ARTICLE AD

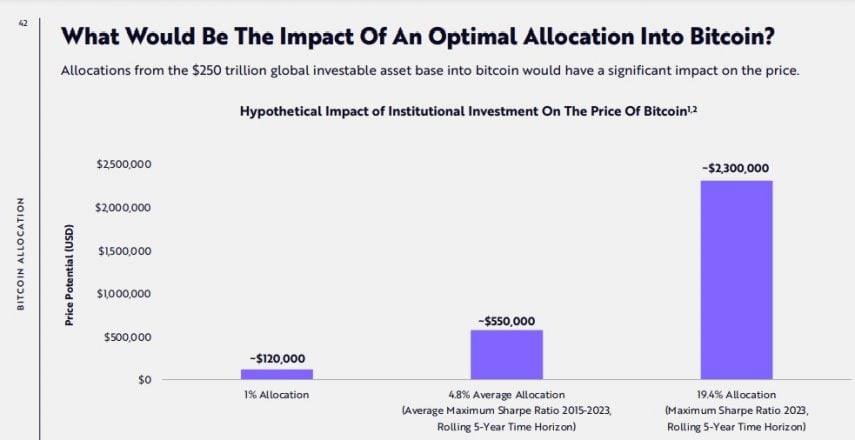

An optimal allocation of $250 trillion, equivalent to over 19% of global assets, to Bitcoin, could send its price to $2.3 million, ARK Invest suggests in a report published today.

The report, titled ‘Big Ideas 2024,’ examines the impact of technology on industries and economies worldwide and the confluence of technology and connectivity. It covers a wide range of subjects, including Bitcoin’s role in investment portfolios and the potential catalysts for Bitcoin’s price actions in 2024.

According to ARK Invest’s projections, an increased allocation of global assets to Bitcoin could have positive implications for its price. ARK Invest estimates that Bitcoin’s price could reach $120,000 if 1% of global assets is allocated to it.

Based on a rolling 5-year time horizon, Bitcoin could rally to $550,000 at an allocation of 4.8%, the average maximum Sharpe Ratio from 2015-2023. The most ambitious scenario is a 19.4% allocation, which could significantly increase Bitcoin’s price to around $2.3 million.

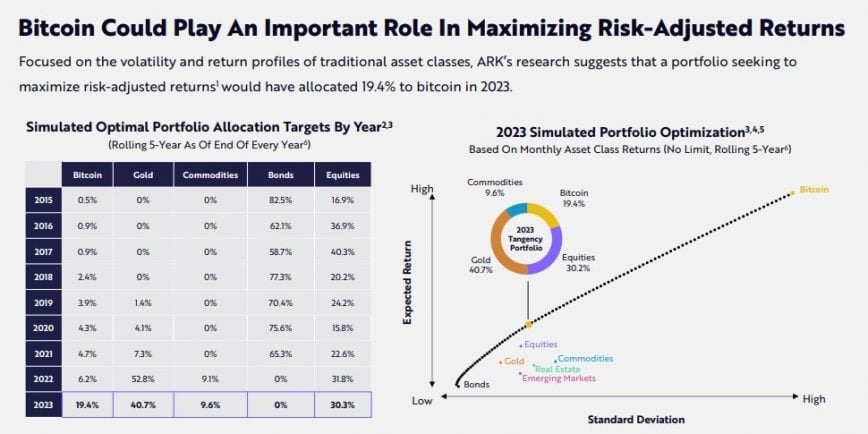

According to ARK Invest, the optimal allocation for a Bitcoin portfolio in 2023 is suggested to be 19.4%. Falling below this allocation may result in suboptimal returns, while exceeding it could expose you to unnecessary risks.

The research also shows that Bitcoin has outperformed all major asset classes, like gold, equities, or real estate, in long-term investment returns. Bitcoin’s compound annual growth rate (CAGR) stands at 44%, dwarfing the average asset class CAGR of 5.7%.

CARG is a metric that calculates how much an investment grows on average each year when you reinvest the profits. It takes the total return of an investment over several years and gives a single average rate. It is commonly used to assess and predict the expected return of a portfolio or asset class over a designated timeframe, often looking at a period of five years.

Highlighting the long-term viability of Bitcoin investments, ARK Invest points out that long-term Bitcoin holdings have paid off, regardless of Bitcoin’s volatility.

“Bitcoin’s volatility can obfuscate its long-term returns. While significant appreciation or depreciation can occur over the short term, a long-term investment horizon has been key to investing in bitcoin,” the research noted. “Historically, investors who bought and held bitcoin for at least 5 years have profited, no matter when they made their purchases.”

Additionally, ARK Invest outlines four key catalysts that could influence Bitcoin’s trajectory this year, including spot Bitcoin ETF launches, Bitcoin halving, institutional adoption, and regulatory developments. According to the study, previous halving events have triggered bull markets, which suggests the upcoming halving could have a comparable impact.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

1 year ago

67

1 year ago

67