ARTICLE AD

Bitcoin has gained 16% in the past week and over 15% in the last 30 days, but price volatility still rocks leveraged crypto positions across the board.

While Bitcoin (BTC) exchanged hands above $49,000 on Feb. 12 following eight consecutive green days, cryptocurrency traders experienced sweeping liquidations in the past 24 hours.

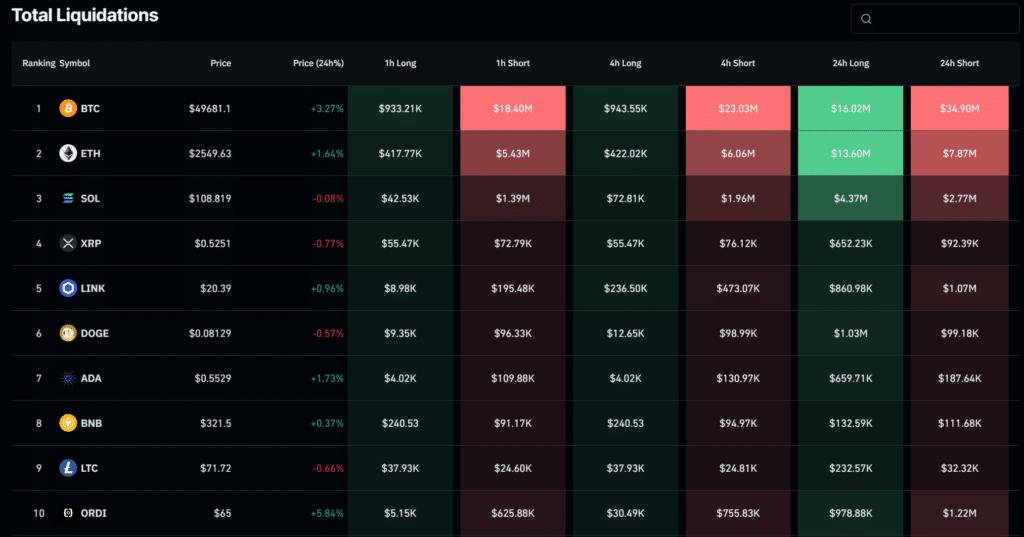

According to CoinGlass, over $135 million was eliminated from crypto markets, represented by both long and short positions. Traders take long bets when they expect higher prices and, conversely, short bets when the prediction tilts toward lower ranges.

The single-largest liquidation order occurred on the crypto exchange OKX and was denominated in an ETH-USD pair worth nearly $4 million. However, the BTC shorts comprised the largest liquidated positions overall.

Over $35 million in short Bitcoin positions were wiped out against roughly $16 million in long trades. Ethereum (ETH) ranked second, but long positions dominated the asset’s closed leveraged bets. Volatility in the crypto markets stopped more than $13 million in ETH longs and over $7 million in ETH shorts.

Solana (SOL) liquidations followed BTC and ETH in third, with less than $8 million in closed leveraged trades.

Top liquidations in 24 hours | Source: CoinGlass

Top liquidations in 24 hours | Source: CoinGlass

Bitcoin surges over $49,000

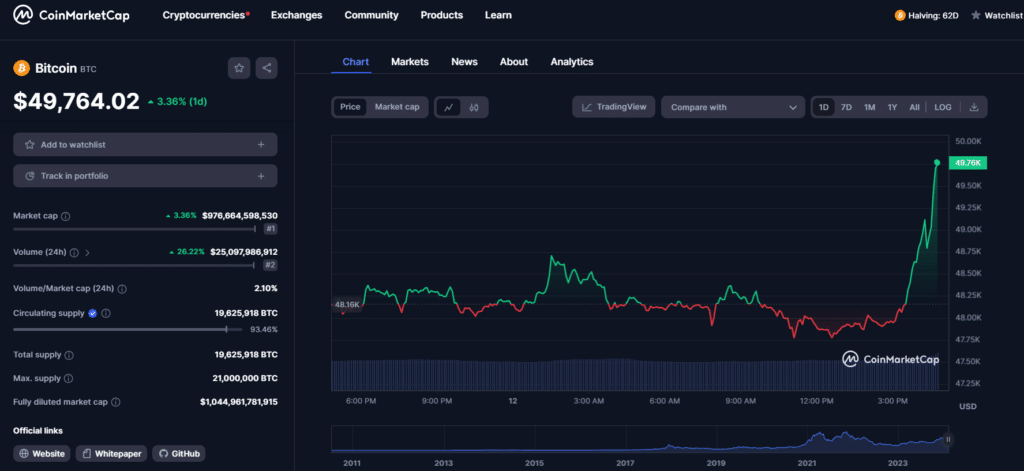

Meanwhile, crypto’s largest token broke above $49,000 for the first time since Jan. 11. BTC had gained over 3% at press time, and interested buyers could acquire the coin for around $49,700 per CoinMarketCap.

A 26% surge in daily trading volume accompanied this price increase, as BTC traders transacted over $25 billion across supported venues. The token’s market capitalization shot up to $970 billion, only $30 billion away from achieving a $1 trillion valuation.

Fifteen years after its debut and 62 days before its fourth halving, BTC would be the first cryptocurrency in history to achieve this milestone.

BTC price on Feb. 12 | Source: CoinMarketCap

BTC price on Feb. 12 | Source: CoinMarketCap

1 year ago

65

1 year ago

65