ARTICLE AD

On-chain data suggests the Bitcoin whales have just participated in some large distribution, but the asset’s price has managed to hold on so far.

Bitcoin Whales Are Selling, But Sharks Are Expanding Holdings

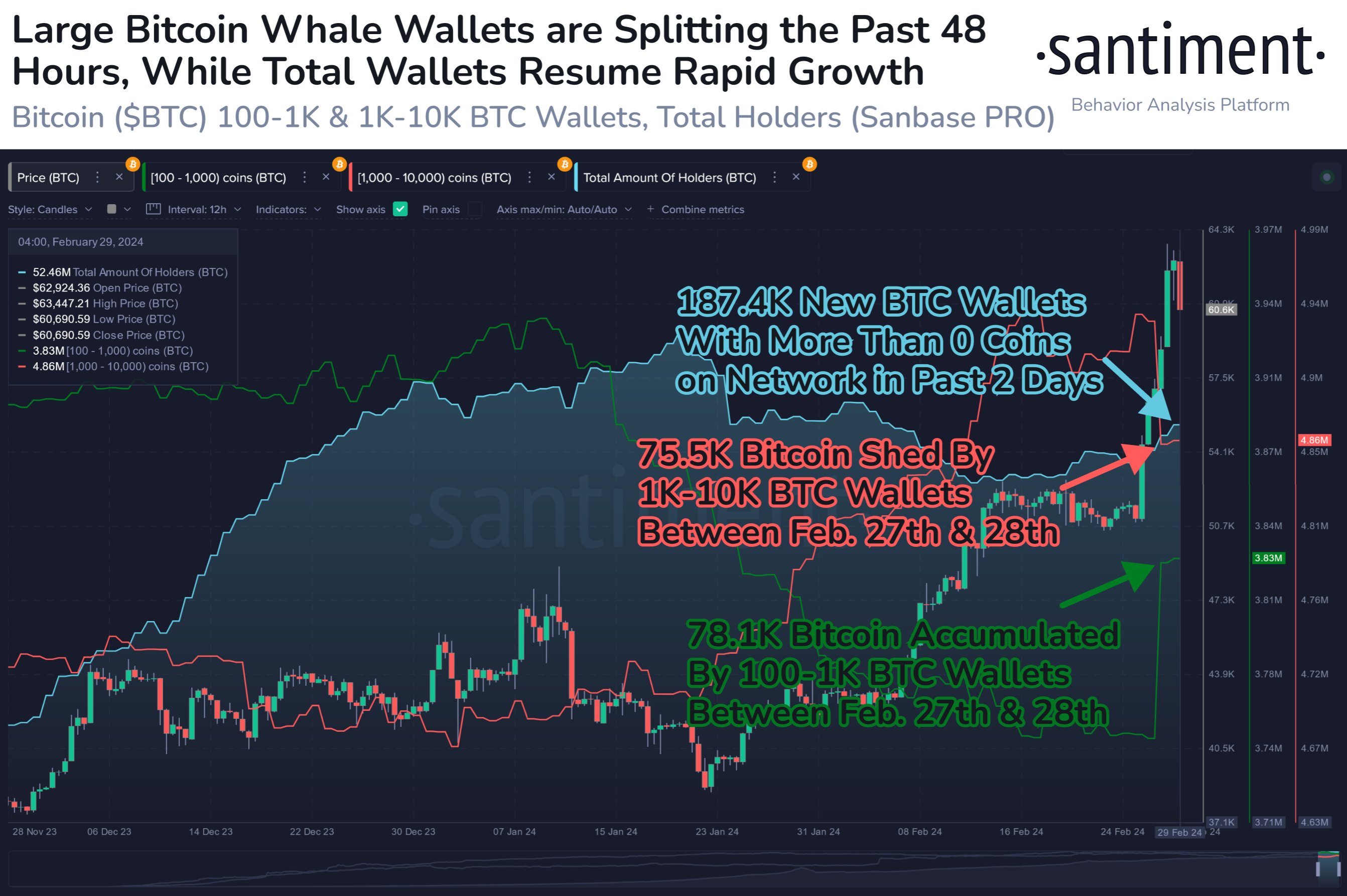

According to data from the on-chain analytics firm Santiment, large BTC wallets are displaying an interesting pattern right now. The indicator of relevance here is the “Supply Distribution,” which keeps track of the total amount of Bitcoin the various wallet groups are currently holding.

Addresses are divided into these cohorts based on the number of tokens that they are carrying. The 1 to 10 coins group, for instance, includes all wallets holding between 1 and 10 BTC.

In the context of the current topic, two cohorts are of interest: sharks and whales. The former investors are typically defined as those owning between 100 and 1,000 BTC, while the latter group includes those with 1,000 to 10,000 BTC.

Since both of these cohorts have such large balances, their behavior can be worth following, as it may end up having effects on the wider market. The whales are naturally the much more powerful of the two, as they hold significantly greater amounts.

The chart below shows the trend in the Bitcoin Supply Distribution for these two large investor groups over the past few months:

As displayed in the above graph, the Bitcoin whales appear to have shed a large number of coins from their holdings as the latest rally in the cryptocurrency’s price has occurred.

In total, these humongous entities have distributed around 75,500 BTC. While the whales appear to have participated in this selloff, the sharks have instead seen a sharp uptrend in their supply.

This cohort has picked up 78,100 BTC during this accumulation spree. Curiously, the amount that the whales have sold is almost the same as what the sharks have bought. This may be because of one of two things.

The first possibility is that the sharks have simply bought these tokens off the hands of the whales. The other, and perhaps the more interesting, scenario is that the “selloff” isn’t actually a selloff but rather a result of the whales breaking down their wallets.

Such a redistribution of holdings into many smaller wallets can naturally cause the kind of effect that has just been observed in the market. And given the symmetry, this could, in fact, be a likely possibility.

Now, why would the whales be showing such a behavior? As Santiment has explained in a reply to a user asking the same question, the whales may be moving smaller portions into or out of exchanges, or they may simply be taking security precautions.

Given that the Bitcoin price has wobbled after the formation of this trend, some selling would have still occurred, but it would appear that the market hasn’t been having too much trouble absorbing this selling pressure so far, as the BTC price has managed relatively well.

BTC Price

Bitcoin had declined into the low $60,000 levels just earlier, but the coin seems to have already bounced back as it’s now back at $62,400.

Featured image from Mike Doherty on Unsplash.com, Santiment.net, chart from TradingView.com

8 months ago

42

8 months ago

42