ARTICLE AD

Bitcoin could reclaim its all-time high with a 4% surge, and experts believe the crypto will grow at least three times its current price during this bull run.

Bitget managing director Gracy Chen said that Bitcoin (BTC) could potentially hit $180,000 to $200,000 in the ongoing cycle thanks to bullish interest in the top cryptocurrency by market cap from institutional stakeholders.

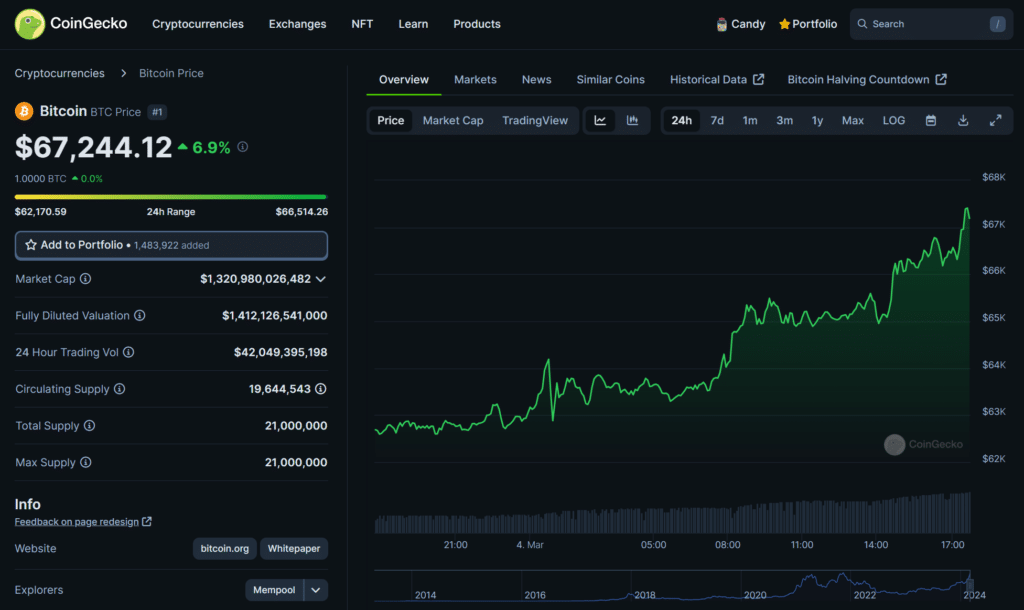

At press time, BTC exchanged hands above $67,200, up over 6% in the past 24 hours per CoinGecko.

From the recent data on Bitcoin investors, it seems holders are less sensitive to price volatility and generally see the halving event as bullish. So, if Bitcoin ETFs keep seeing strong net inflows this week, chances are high that we will a new all-time high soon.

Gracy Chen, Bitget managing director BTC chart | Source: CoinGecko

BTC chart | Source: CoinGecko

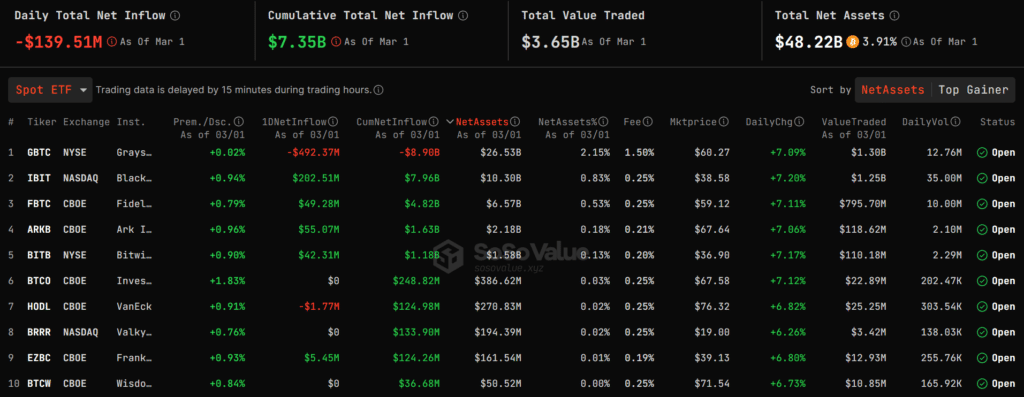

Nine spot BTC ETF issuers have attracted over $7 billion in cumulative inflows despite Grayscale investors cashing out nearly $9 billion from the firm’s converted GBTC exchange-traded fund, according to data from SoSoValue.

The new Bitcoin fund providers boast over $20 billion in assets under management (AUM) and have amassed at least 750,000 BTC since trading opened across U.S. exchanges on Jan. 11.

Spot BTC ETF data | Source: SoSoValue

Spot BTC ETF data | Source: SoSoValue

The prevailing sentiment amongst analysts and experts suggests that a supply shock is upcoming, particularly with the Bitcoin halving expected next month. In April, BTC’s network will reduce the reward for mining new blocks by 50%, slashing the rate at which new tokens enter circulation to maintain scarcity and tame inflation.

Opinion leaders like Matrixport, Fundstrats Thomas Lee, and Anthony Scaramucci opine that increasing demand from spot Bitcoin ETFs coupled with the halving and incoming institutional money should trigger a parabolic BTC run far above previous ATH.

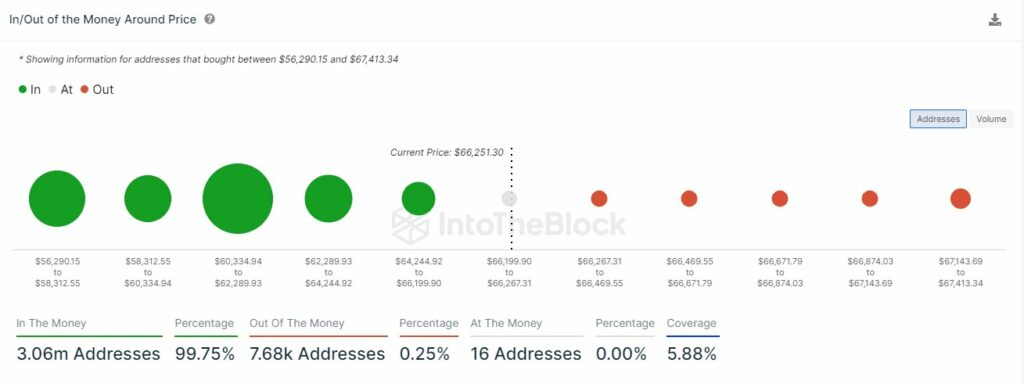

99% of Bitcoin addresses in profits

Bitcoin’s surging price has resulted in gains for most holders, as 99.75 of BTC addresses are now in profits per IntoTheBlock data, meaning that losses incurred by investors who bought at the top of crypto’s previous bull run have almost been wholly reconciled.

Fewer than 1% of holders of around 7,680 addresses are currently out of the money. However, holders could see profits on their positions should BTC push above $67,413 for the first time since late 2021.

BTC profit chart | Source: IntoTheBlock

BTC profit chart | Source: IntoTheBlock

8 months ago

42

8 months ago

42