ARTICLE AD

Santiment highlights how important whale accumulation is for a trend shift in crypto prices.

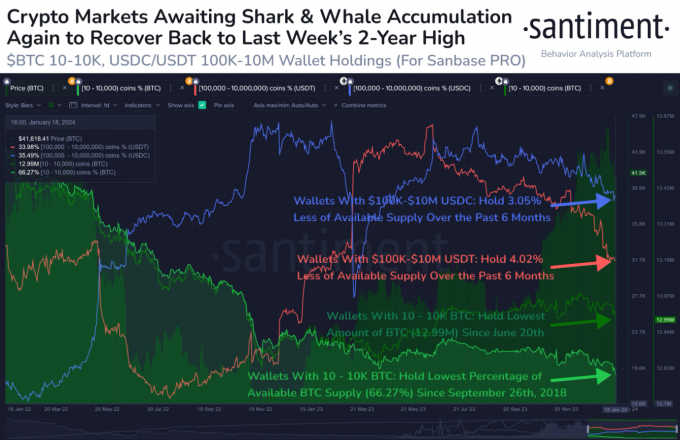

The number of ‘whale’ investors holding Bitcoin (BTC), USD Coin (USDC), and Tether USD (USDT) has shrunk in the past six months, according to data from crypto analytics platform Santiment. Not even the spot Bitcoin ETF approval was enough to keep those qualified investors in the market.

Whales are wallet addresses with significant amounts of a crypto asset. Stablecoin holders with balances between $100,000 and $10 million are considered whales and sharks by Santiment, while Bitcoin whales are addresses holding 10 to 10,000 BTC.

The data published by Santiment reveals that USDC whales, as of January 22, accounted for 35.5% of holders, down 3% from July 23, 2023. USDT whales have shown an even more significant decline, dropping from 38.4% to 34% within the same timeframe.

Bitcoin whales have not been immune to this trend, though their reduction is less pronounced. There has been a slight 0.7% pullback in the number of BTC whale addresses, reaching its lowest level since June 20 of the previous year.

Santiment, in a recent post on X (formerly Twitter), highlighted the significance of whale accumulation in predicting market movements. They suggest that such accumulation could signal a return to bullish trends, similar to those observed from October to December of the previous year.

This is particularly relevant considering the proximity of the Bitcoin halving event, which is widely regarded as a pivotal moment likely to propel BTC prices and, by extension, the broader crypto market.

In the context of these whale movements, it’s noteworthy to mention the role of spot Bitcoin ETFs in the US market. As of Jan. 17, spot Bitcoin ETFs in the US held $27 billion in Bitcoin, or approximately 632,000 BTC. Per a CoinGecko report published on Jan. 18, this amount accounts for 3.2% of BTC’s total supply.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

1 year ago

83

1 year ago

83