ARTICLE AD

Bitcoin's implied volatility sees a marked decrease, signaling a shift towards a more stable market.

Bitcoin (BTC) volatility has been decreasing since its halving in April, which indicates a shift towards price stability, according to the latest “Bitfinex Alpha” report.

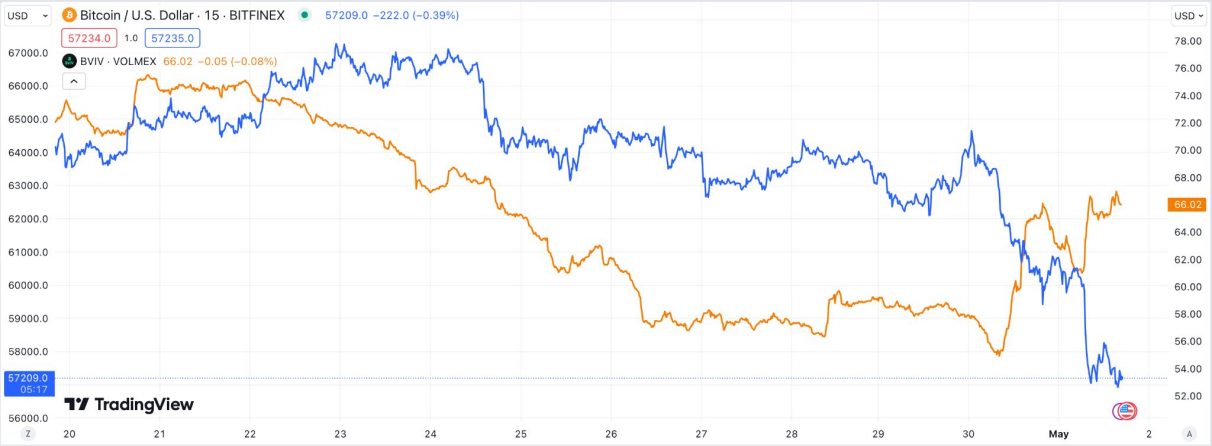

Bitcoin’s implied volatility (BVIV) plummeted by 18%, from 74.5% to 56.4%, signaling a market adjustment to the new supply dynamics. Ethereum’s implied volatility (EVIV) also fell by 9.9%, from 61.9% to 52%, despite a slight uptick in price.

Bitcoin’s implied volatility. Image: Bitfinex/TradingView

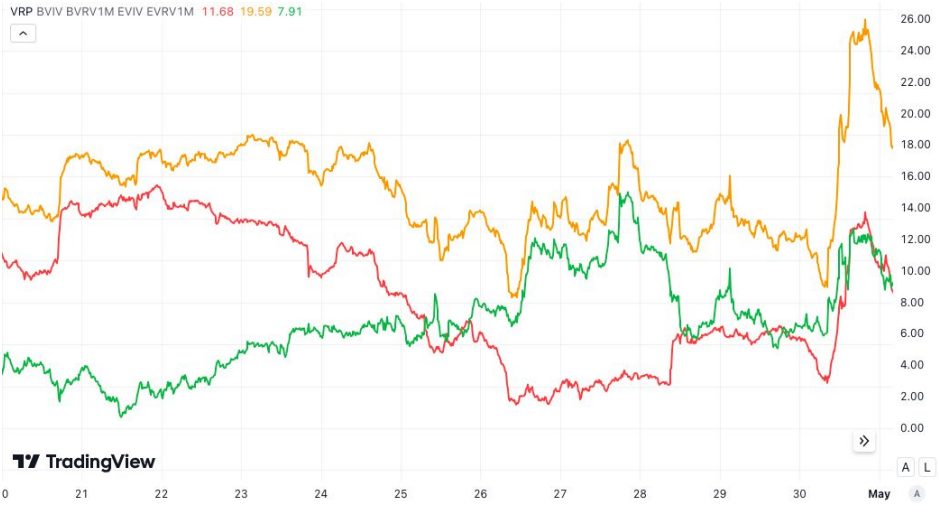

Bitcoin’s implied volatility. Image: Bitfinex/TradingViewThe reduction in volatility risk premiums (VRP) for both Bitcoin and Ethereum suggests a recalibration of market expectations. Bitcoin’s VRP dramatically decreased to 2.5% from 15%, with Ethereum’s VRP following suit, dropping to 8.5% from 18%. This narrowing of the VRP points to a realignment of investor sentiment towards a more predictable post-halving market environment.

The changes in spot-volatility correlations for Bitcoin and Ethereum further underscore this trend, with Bitcoin’s one-week spot-vol correlation decreasing to -20% from -56%. The market’s response to the halving indicates a lessened concern for future uncertainties and a consensus that volatility may be lower than previously expected.

BTC VRP (red), ETH VRP (orange) and VRP difference (green). Image: Bitfinex/TradingView

BTC VRP (red), ETH VRP (orange) and VRP difference (green). Image: Bitfinex/TradingViewDespite the bearish trajectory Bitcoin has taken since reaching a new all-time high in March 2024, the Exchange Whale Ratio suggests that a stabilization of selling pressure could be imminent. The Realised Loss breakdown reveals that short-term holders are currently the main drivers of selling pressure. However, the Short-Term Holder MVRV (STH-MVRV) ratio is at 0.96, hinting at a potential market recovery as selling pressure subsides.

Moreover, the Bitcoin Fundamental Index (BFI), an index that assesses various aspects of Bitcoin’s network health also points to a possible upward trend, as network growth indicators surpass levels seen at past market bottoms. The market’s direction now heavily relies on liquidity expectations set by upcoming FOMC decisions, Bitfinex’s analysts conclude.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

6 months ago

36

6 months ago

36