ARTICLE AD

After capitulating on March 19, Bitcoin recovered on March 20. However, while the crypto community expects more rapid gains, even above the all-time highs of around $73,800, Willy Woo, an on-chain analyst, thinks the coin will likely consolidate in the days ahead.

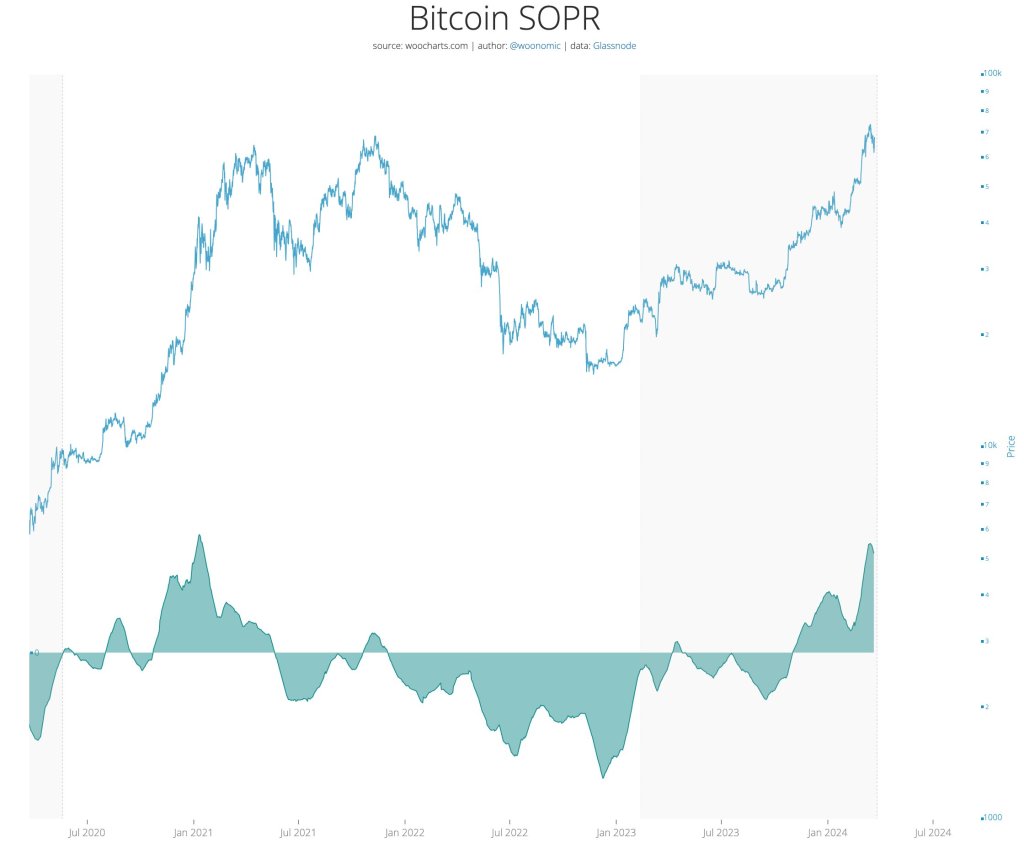

SOPR Peaked At An Unusually High Level: Profit-Taking?

Taking to X, Woo listed several on-chain metrics, some of which, while supporting prices, are countered by others that might slow down the uptrend. At the top of the list, the analyst notes how the Spent Output Profit Ratio (SOPR) reading is printed out.

The SOPR is used to measure the profitability of Bitcoin transactions. When it is, it suggests that more BTc being moved around are in green. While this reading has risen in the past few trading weeks, how it peaked is a concern.

Bitcoin SOPR peaking | Source: Willy Woo on X

Bitcoin SOPR peaking | Source: Willy Woo on X

In Woo’s assessment, there is likely profit-taking since the SOPR peaked at an unusually “high level.” Accordingly, profit-taking translates to holders exiting, which means selling on the spot, possibly resulting in a sideways consolidation.

However, the analyst finds reasons for optimism. Specifically, the recent fall from the swing high, at around $73,800, was around 20%. This dip tends to be more severe compared to historical cycles and, more importantly, before halving.

The analyst said it fell by over 30% in the last cycle before halving in 2020.

Additionally, the analyst views the current rise in “Macro risk signal,” a metric that compares inflows to risky asset prices like Bitcoin and crypto, as a positive sign. Even though it is rising and bullish, it may “freak out” investors, shaking out some before prices rally to new levels.

Bitcoin To Consolidate, Altcoins To Pump?

What’s happening to Bitcoin might also impact altcoins and leverage traders. Specifically, the analyst thinks that altcoins will likely pump as Bitcoin consolidates in a technically bullish structure.

Even so, by Woo’s assessment, the fact that leverage ratios on perpetual swap bets haven’t been reset means traders should be careful because of the expected volatility tagging position adjustments.

While Woo is bullish, predicting possible choppy price action in April, traders are bullish. Considering the recent wave of institutional demand, Halving might drive prices higher in the coming sessions.

Presently, BTC bulls have reversed losses of March 19. The coin is trading above the 20-day moving average. Optimistic traders look at $73,800 as the short- to medium-term target.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

9 months ago

61

9 months ago

61