ARTICLE AD

Bitcoin has just broken above the $65,000 level. Here’s a possible reason that may be contributing to this fresh bullish momentum in the asset.

Bitcoin Has Edged Further Closer To A New High With Its Latest Break

After consolidating near the $62,000 mark for a few days, Bitcoin has finally witnessed some uptrend in the past day, as it has not only returned back to the earlier high of $64,000, but also smashed past it to claim the $65,000 level.

The chart below reveals how cryptocurrency has performed in the last few days:

With its returns of more than 5% inside the 24 hours, Bitcoin is among the best performers in the market, with only Cardano (ADA) and Dogecoin (DOGE) outperforming it inside the top 10 coins by market cap list.

Following this rally, BTC has now arrived back at the top observed in April 2021 and is now only a 6% rise away from hitting the $69,000 all-time high set in November 2021.

Now, one question that’s bound to be on the minds of investors would be: what’s driving this latest surge in the asset? Naturally, there are always several reasons factoring into a rally like this, but a major one would be institutional buying pressure.

BTC Coinbase Premium Gap Has Been Positive Recently

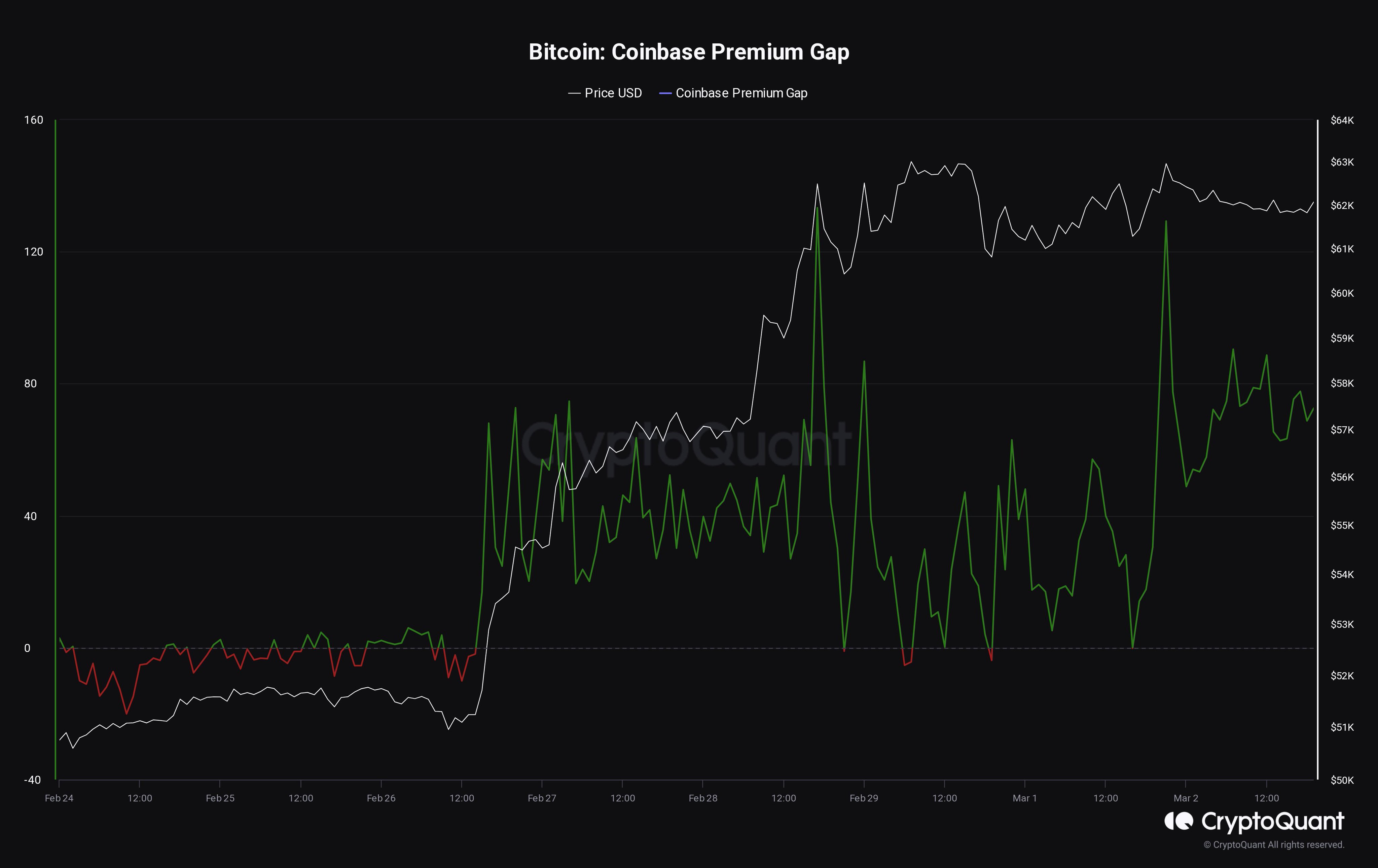

As explained by CryptoQuant Netherlands community manager Maartunn in a post on X, the BTC Coinbase Premium Gap remained positive through the weekend.

The “Coinbase Premium Gap” is an indicator that keeps track of the difference between the Bitcoin prices listed on Coinbase (USD pair) and Binance (USDT pair). This metric’s value can tell us about the difference between the buying (or selling) behaviors on the two platforms.

The below chart shows what the indicator looked like over the weekend:

From the graph, it’s apparent that the Bitcoin Coinbase Premium Gap had turned positive in the last few days of February and remained so in the starting days of this month. Positive values suggest that the BTC price listed on Coinbase has been higher than that on Binance.

The former exchange is known to be the preferred platform of the US-based institutional entities, while the latter hosts global traffic. This would mean that a positive premium can suggest a stronger buying pressure from the American whales.

It’s visible in the chart that the high Coinbase Premium coincided with BTC’s initial surge above $60,000 at the end of last month, implying that these institutional investors played a role.

This weekend also saw high values of the indicator, which may be the reason why Bitcoin has seen its latest rally. Given the pattern, the Coinbase Premium Gap could be to keep an eye on in the coming days, as the large American traders continuing to buy could be a sign that BTC is ready to go higher.

Featured image from Shutterstock.com, CryptoQuant.com, chart from TradingView.com

8 months ago

43

8 months ago

43