ARTICLE AD

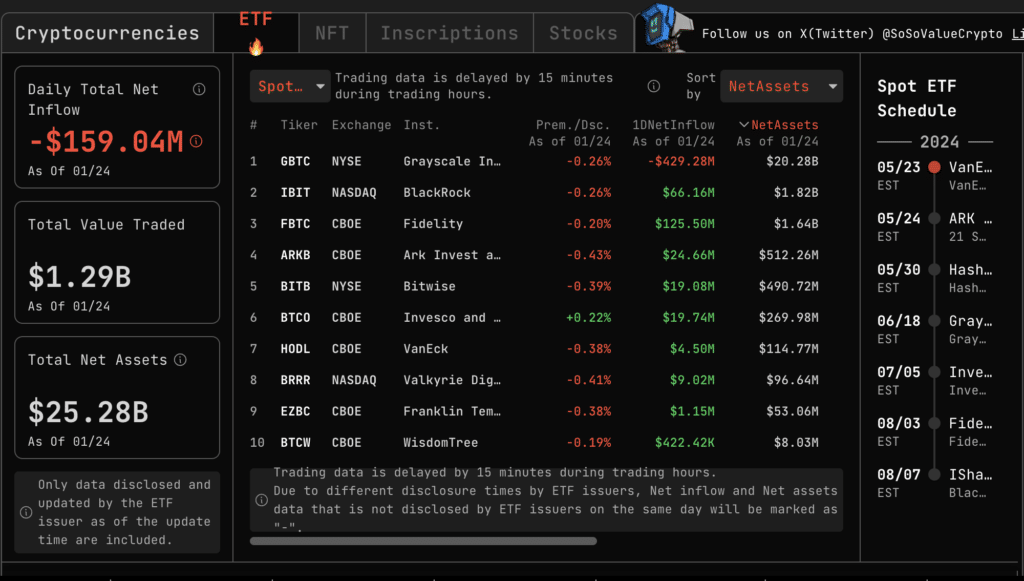

On Jan. 24, the total net outflow of Bitcoin spot ETFs was $159 million, the largest single-day total net outflow.

According to the analytics platform Alpha, on Jan. 24 the total net outflow of Bitcoin spot ETFs hit $159 million, the largest one-day net outflow since launch.

Source: Alpha

Source: Alpha

Grayscale ETF has been the leader in net outflows with $429 million since the fund’s launch. All ETFs except Grayscale had net inflows of $270 million.

At the same time, for the second day in a row, the outflow of funds from Grayscale Bitcoin Trust (GBTC) has been decreasing. The figure was the lowest since the launch of spot Bitcoin ETFs in the United States.

Bloomberg analyst Eric Balchunas wrote in X that GBTC outflows are showing a “downward trend.” However, he noted that liquidations are still huge.

$GBTC volume down again today.. could be sign of some exhaustion in the selling (same thing happens in stocks, $SPY volume goes up w selling, down w peace). We'll see tonight tho. And I'm only reporting on shares out data sent by their admin to BBG. Only thing you can 100% trust. pic.twitter.com/m9uRs7tBr5

— Eric Balchunas (@EricBalchunas) January 24, 2024On Jan. 23, the outflow amounted to $515 million, and on the 22nd – $640 million, according to CC15Capital. In total, over nine trading days, the Bitcoin Trust lost 106,092 BTC worth about $4.4 billion.

However, Grayscale CEO Michael Sonnenshein believes that most of the 11 spot Bitcoin ETFs approved by the U.S. Securities and Exchange Commission (SEC) are likely to fail. In his opinion, only “two or three exchange-traded funds will probably achieve some critical mass.”

1 year ago

76

1 year ago

76