ARTICLE AD

Over $1 billion worth of shares were traded across all spot Ethereum products on the debut day.

Key Takeaways

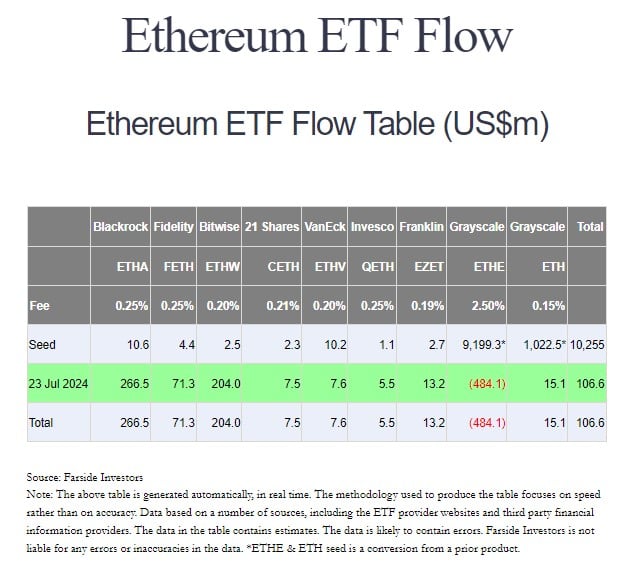

BlackRock's iShares Ethereum Trust (ETHA) dominated with over $266 million in inflows. The debut of spot Ethereum ETFs overshadowed Bitcoin ETFs, with outflows of $78 million. <?xml encoding="UTF-8"?>US spot Ethereum exchange-traded funds (ETFs) made a strong debut on Tuesday, attracting nearly $107 million in total inflows, according to data from Farside Investors. BlackRock’s iShares Ethereum Trust (ETHA) led the pack with over $266 million on its first day of trading.

Source: Farside Investors

Source: Farside InvestorsThe Bitwise Ethereum ETF (ETHW) and Fidelity Ethereum Fund (FETH) were also among the top performers, capturing $204 million and over $71 million in net inflows, respectively.

Other gains were seen in Franklin Ethereum ETF (EZET), VanEck Ethereum ETF (ETHV), 21Shares Core Ethereum ETF (CETH), Invesco Galaxy Ethereum ETF (QETH), and Grayscale Ethereum Mini Trust (ETH).

In contrast, Grayscale’s Ethereum Trust (ETHE) bled $484 million on its first day. The outflows represent 5% of the fund’s total value. As of July 2024, ETHE had over $9 billion in assets under management.

The conversion of the Grayscale Ethereum Trust to a spot ETF allowed investors to easily sell their shares, potentially leading to a large outflow. The situation likely mirrors the launch of spot Bitcoin ETFs in January, where Grayscale’s Bitcoin Trust (GBTC) also faced substantial outflows.

On the first day of trading, over $1 billion worth of shares changed hands across all the spot Ethereum products, as reported by Crypto Briefing. Grayscale’s ETHE dominated the trading volume, followed by BlackRock’s ETHA and Fidelity’s FETH.

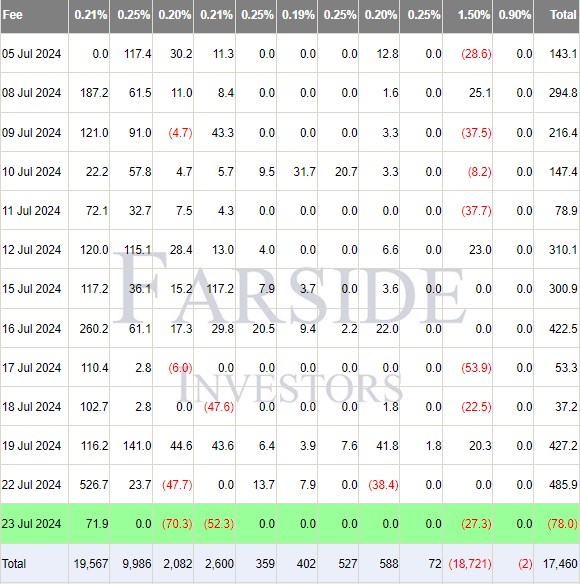

The launch of spot Ethereum ETFs overshadowed Bitcoin ETF performance, with flows turning negative. Farside’s data reveals that US spot Bitcoin funds suffered $78 million in outflows on Tuesday, ending a 12-day inflow streak initiated on July 5.

US spot Bitcoin ETFs ended their inflow streak – Source: Farside Investors

US spot Bitcoin ETFs ended their inflow streak – Source: Farside InvestorsBlackRock’s iShares Bitcoin Trust (IBIT) was the sole gainer of the day. IBIT saw nearly $72 million in inflows.

Meanwhile, investors withdrew approximately $80 million combined from Grayscale’s Bitcoin Trust (GBTC) and ARK Invest’s Bitcoin ETF (ARKB) yesterday. Bitwise’s BITB recorded the day’s largest asset exodus, exceeding $70 million.

Disclaimer

4 months ago

12

4 months ago

12