ARTICLE AD

If GBTC outflows keep impacting Bitcoin prices, volatility may rise on the way down.

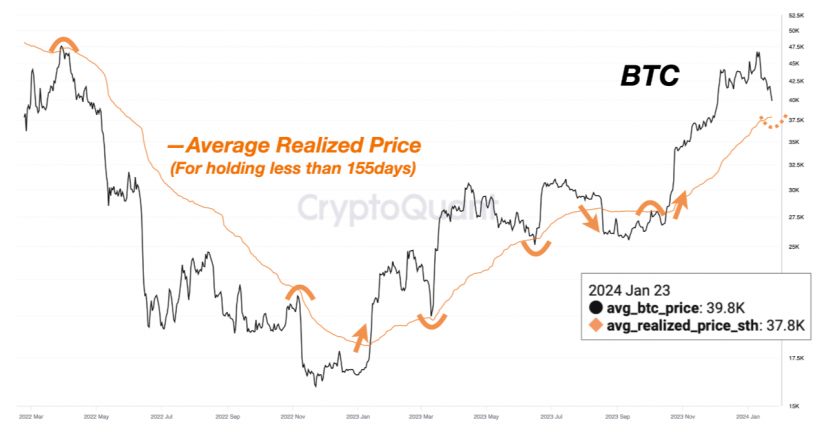

Bitcoin (BTC) bulls might have another chance to accumulate if the price goes below the $37,800 level, according to a Jan. 23 post by the on-chain data platform CryptoQuant. The user SignalQuant highlighted that the current average short-term (STH) realized price for the last 155 days aligns with the specified price level.

What makes this metric particularly intriguing is the observed pattern following the breach of these support or resistance thresholds. Each time the market price crosses these points, a one-directional movement ensues, marked by increased price volatility, says SignalQuant. If the Bitcoin price crosses this indicator in a downward movement, it may favor BTC accumulation by a dollar-cost averaging (DCA) strategy, adds the analysis author.

The STH Realized Price is achieved by dividing the realized cap of a crypto asset by its total supply. When calculated considering 155-day periods, this could be used as a support and resistance indicator.

Historical data reveals its pivotal role in shaping market trends. In March 2023 and June 2023, the STH 155-day Realized Price provided substantial support. Conversely, in April 2022, November 2022, and October 2023, it acted as a formidable resistance level. This pattern highlights the STH 155-day Realized Price as not just a passive indicator but a potential catalyst for market shifts.

Past BTC price movements based on STH 155-day Realized Price. Image: CryptoQuant/SignalQuant

Past BTC price movements based on STH 155-day Realized Price. Image: CryptoQuant/SignalQuantAt the time of writing, Bitcoin is priced at $40,122.52 with a 1.9% recovery in the last 24 hours, after staying at the sub-$40,000 price level for most of Jan. 23.

Moreover, CryptoQuant indicated through another chart a potential easing on Grayscale’s GBTC exchange-traded fund (ETF) outflow impact on Bitcoin price. After yesterday’s outflows of almost $600 million, BTC price went up 3.6% marking the first time the asset value went up after the spot ETFs approval in the US.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

1 year ago

63

1 year ago

63