ARTICLE AD

Bitcoin (BTC) has been consistently rising over the past month and is getting close to its all-time $68,800 in November 2021. Now traders are betting on a further price rally, according to Santiment.

BTC is up by 9% in the past 24 hours and is trading at around $56,200 at the time of writing. The flagship asset’s market cap surpassed the $1.1 trillion mark with a market dominance of 51.9%.

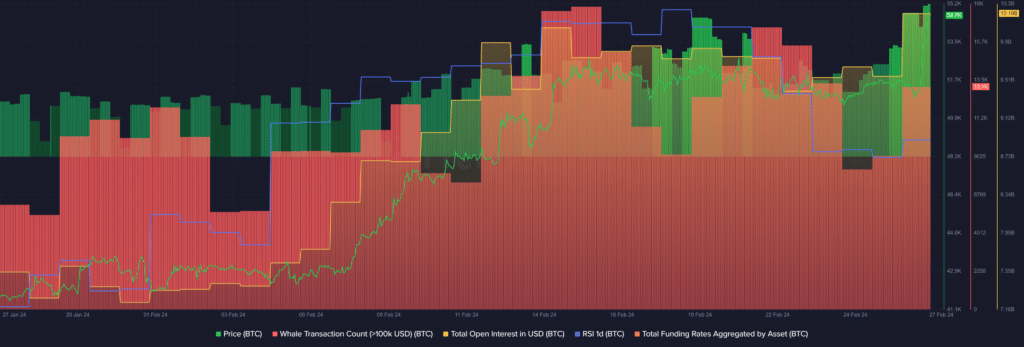

BTC price, whale activity, open interest, funding rate and RSI – Feb. 27 | Source: Santiment

BTC price, whale activity, open interest, funding rate and RSI – Feb. 27 | Source: Santiment

As Bitcoin gained bullish momentum on Feb. 26, Michael Saylor’s MicroStrategy acquired 3,000 more BTC at an average price of $51,813 — worth $155 million.

According to data provided by Santiment, Bitcoin’s total open interest (OI) surged from $9.55 billion to $10.2 billion — a level last seen in July 2022.

Following the price rally, the amount of trades betting on a further price increase for Bitcoin has also surged. Per the market intelligence platform, the total funding rate aggregated by BTC on all exchanges rose from 0.016% to 0.019%.

The indicator shows that the amount of long-positioned trades has slightly increased.

According to Santiment, the number of whale transactions consisting of at least $100,000 worth of BTC increased from 9,067 to 13,142 unique trades over the past 24 hours. When an asset’s whale activity surges, usually high price volatility would be expected.

In addition, Bitcoin’s Relative Strength Index (RSI) hiked from 70 to 73 over the past day, per Santiment data.

The indicator suggests that Bitcoin might be slightly overheated at the current price point and a cooldown could be expected. For BTC to stay bullish, its RSI would need to stay below the 60 mark.

Over the past 12 months, Bitcoin has rallied 140%.

8 months ago

49

8 months ago

49