ARTICLE AD

Bitcoin surpasses one billion transactions amid market fluctuations.

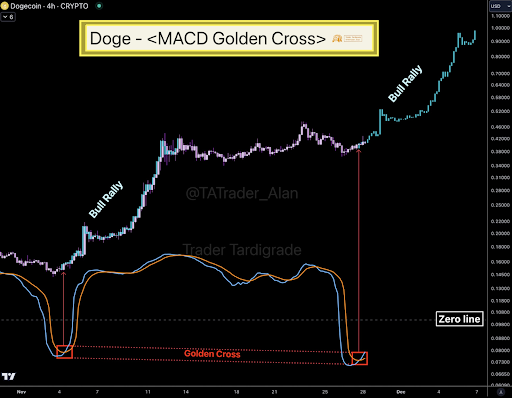

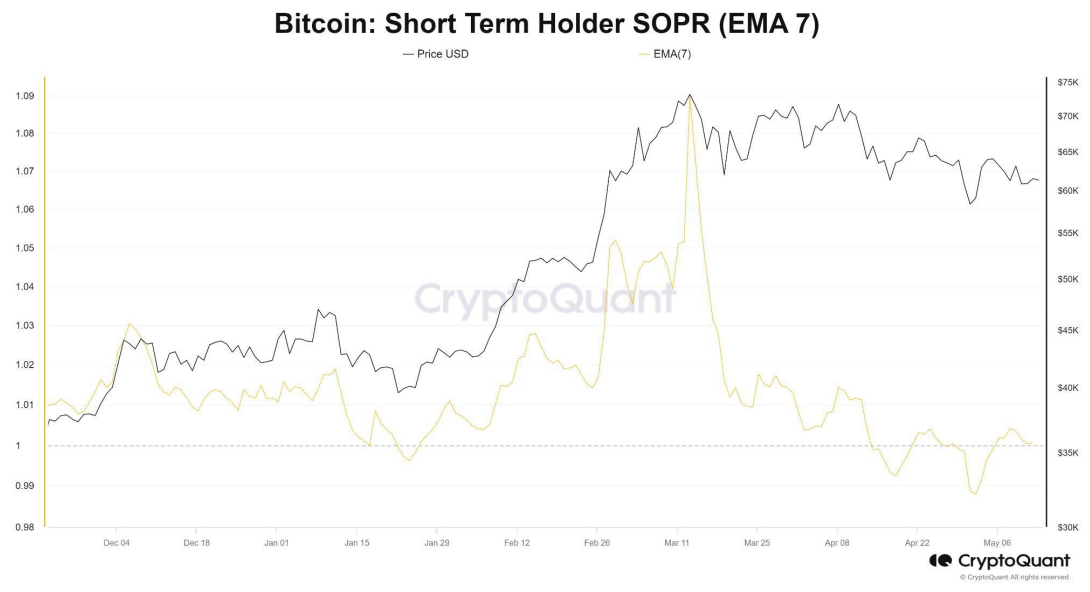

Bitcoin (BTC) short-term holders are behind the recent pullbacks in price, as the negative economic indicators from the US and cautious Federal Reserve statements make them panic, according to the “Bitfinex Alpha” report latest edition. Short-term Bitcoin holders are investors who have held their positions for less than 155 days.

Despite the sell-off by short-term holders, on-chain data reveals that long-term holders are not following suit. The “Long-Term Holder Spending Binary Indicator” indicates that these investors have maintained their positions, signaling a potential shift in market dynamics and a possible resolution to the upside for Bitcoin’s price range.

Image: Bitfinex/CryptoQuant

Image: Bitfinex/CryptoQuantAmidst this trading behavior, the Bitcoin network has surpassed one billion transactions, highlighting its foundational strength and potential for future value appreciation.

The decrease in mining difficulty presents an opportunity for miners to stabilize the network’s hash power and reduce the need to sell mined Bitcoin for operational costs. This is further supported by the commitment of long-term holders, who are demonstrating confidence in Bitcoin’s long-term value.

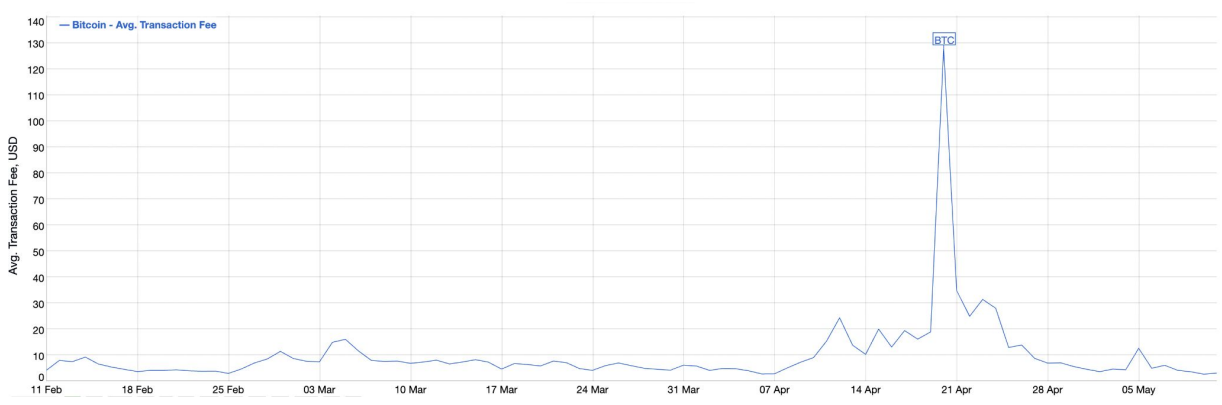

Bitcoin’s network fundamentals remain robust, with over 625,000 on-chain transactions recorded on May 6th alone. The network’s ability to handle a high volume of transactions showcases its scalability and security. As the network continues to grow, the challenge will be to scale efficiently to accommodate a larger user base.

Image: Bitfinex/Bitinfocharts

Image: Bitfinex/BitinfochartsThe recent 6% reduction in mining difficulty is one of the most significant developments, offering relief to miners post-halving. This adjustment allows remaining miners to earn more Bitcoin with the same computational effort.

Meanwhile, spot Bitcoin ETFs have experienced significant volatility, reflecting mixed investor sentiment towards the asset. Last week, Bitcoin ETFs saw net inflows, while Ethereum ETFs experienced net outflows, with the BTC price reflecting some of this sentiment.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

6 months ago

33

6 months ago

33