ARTICLE AD

Bitcoin's stability challenged by consistent selling from influential investors.

Bitcoin (BTC) dropped by 4.4% last week pressured by long-term holders (LTH), whales, and miners selling their holdings, according to the latest edition of the “Bitfinex Alpha” report. The movements happened mainly through exchange sales and over-the-counter (OTC) transactions.

These groups, historically known to divest during bull markets and consolidation phases, are demonstrating their market influence once again. The recent selling, though less intense than previous instances, underscores the significant impact LTHs and whales have on liquidity and price fluctuations.

Image: Bitfinex/TradingView

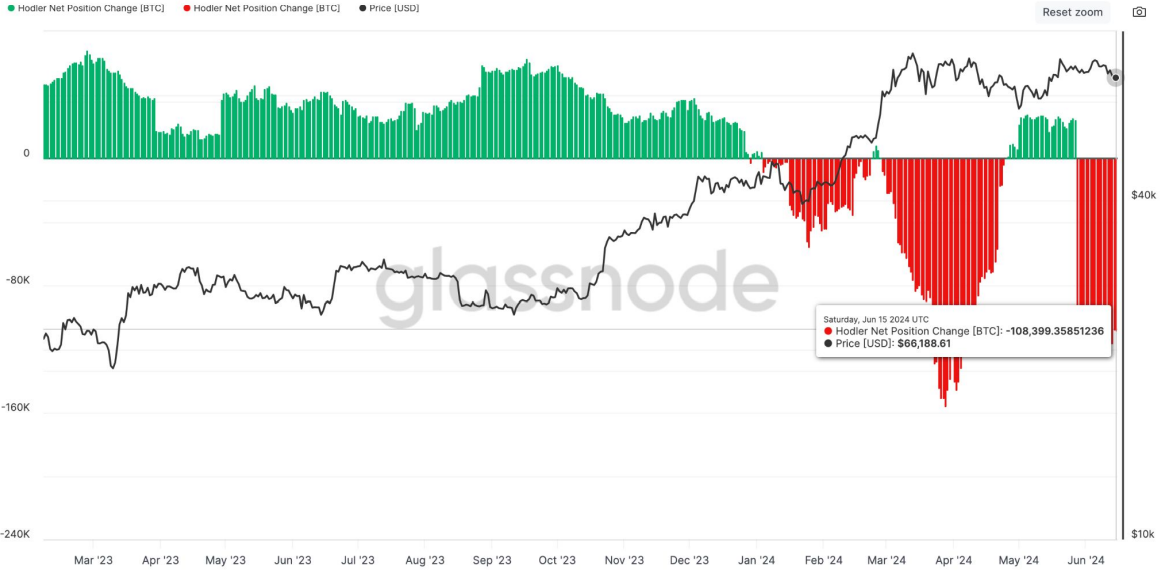

Image: Bitfinex/TradingViewNotably, on-chain metrics reveal that LTHs were the main contributors to the recent sell-off, overshadowing exchange-traded funds (ETF) outflows. This activity aligns with the unwinding of the basis arbitrage trade highlighted in the previous week’s Bitfinex Alpha report. The “Hodler Net Position Change” metric, which tracks the monthly position changes of LTHs, has registered negative activity, indicating a selling trend among this cohort.

Hodler Net Position Change. Image: Bitfinex/Glassnode

Hodler Net Position Change. Image: Bitfinex/GlassnodeAdditionally, the top 10 inflows into exchanges have risen as a proportion of total inflows, signaling heightened whale activity. This trend typically precedes a price drop, although the past three months have seen Bitcoin’s price remain relatively stable, possibly due to robust spot ETF demand. Nonetheless, the ongoing selling is seemingly capping Bitcoin’s potential price gains.

The Coinbase Premium Index, another indicator of whale behavior, suggests strong selling pressure from US investors on Coinbase Pro, as evidenced by a consistent negative percentage difference compared to other major exchanges.

Furthermore, an inverse relationship between Bitcoin’s price and miner reserves has been observed, with a notable decline in miner reserves coinciding with the peak in Bitcoin’s price around March 2024, indicating miners were selling to capitalize on high prices and prepare for the halving event.

As miner reserves approach four-year lows, it suggests that selling pressure from this group may be nearing a critical point, potentially impacting future market dynamics.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

3 months ago

26

3 months ago

26