ARTICLE AD

The Bitcoin price took a downside turn over the weekend and seems ready to re-test critical support levels. The downside price action was triggered by a spike in selling pressure following the approval of Bitcoin spot Exchange Traded Funds (ETFs) in the US.

As of this writing, the Bitcoin price trades at $40,900 with a 2% loss in the past 24 hours. Over the last week, these losses doubled, with other assets in the crypto top 10 by market underperforming, except for Dogecoin (DOGE), which still records a 4% profit in the same period.

BTC’s price trends to the upside on the daily chart. Source: BTCUSDT on Tradingview

BTC’s price trends to the upside on the daily chart. Source: BTCUSDT on Tradingview

Bitcoin Price Loses Steam, How Low Can BTC Go?

Via the social media platform X, the founder and former CEO of crypto exchange BitMEX, Arthur Hayes, shared a forecast for the Bitcoin price. According to Hayes, BTC seems poised to lose its current levels.

The crypto founder and trader claims that the low timeframe price action will likely push Bitcoin below $40,000 and potentially below $35,000 if bulls fail to defend the higher area around these levels.

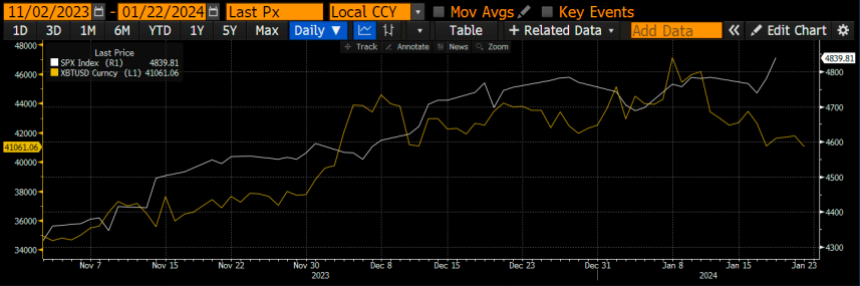

The main issue regarding the current market structure rests upon the liquidity in the Bitcoin market. As seen in the chart below and as pointed out by Hayes, the liquidity in the BTC market has been trending to the downside since the Bitcoin spot ETF was approved.

As a result, and due to the constant selling pressure from the Grayscale Bitcoin Trust (GBTC), the market has been trending to the downside and could maintain this course until the next major macroeconomic event.

On the above, the BitMEX founder stated:

Why has $SPX and $BTC stopped moving up together post US BTC ETF launch? Both are love more $ liq, which one is right about the future? $BTC is telling us that there are hiccups ahead for $ liq, next signpost is 31st Jan US Treasury refunding annc (announcement).

The BTC market sees a decline in liquidity, impacting the price action. Source: Arthur Hayes on X

The BTC market sees a decline in liquidity, impacting the price action. Source: Arthur Hayes on X

If Bitcoin Goes South, What Levels Could Hold The Line?

A pseudonym crypto analyst showed a cluster of buying orders stacked from the $38,819 to the $40,000 levels in a separate report. In other words, these levels should present opposition and seem like BTC’s biggest opportunity to bounce back, at least on low timeframes.

In that sense, the analyst stated the following, anticipating a possible short-term recovery, and showing the image below:

Some big zones starting to build up around 41K & 42K. Pretty certain we’ll at least take out that top part somewhere next week. Will see if price sustains after that.

BTC chart shows a stack of bid liquidity around $38,800 to $40,000. Source: DaanCrypto on X

BTC chart shows a stack of bid liquidity around $38,800 to $40,000. Source: DaanCrypto on X

Cover image from Unsplash, chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

1 year ago

81

1 year ago

81