ARTICLE AD

Exchange outflows of $2.7B in Bitcoin highlight shifting investor behavior amid ETF milestones and declining on-platform balances.

Key Takeaways

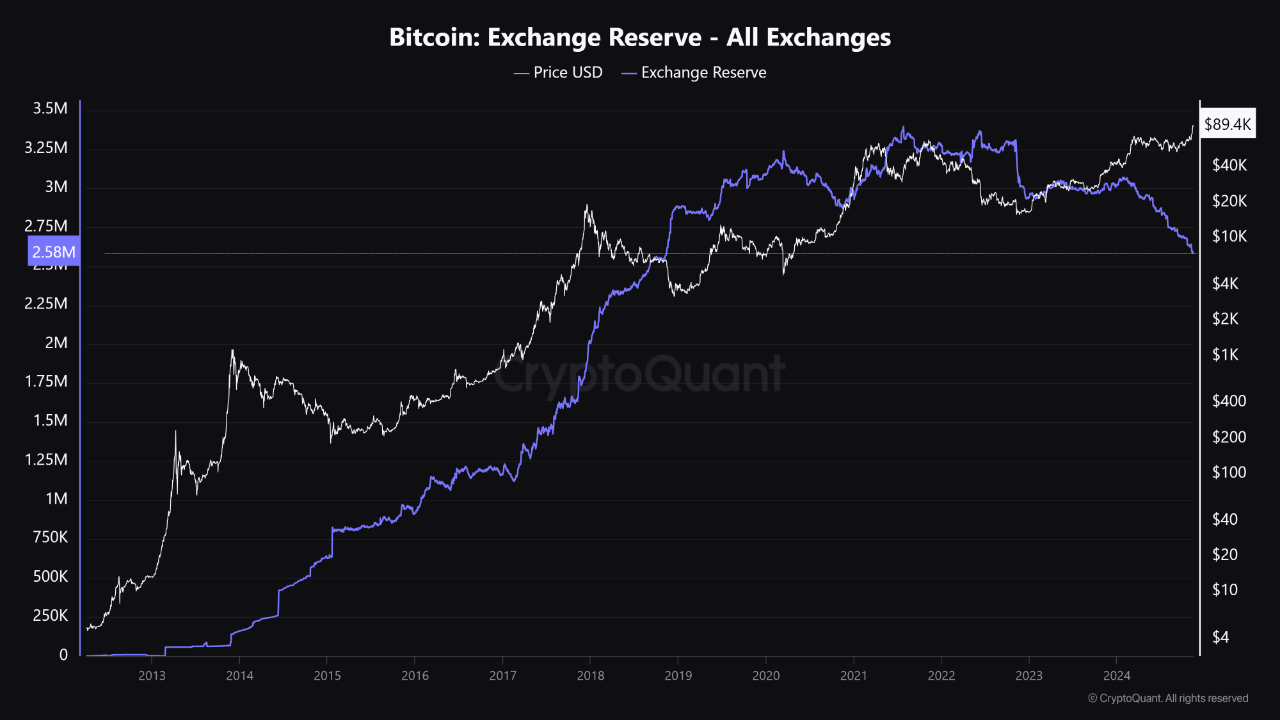

Bitcoin reserves on exchanges have dropped to 2.3 million, the lowest level since November 2018. Data from CoinGlass shows $2.7B in weekly outflows and $7.58B in monthly outflows as confidence in Bitcoin grows with ETFs now holding 1 million BTC. <?xml encoding="UTF-8"?>Bitcoin reserves on exchanges have fallen to their lowest level since November 2018, according to a CryptoQuant-verified analyst.

Bitcoin Exchange Reserve Chart (Source: CryptoQuant)

Bitcoin Exchange Reserve Chart (Source: CryptoQuant)Data from CoinGlass shows exchanges experienced outflows of roughly 30,000 Bitcoin, valued at $2.7 billion, in the past week.

Over the last 30 days, outflows reached 85,000 Bitcoin, worth $7.6 billion.

Exchange-held Bitcoin has declined steadily since January, dropping from 2.72 million to 2.3 million Bitcoin, as investors move their holdings to private wallets for long-term storage.

The trend coincides with the growth of Bitcoin ETFs, which now collectively hold 1 million Bitcoin.

BlackRock has emerged as the largest institutional Bitcoin holder, with more than 470,000 Bitcoin valued at $41 billion under management.

With a reduced supply on exchanges and a growing dominance of long-term holders and ETFs, the Bitcoin market could become more resilient, setting the stage for potential new price peaks.

Disclaimer

2 months ago

19

2 months ago

19