ARTICLE AD

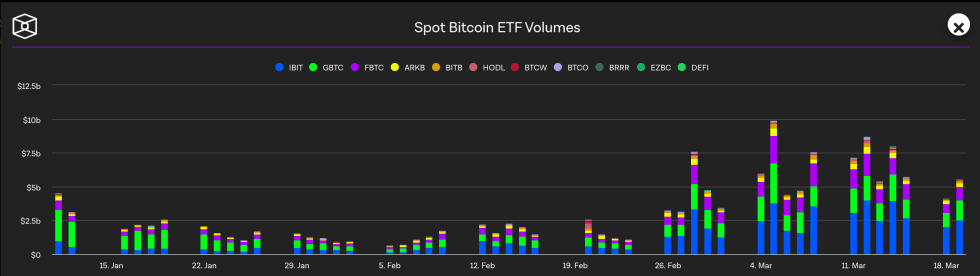

As of the latest data, the US spot Bitcoin Exchange-Traded Funds (ETFs) have surged past a notable milestone, with cumulative trading volume breaching the $150 billion mark on March 19.

This development is particularly noteworthy considering the spot ETFs‘ relatively short period in the market, following their approval by the Securities and Exchange Commission (SEC) less than three months ago.

However, despite this milestone, the market has not been without its challenges. Record net outflows were also observed amid a notable dip in Bitcoin’s price yesterday.

Record Trading Volumes And Market Dynamics

The achievement of surpassing $150 billion in cumulative trading volumes for US spot BTC ETFs reflects a significant interest and participation in the cryptocurrency market. Notably, a substantial portion of this volume was recorded in a relatively short span, with $50 billion added since March 8 alone.

Additionally, yesterday alone, trading volumes reached $5.6 billion, led by BlackRock’s IBIT, Grayscale’s GBTC, and Fidelity’s FBTC, highlighting the active engagement of investors with these financial instruments.

Bitcoin Spot ETF Volume. | Source:TheBlock

Bitcoin Spot ETF Volume. | Source:TheBlock

However, this enthusiasm has been tempered by a significant market shift, with Grayscale’s GBTC experiencing a “squeeze” in market share amid daily outflows.

Conversely, BlackRock’s IBIT has emerged as a primary beneficiary, witnessing a substantial increase in market share from 22.1% as of inception to 45.2%.

Record Bitcoin Spot ETFs Outflows And Vulnerabilities

The cryptocurrency market’s inherent volatility was underscored by the net outflow of $326.2 million from US spot Bitcoin ETFs, which more than doubled the previous record of $158.4 million set earlier in the year.

Bitcoin ETF Flow – 19 March 2024

All data in. Record net outflow of $326m pic.twitter.com/iBmBiMR74Z

— BitMEX Research (@BitMEXResearch) March 20, 2024

This outflow, particularly evident in Grayscale’s GBTC, which saw significant withdrawals, points to investor caution amidst fluctuating market conditions.

Grayscale Bitcoin Trust w/ most outflows of *any* ETF since March 2009 stock market low…

Only took 2 months.

via @Todd_Sohn pic.twitter.com/vX6dtcd6sR

— Nate Geraci (@NateGeraci) March 19, 2024

Amid this development, Peter Schiff has critiqued spot Bitcoin ETFs, highlighting a significant drawback: their liquidity is confined to the operational hours of the US market.

Schiff highlighted that this limitation means that in the event of a market downturn outside these hours, investors cannot sell their holdings until the US market resumes trading, leaving them in a “helpless” position to react to overnight market movements.

One problem with owning #Bitcoin in an ETF is that liquidity is limited to U.S. market hours. So if the market crashes overnight, you have no ability to sell until the U.S. market opens for trading in the morning. Very frustrating to watch helplessly with no ability to get out.

— Peter Schiff (@PeterSchiff) March 19, 2024

Featured image from Unsplash, Chart from TradingView

9 months ago

34

9 months ago

34