ARTICLE AD

Record Bitcoin holdings by whales suggest a bullish market trend.

Key Takeaways

Bitcoin whales have reached a record accumulation of 670,000 BTC. Historical trends show whale buying often precedes major market rallies. <?xml encoding="UTF-8"?>Bitcoin whales have reached a historic milestone by accumulating 670,000 BTC, the highest level of whale holdings on record, according to a post by crypto analysis firm CryptoQuant.

Although Bitcoin recently experienced a slight retracement, it has been trading within a steady range of $66,000 to $69,000 over the past 10 days, signaling a potential upward trend as it attempts to break its all-time high of $73,000.

This accumulation by Bitcoin whales is significant and is viewed as a bullish signal, aligning with historical patterns where whale buying behavior often precedes major price rallies.

Bitcoin 1-Year Change in Whales Holdings (CryptoQuant)

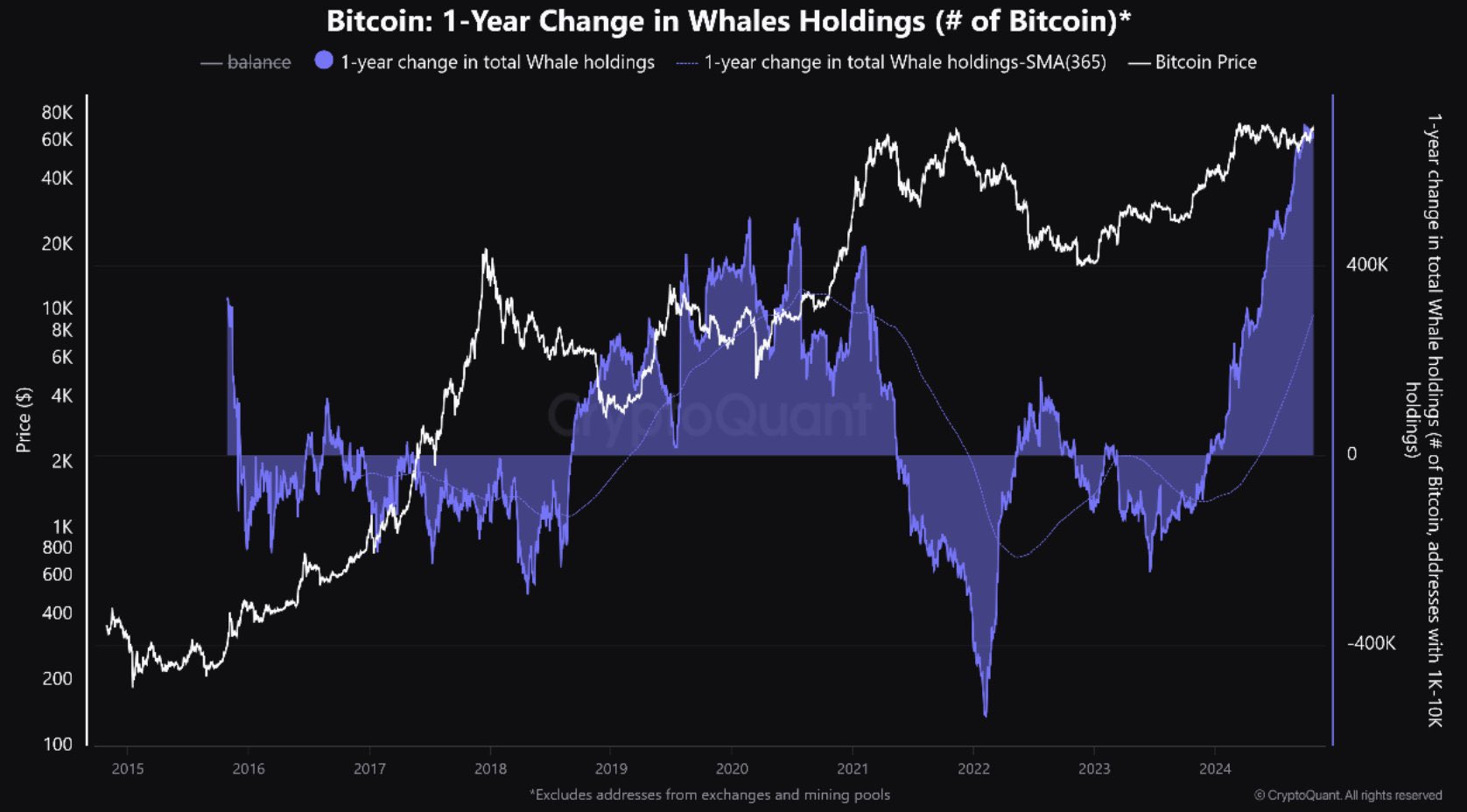

Bitcoin 1-Year Change in Whales Holdings (CryptoQuant)The chart tracking whale holdings from 2015 to 2024 illustrates this trend clearly. The blue shaded area, which represents the one-year change in total whale holdings, has surged in recent months, reflecting a significant accumulation by these large holders.

Historically, similar buying phases, such as those observed in 2016-2017 and 2020-2021, were followed by substantial price increases in Bitcoin.

The chart also includes a 365-day Simple Moving Average, which highlights a sharp increase in whale buying, suggesting strong, sustained interest in Bitcoin by large investors.

According to the chart from CryptoQuant’s post, the real surge in Bitcoin growth typically begins once whales gradually reduce their holdings, reaching negative percentage change values.

While whale accumulation suggests optimism, Bitcoin’s price remains in a sideways trend, a common pattern observed during past accumulation periods.

This trend supports the notion that whales are positioning themselves for potential gains in the medium and long term.

The accumulation phase points to a positive outlook for Bitcoin, but if new highs aren’t reached by late November, especially around the US election, it could indicate challenges in the bull cycle.

Disclaimer

1 month ago

41

1 month ago

41