ARTICLE AD

Willy Woo, an on-chain analyst, took to X on April 29, raising concerns about the fate of retail Bitcoin investors if the world, especially the United States, plunges into a recession.

Woo, referencing historical events, argues that while large Bitcoin holders, or “whales,” are likely to weather the storm since they control private keys of their coins, retailers or everyday BTC investors might face a different reality.

Who Will Be Safe If The United States Government Began Confiscating Bitcoin?

The analyst compares the current market and the economic downturn of the Great Depression of 1930. During that time, the United States government, Woo warned, seized gold from the public to replenish national reserves.

Woo now raises the question of whether a similar scenario could unfold with Bitcoin. If so, it could potentially lead to more severe consequences for retail investors.

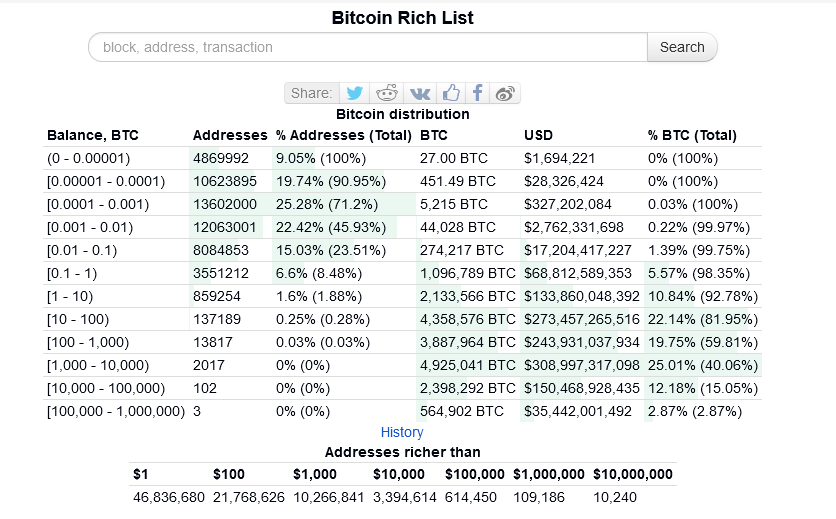

Whether the government will succeed or not will largely depend on one crucial factor: Bitcoin storage. Sharing data, Woo notes that a staggering 87% of Bitcoin is held in self-custody wallets. For instance, through these wallets, like the Samourai wallet, individuals control their private keys, meaning they can sign transactions, proving that they own coins.

Meanwhile, roughly 1% are held by spot Bitcoin exchange-traded fund (ETF) issuers like Fidelity. Spot ETF issuers, especially from the United States, offering competitive and low rates, have been rapidly buying BTC from multiple sources, including via exchanges and over-the-counter (OTC) markets, to meet the rising demand from investors, including institutions.

According to Lookonchain data, by April 26, all spot Bitcoin ETF users held over 834,000 BTC less than three months after launching.

Spot BTC ETF flows tracker | Source: Lookonchain via X

Spot BTC ETF flows tracker | Source: Lookonchain via X

On the other hand, 12% of all BTC sits on exchanges like Binance, Kraken, and Coinbase. Most of these coins belong to investors or traders who actively engage. Through centralized exchanges, BTC holders, though not in control of their coin’s private keys, can liquidate for altcoins like Cardano, fiat like USD, or even stablecoins.

United States Inflation Rising, GDP Data Soft: Recession Incoming?

While most BTC is held via non-custodial wallets, Woo said this route is taken mainly through whales. On the other hand, most retailers fall in the 12% category, keeping their coins via centralized exchanges. This distinction, Woo continues, becomes critical during economic turmoil.

Still, it remains unclear who a whale is, per Woo’s categorization. Bitinfocharts data on April 29 shows that over 65% of BTC is in the hands of those who control less than 0.1 BTC or retailers.

Bitcoin rich list | Source: Bitinfocharts

Bitcoin rich list | Source: Bitinfocharts

Some analysts worry that rising inflationary prices in the United States and falling real GDP, as economic data shows, might plunge the country into a recession. For now, eyes will be on the Federal Reserve (Fed) and Jerome Powell when they set the country’s interest rate this week.

Feature image from Canva, chart from TradingView

7 months ago

40

7 months ago

40