ARTICLE AD

Bitcoin ETFs achieve $20 billion in inflows, outpacing gold.

Key Takeaways

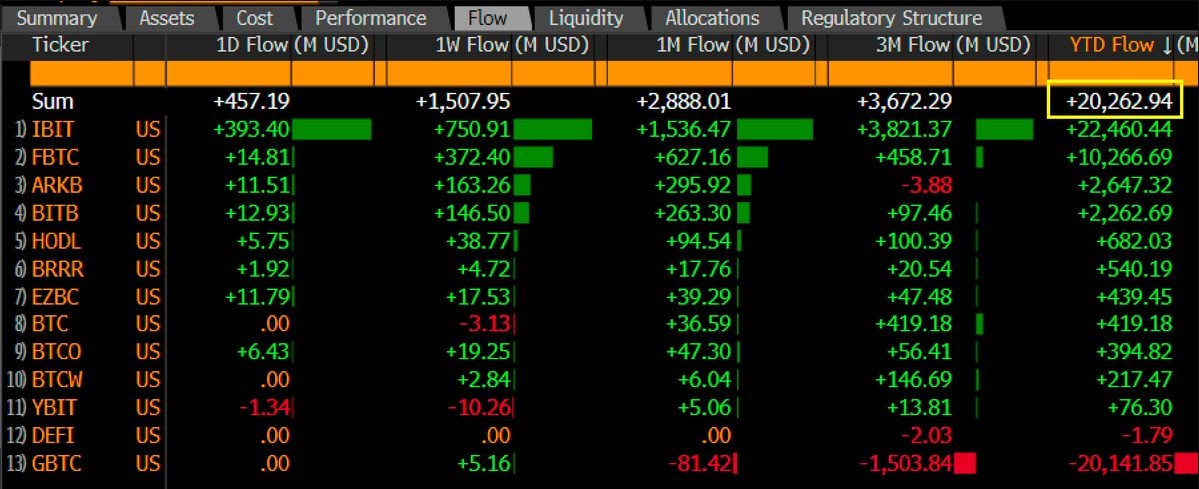

Bitcoin's potential to reach six-figure prices is supported by increased whale accumulation and ETF demand, among other factors. Institutional investments in Bitcoin are growing rapidly, with US Bitcoin ETFs logging over $20 billion in less than ten months. <?xml encoding="UTF-8"?>Bitwise CIO Matt Hougan predicts that Bitcoin will reach six-figure prices as several key factors are lining up, including growing whale accumulation and reduced Bitcoin supply post-halving.

Bitcoin whales purchased a staggering 60,000 BTC within 24 hours. According to crypto analyst Quinten Francois, this is an unusually high volume of buying activity for large investors.

Never in the history of #Bitcoin have whales been buying $BTC this aggressive pic.twitter.com/2DIw33c3HW

— Quinten | 048.eth (@QuintenFrancois) October 18, 2024

Experts interpret the aggressive buying spree as a sign of renewed confidence by whales in Bitcoin’s price potential. Whales typically buy large quantities of an asset when they believe its value will skyrocket.

Surging demand for Bitcoin ETFs is also expected to increase institutional investment in Bitcoin, which could send prices soaring, according to Hougan.

The group of US spot Bitcoin ETFs, which debuted less than ten months ago, has logged over $20 billion in net inflows. Compared to these funds, it took gold ETFs about five years to reach the same milestone.

Author: Eric Balchunas

Author: Eric BalchunasHougan also adds the upcoming US presidential election to the list of positive catalysts for Bitcoin’s value. Bitcoin and the crypto industry as a whole have grown important in this year’s election race.

Two major candidates, Donald Trump and Kamala Harris, have shown their respective supportive stances toward the industry. Analysts suggest that Bitcoin could benefit from the event, no matter who wins the White House.

On the economic front, the increasing national debt in the US, China’s stimulus measures, and global monetary adjustments, could also help boost Bitcoin’s prices. Central banks around the world, like the Fed, are adjusting their monetary policies to stimulate their economies.

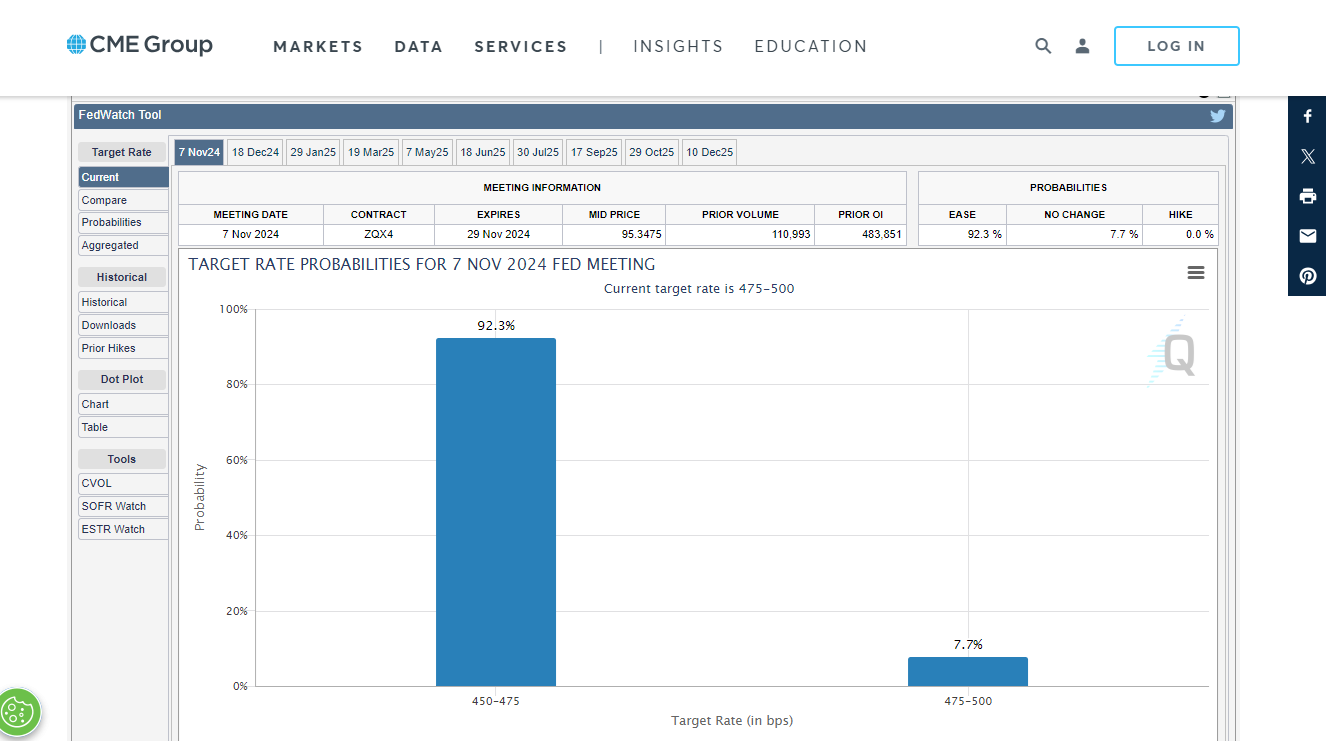

Earlier this week, the ECB cut rates by 25 basis points, following the Fed’s aggressive rate reduction last month. Market observers expect two other rate cuts by the Fed in its FOMC meetings in November and December, with odds leaning toward a 25 basis-point cut, as of October 18, according to CME FedWatch.

Disclaimer

Disclaimer

1 month ago

13

1 month ago

13