ARTICLE AD

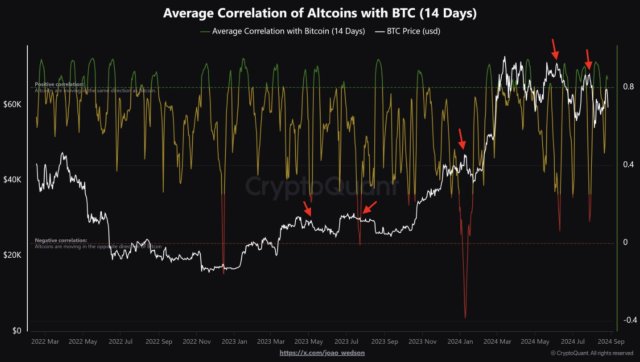

As the entire crypto market is demonstrating a rebound, a crypto expert has provided insights on the relationship between altcoins and Bitcoin, the largest cryptocurrency asset, emphasizing how closely the recent performance of altcoins is connected to the current movement of BTC.

This relationship is especially clear when there is a lot of volatility, as changes in BTC can have a ripple effect on the cryptocurrency market as a whole, demonstrating the digital asset’s dominance in the industry.

Altcoins Movement Aligns With Bitcoin’s Performance

In the ever-evolving world of cryptocurrency, understanding the correlation of tokens is crucial for investors to navigate the volatile digital asset market. Due to this, Joao Wedson, a crypto investor and researcher has shed light on the correlation between altcoins and Bitcoin.

The expert underscores how much Bitcoin’s price trends continue to impact the general altcoin market behavior, even though the coins can occasionally show independent price movements.

According to Wedson, there is a positive correlation between altcoins and BTC at the moment, which suggests that these tokens are tracking BTC’s price trend in the past few days. With altcoin moving in lockstep with BTC, it seems that investors are confident about the entire crypto market, triggering a general alignment in the market.

Altcoins’ correlation with Bitcoin | Source: CryptoQuant on X

Altcoins’ correlation with Bitcoin | Source: CryptoQuant on X

Presently, Wedson highlighted that altcoins that are now showing the highest relationship with BTC’s price movement include BNT, AXS, Chainlink (LINK), Algorand (ALGO), and Cardano (ADA), which implies that they are closely following the changes in its price trend.

Meanwhile, other top altcoins such as DASH, CRV, DYDX, BNB, and ALICE are exhibiting the lowest correlation levels, indicating that they are gradually becoming less dependent on Bitcoin.

Nonetheless, Wedson underlined that all these altcoins, despite their individual variances, are still generally demonstrating a positive correlation, suggesting the impact of BTC’s performance on the tokens.

Although the correlation between altcoin and BTC is currently positive, Wedson has stressed the importance for investors to conduct lucid observations of the trend before taking any action, given the volatile nature of the crypto market.

This behavior, according to the expert supports the theory that the general market is now moving in tandem with BTC, which could trigger stability in the short term. However, it also necessitates consistent observation to spot any possible irregularities that can present risks in the future.

Impact On The General Market

Wedson noted that historically when the average altcoin correlation tends to turn negative, it is considered a danger sign for BTC and the overall market, which means investors are expected to be very cautious during this period. Typically, the negative alignment takes place when altcoins perform significantly better than Bitcoin, frequently leading to a decline in BTC’s value.

He further drew attention to several occasions in January, June, and July of this year when altcoins outpaced BTC. However, not too long after, the market witnessed a “dump,” especially in Bitcoin, underscoring the significance of keeping an eye on these signals.

Featured image from Unsplash, chart from Tradingview.com

2 months ago

22

2 months ago

22