ARTICLE AD

Traders betting against Bitcoin price were particularly hard hit, as the rapid ascent left little room for margin calls and forced liquidations.

Key Notes

Bitcoin surged to $64,173, liquidating over $100 million in short positions, impacting 54,422 traders globally.Mt Gox delayed a $9 billion Bitcoin return to creditors, calming sell-off fears and aiding market recovery."Uptober" optimism continues as Bitcoin gains in 9 of 11 years, boosting bullish market sentiment.Bitcoin BTC $64 470 24h volatility: 2.4% Market cap: $1.27 T Vol. 24h: $27.42 B has reclaimed the $64,000 mark, leading to a significant upheaval in the crypto derivatives market. Over the past 24 hours, short positions in the crypto market have been liquidated to more than $100 million as Bitcoin’s price surge caught many traders off guard.

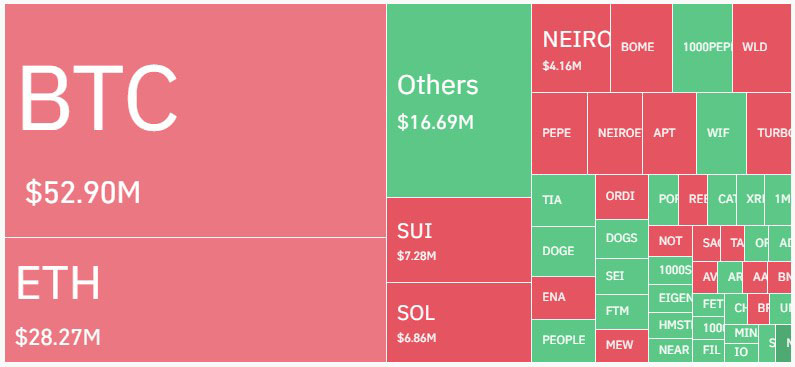

According to data from CoinGlass, over $101.57 million in short positions have been liquidated across the crypto market as a result of Bitcoin’s sudden price movement. In total, 54,422 traders faced liquidations amounting to more than $167.18 million. Bitcoin shorts alone accounted for $52.90 million of the day’s total liquidations, followed by Ether shorts at $28.27 million.

Source: Coinglass

Traders betting against Bitcoin prices were particularly hit hard, as the rapid ascent left little room for margin calls and forced liquidations. Bitcoin’s market dominance has also seen a notable increase, rising above 58%, which approaches its highest level since April 2021, according to TradingView.

On October 14, Bitcoin price had risen by 1.90%, reaching $64,040. Trading volumes also seen a 52% spike in the last 24 hours. Bitcoin reached $64,173, its highest point in October and the highest price it has reached since the end of September.

Source: CoinMarketCap

Mt. Gox Delays $9B Asset Return

Bitcoin began its rise on Monday, building on a strong comeback from the weekend. Mt. Gox, a crypto exchange that’s no longer active, announced it would wait another year to return assets to creditors. This decision helped calm fears of a big sell-off that could have shaken the market further. Even with this relief, Bitcoin and other cryptocurrencies stayed mostly steady.

Last week, the people in charge of Mt. Gox shared their plan to give back the remaining assets by October 31, 2025. Almost $9 billion in stolen tokens, mainly Bitcoin from the 2014 hack, are part of this plan. However, they still have $2.8 billion worth of tokens left, which makes investors uneasy about how it might affect Bitcoin’s supply.

Earlier this year, the idea of these assets being returned caused Bitcoin prices to drop significantly. The fear of a sudden increase in Bitcoin supply led to significant losses in the market. But with Mt. Gox delaying the return, Bitcoin has had a chance to recover and reach new heights.

Uptober Surge Continues Nine of Eleven Years

Many analysts are speculating about the onset of “Uptober”. Historically, October has been a positive month for Bitcoin, witnessing gains in nine of the past eleven years. This pattern has heightened expectations that Bitcoin could continue its upward momentum throughout the month.

Bitcoiner Kyle Chassé shared his optimistic outlook with his 219,000 followers on X (formerly Twitter) on October 14. He stated, “The tides are shifting,” and expressed confidence that the market is entering one of its most “exciting phases.” Chassé further emphasized:

“The next big rally isn’t just a possibility — it’s a reality waiting to unfold.”

On-chain analyst James Check added his perspective, urging traders to “Pray for the bears”, highlighting the challenges that bearish traders might face in the current bullish environment. These sentiments reflect a broader market optimism tempered by caution among those positioned against the upward trend.

Meanwhile, Ethereum has also shown strength, confirming a breach of the $2,440 level. The price began the day with a strong rise, reinforcing expectations of a continuing bullish trend on both intraday and short-term bases. Technical analysis indicates that Ethereum has completed a double bottom pattern, with a confirmation line at $2,515.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Bitcoin News, Cryptocurrency News, News

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

1 month ago

14

1 month ago

14