ARTICLE AD

Analysts see whale activity, miner reserves as key to Bitcoin's market dynamics.

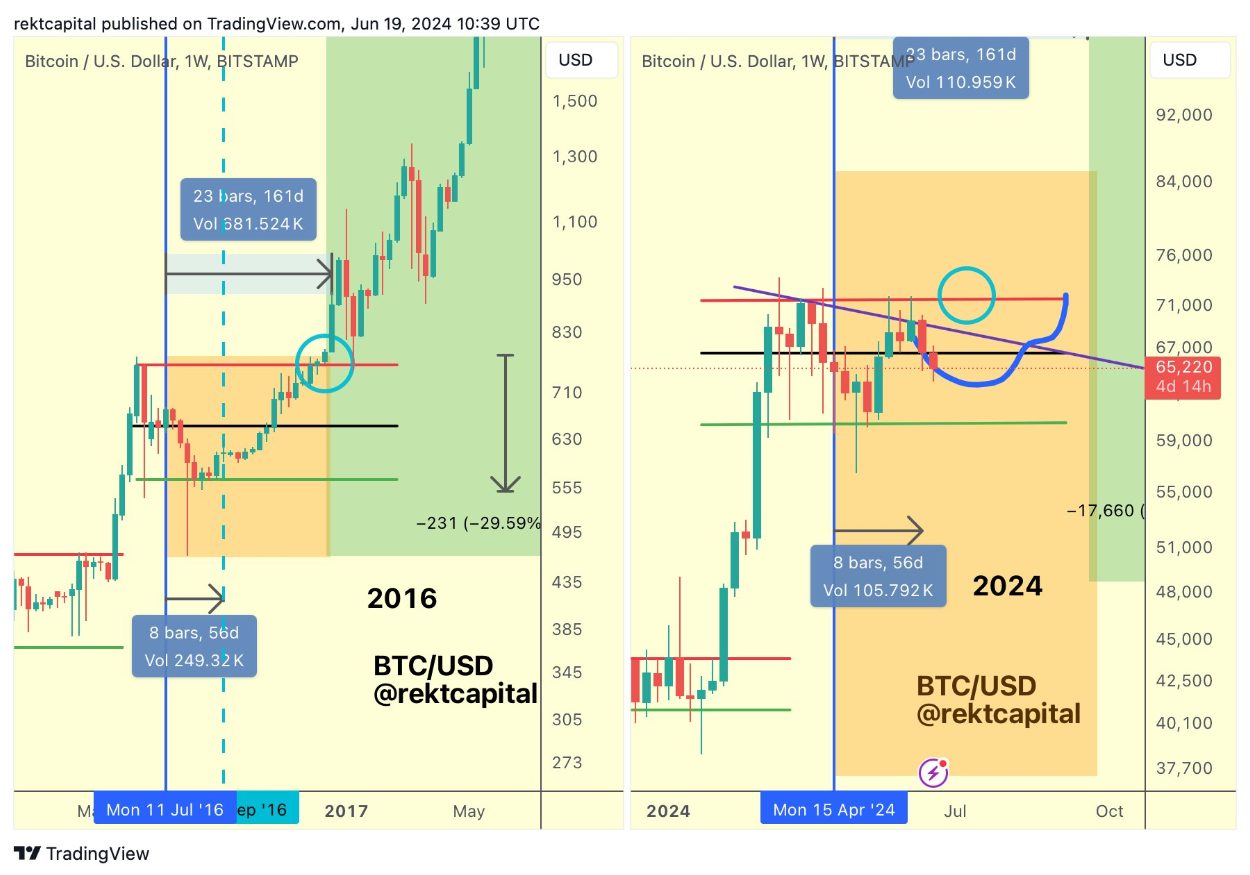

Bitcoin (BTC) has suffered pressure from a downtrend in June so far, according to the trader identified as Rekt Capital. A breakout from this trend, however, could spark a price reversal and put BTC back in its upward movement.

Bitcoin has been in a constant downtrend all of June thus far (light blue)

But break this downtrend line and BTC will initiate a price reversal$BTC #Crypto #Bitcoin pic.twitter.com/SgkVRoMsfA

— Rekt Capital (@rektcapital) June 18, 2024

Notably, the price reversal wouldn’t be the start of a parabolic upward movement, but a local reversal. This means that Bitcoin would still be stuck in the range between $60,600 and $71,500, which is constantly described by Rekt Capital in his analysis.

Moreover, the price action so far is comparable to previous 60-day post-halving periods, which might calm investors who are desperate about the possibility of the current bull cycle coming to an end.

Rekt Capital also identified a pattern where Bitcoin might retrace to $64,000 in the next weeks and slowly climb back towards $71,000 until September.

Image: Rekt Capital/TradingView

Image: Rekt Capital/TradingViewBitfinex analysts recently identified that Bitcoin is under pressure from different investors, such as whales, long-term holders, and miners. As reported by Crypto Briefing, on-chain data related to those three groups of BTC holders are still unfavorable for Bitcoin’s future.

Inflows of BTC into exchanges have risen as a proportion of total inflows, signaling heightened whale activity and a trend that typically precedes a price drop. Additionally, an inverse relationship between Bitcoin’s price and miner reserves has been observed, with a notable decline in miner reserves coinciding with the peak in Bitcoin’s price around March 2024.

This indicates that miners were selling to capitalize on high prices and prepare for the halving event. As miner reserves approach four-year lows, it suggests that selling pressure from this group may be nearing a critical point, potentially impacting future market dynamics.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

3 months ago

23

3 months ago

23