, investments are built around having a thesis […] It’s hard to overstate how much the thesis has now changed for BTC in terms of the policy/political element.”

#2 Rumors About Bitcoin Nation-State Adoption

The strategic plans to establish a national Bitcoin reserve under Trump carry substantial geopolitical weight, potentially igniting a global race to amass Bitcoin reserves. David Bailey remarked, “The Bitcoin Space Race has begun,” noting that “the game theory is playing out faster than anyone could have expected.”

Mike Alfred, founder and Managing Partner of Alpine Fox LP, shared his excitement on X: “I just got a call out of the blue. It was someone important and they said someone huge is buying Bitcoin in size tonight. I almost couldn’t believe it when they said the name. Wild. We are going so much higher.”

Bailey commented on November 10, “There is at least one nation state that has been actively acquiring Bitcoin and is now a top 5 holder. Hopefully, we hear from them soon.” His assertion, accompanied by a meme suggesting certainty over speculation. He added on the size: “Top 5 holder of bitcoin across all users.”

There is at least one nation state that has been actively acquiring Bitcoin and is now a top 5 holder. Hopefully we hear from them soon.

— David Bailey🇵🇷 $0.85mm/btc is the floor (@DavidFBailey) November 9, 2024

#3 Short Squeeze

A significant short squeeze has also contributed to Bitcoin’s price surge. Charles Edwards, founder of Capriole Investments, commented on X: “Circa $1B of shorts squeezed! From the weekend move from $76 to $81K. Open interest at the same level as when BTC traded at $62K. Provided funding continues to settle down, a very healthy up move.”

Data from Coinglass corroborates this, revealing that on Sunday, $133.15 million in BTC shorts were liquidated, with additional $33 million on Saturday. This substantial liquidation of short positions has reduced selling pressure, thereby fueling further upward momentum in Bitcoin’s price.

#4 Retail Is Back

The resurgence of retail interest has been another pivotal factor in Bitcoin’s recent rally. Cameron Winklevoss, founder of Gemini, observed on X: “The road to $80k bitcoin was paved with steady ETF demand. Not retail FOMO. Little fanfare. People buy ETFs, they don’t sell them. This is sticky HODL-like capital. Floor keeps rising. Where are we in the cycle? We just won the coin toss, innings haven’t started.”

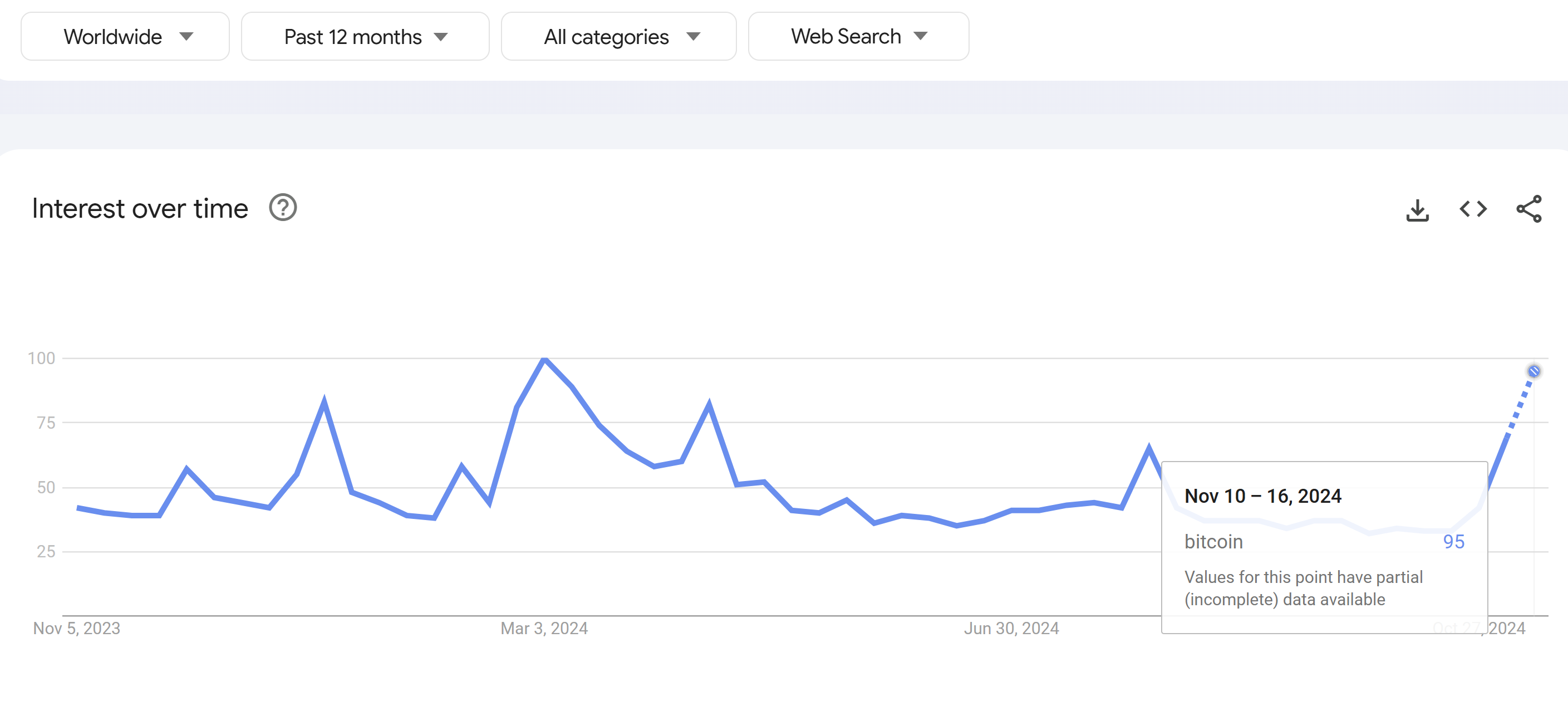

Google Trends data supports this narrative, indicating a 53% increase in Bitcoin-related searches since the first weekend of October. On November 10, Bitcoin web searches peaked at 95, up from 42 points at the end of October. This surge in search activity suggests heightened retail interest and potential influxes of new investors into the market.

Google searches for ‘Bitcoin’ | Source: Google Trends

Google searches for ‘Bitcoin’ | Source: Google Trends

At press time, BTC traded at $81,259.

Bitcoin price, 1-day chart | Source: BTCUSDT on TradingView.com

Bitcoin price, 1-day chart | Source: BTCUSDT on TradingView.com

Featured image created with DALL.E, chart from TradingView.com

2 months ago

25

2 months ago

25