ARTICLE AD

On-chain data shows the demand from retail investors for Bitcoin has slumped to 3-year lows, a sign that may be bearish for BTC.

Bitcoin Retail Investor Transfer Volume Has Plummeted Recently

As explained by CryptoQuant founder and CEO Ki Young Ju in a new post on X, retail investor demand has seen a sharp decline recently. The “retail investors” here refer to the smallest investors in the Bitcoin market.

The transfer volume corresponding to them is generally used to track the demand for using the cryptocurrency that’s present among any cohort. In the case of retail investors, their transactions are typically valued at less than $10,000 due to their small size.

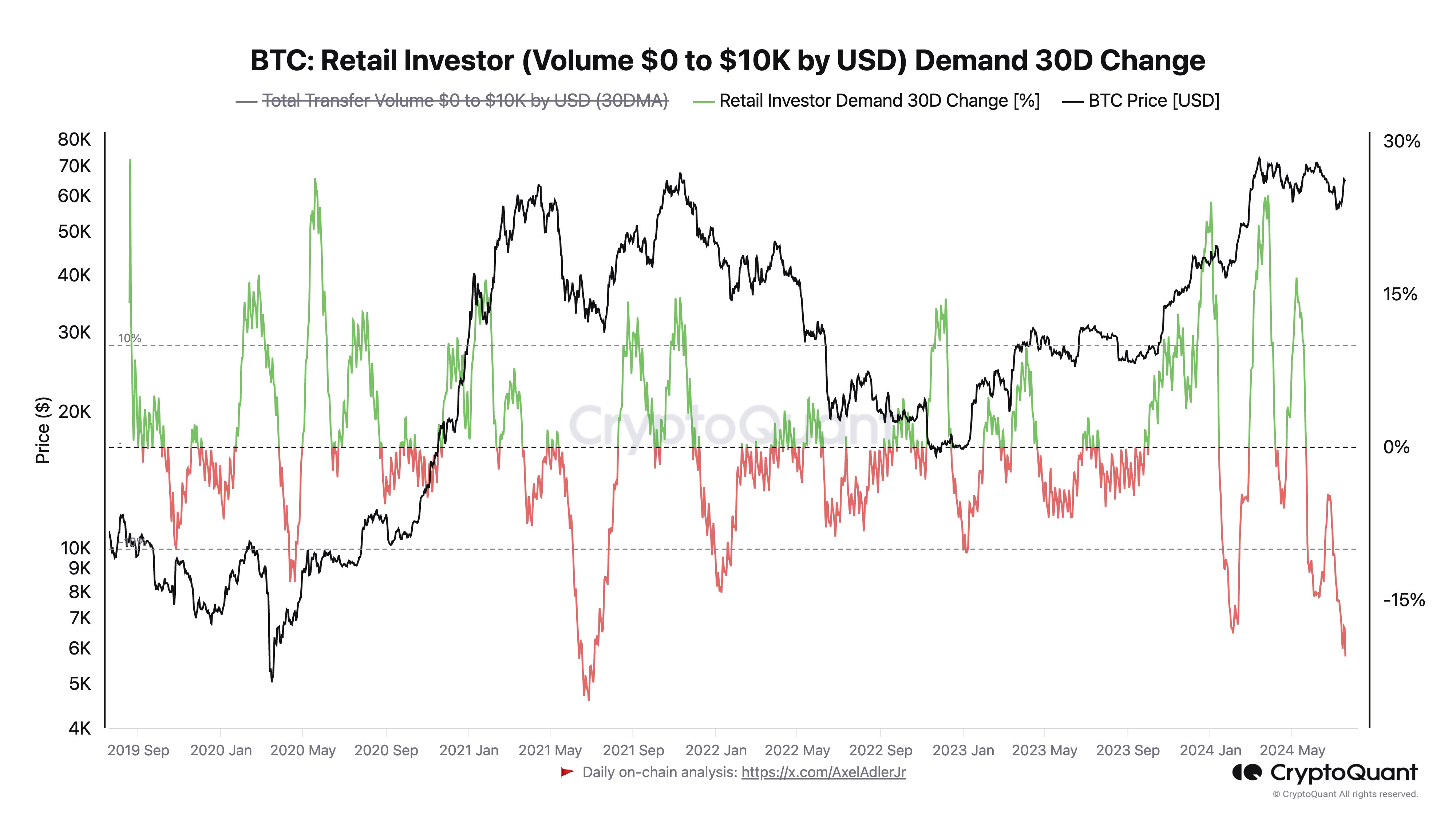

As such, Young Ju has cited the 30-day change in the total transfer volume for transactions of this size to show what the demand among retail investors is currently looking like.

Below is the chart shared by the CryptoQuant founder that displays the trend in this metric over the past few years.

As is visible in the above graph, the 30-day change for the retail investor transfer volume has recently plunged deep into the negative territory for Bitcoin, implying that the transfer volume associated with these holders has been shrinking.

The decline rate is quite notable, as the metric’s value is currently at the lowest level in around three years. This drawdown would suggest that the recent bearish action in the market has made retail investors lose interest in the cryptocurrency.

The BTC price has been recovering over the past week, but it’s clear that it hasn’t been enough yet to reignite demand among this cohort. It remains to be seen whether the transfer volume for these investors sees a turnaround in the coming days if the price continues in this trajectory.

While demand for using the blockchain has been low among retail investors recently, they have still been buying, as analyst James Van Straten has explained in an X post.

The analyst has also pointed out how these investors have started to behave like smart money. The chart shows that they have been buying net amounts during dips in the Bitcoin price while selling around tops.

The most prominent example of this pattern is the buying spree this group went on during the bear market lows following the crash due to the collapse of the cryptocurrency exchange FTX.

BTC Price

When writing, Bitcoin is trading around $64,100, up over 11% in the last seven days.

Featured image from Dall-E, Glassnode.com, CryptoQuant.com, chart from TradingView.com

4 months ago

27

4 months ago

27