ARTICLE AD

Data shows that Bitcoin sentiment has been on the edge of extreme greed recently, but investors haven’t yet looked ready to embrace the hype.

Bitcoin Fear & Greed Index Is Currently Pointing At ‘Greed’

The “Fear & Greed Index” refers to an indicator created by Alternative that tells us about the general sentiment among the investors in the Bitcoin and the wider cryptocurrency sector.

This index calculates the sentiment as a number between zero and a hundred. This calculation uses data from the following five factors: volatility, trading volume, social media sentiment, market cap dominance, and Google Trends.

When the value of this metric is greater than 53, it means the investors share a sentiment of greed. On the other hand, under 47 suggests the presence of fear in the market. The territory in between these two thresholds corresponds to a net-neutral mentality.

Now, here is what the Bitcoin Fear & Greed Index is like right now:

As is visible above, the latest value of the Fear & Greed Index has been 70, which suggests the traders as a whole are holding a notable greedy sentiment. This isn’t a new development, however, as the market has in fact already been in this territory for the past week or so.

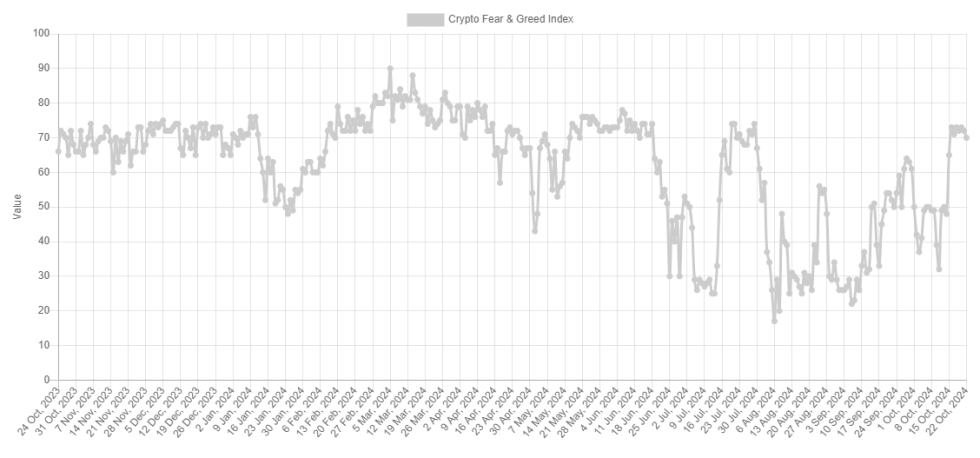

The below chart shows the trend in this indicator over the past year.

The graph shows that the index had plunged into fear territory earlier in the month due to the bearish action that the price had seen. However, trader mood has seen a significant uplift with the recovery rally.

In this latest streak of greed, the indicator has touched a high of 73. This value is close to a special region called the extreme greed, which occurs at 75 and above.

In the past, the indicator has generally breached this territory during market euphoria. Such a large amount of hype is something that has historically led to tops in the price.

There is also a similar region for the fear side, known as extreme fear (occurring at 25 and below). Market despair levels so deep have generally facilitated bottoms in the coin.

The Bitcoin Fear & Greed Index has stagnated just beyond the extreme greed region in the last few days and the reason is likely to be that the rally has seen a setback.

The fact that the investors haven’t just yet sat on the hype train, though, may be a positive sign for this run to succeed, as it means that at least excessive greed hasn’t become an obstacle for it so far.

BTC Price

Bitcoin has retraced back to $67,300 after having gone above $69,000 a couple of days ago.

Featured image from Dall-E, Alternative.me, chart from TradingView.com

1 month ago

30

1 month ago

30