ARTICLE AD

The recent decline in Bitcoin’s value may be partly attributed to traders’ growing interest in speculative memecoins that offer limited liquidity.

In a dramatic turn of events, Bitcoin (BTC), the bellwether of the cryptocurrency market, has tumbled below the $67,000 mark, triggering a frenzy of liquidations totaling over $650 million. This sharp downturn comes on the heels of a failed attempt to breach the formidable $72,400 resistance level, leaving traders and investors alike on edge as they navigate the cryptocurrency market’s rollercoaster ride.

Analysts are now closely watching for signs of a market bubble and predicting possible support levels as Bitcoin’s price trajectory remains uncertain.

Market Turmoil as Bitcoin Price Falls Below $67,000

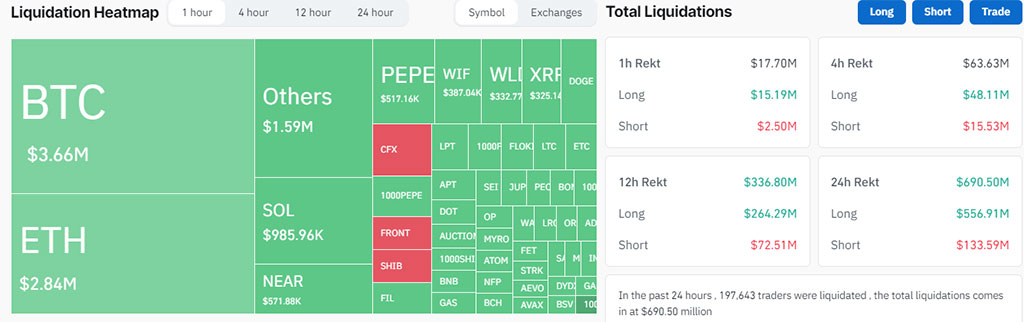

Crypto Liquidations Heatmap. Photo: Coinglass

The crypto market experienced a tumultuous period with Bitcoin plunging below the $67,000 mark, causing a chain reaction of liquidations totaling more than $650 million in losses.

Liquidations happen when traders are unable to meet the margin requirements for their leveraged positions, forcing them to close these positions. This event serves as a stark reminder of the volatility inherent in cryptocurrency investments and emphasizes the need for robust risk management practices among traders and investors.

Bitcoin’s decline came after it struggled to surpass the crucial $72,400 resistance level. Initially, there were signs of a recovery as the cryptocurrency bounced back from $68,500 to $72,400.

The bullish surge was fleeting, and Bitcoin hit a wall at the $72,400 mark. Soon after, the digital asset plummeted to $66,700, catching many traders off guard. This swift reversal triggered a cascade of liquidations, affecting a massive portion of the trading community.

Analysts Suggest “Bubble Traits” and Warn Further Price Correction

The recent drop in Bitcoin’s value has sparked concerns among experts, who draw parallels between current market dynamics and past speculative bubbles.

Michael Hartnett, Bank of America Corp.’s Chief Investment Strategist, points to similarities with previous bubbles, citing the tech sector’s ‘Magnificent Seven’ stocks and the cryptocurrency market’s record highs as examples of potentially unsustainable price levels.

As Bitcoin price remains volatile, analysts are closely watching for potential support levels and future price movements. Some analysts suggest that Bitcoin could test the $65,000 to $66,000 range soon. Jesse Myers, a BTC analyst, warns of a potential short squeeze at $74,000, but also notes that there is ample supply available for liquidating long positions at $66,000.

However, amid the market downturn, there are substantial trading prospects for those looking to invest in the primary cryptocurrency. With approximately 197,643 liquidated orders, the impact of this market swing is evident, presenting a great trading potential.

The impact of Bitcoin’s performance has been significant, affecting a majority of the top 100 cryptocurrencies, which have seen declines over the past 24 hours.

Why Did Bitcoin Price Plummet?

The recent decline in Bitcoin’s value may be partly attributed to traders’ growing interest in speculative memecoins that offer limited liquidity. According to data from Santiment, traders tend to reinvest their profits into these meme tokens whenever Bitcoin reaches new highs.

Why is #Bitcoin down 6.6% today?

We noticed that a #Binance deposit wallet moved 4,637 $BTC($329M) to #Binance hot wallet in the past 24 hours.

Coincidentally, the deposit wallet also moved 4,876 $BTC($319M) to #Binance hot wallet during the $BTC drop on Mar 5. pic.twitter.com/EHEzGwV1U9

— Lookonchain (@lookonchain) March 15, 2024

Additionally, LookOnChain, a data platform, reported a substantial deposit of 4,637 BTC, valued at nearly $330 million, into Binance’s Hot Wallet in the last 24 hours. Interestingly, this wallet had previously deposited 4,876 BTC on March 5, a move that coincided with a 14% market correction.

9 months ago

44

9 months ago

44