ARTICLE AD

Spot Bitcoin ETFs saw a steady increase in inflows in the first four days.

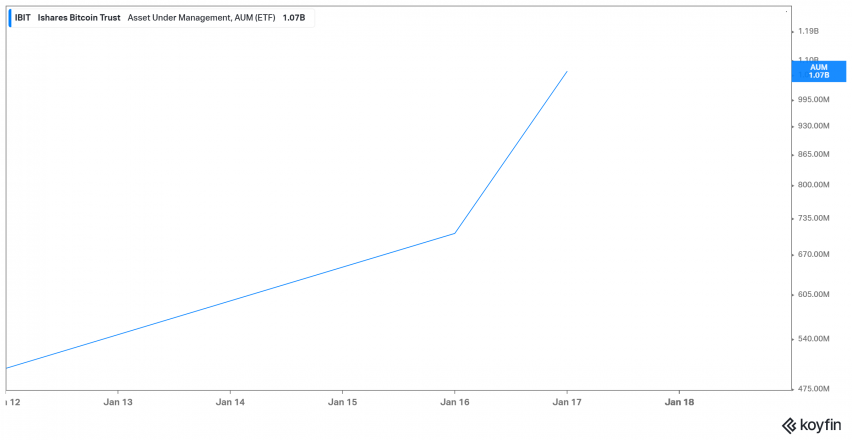

BlackRock now holds around 25,000 Bitcoin, worth over $1 billion in its spot Bitcoin ETF, becoming the first in a recent group of Bitcoin ETF providers to reach this milestone, according to data from financial data and analysis platform Koyfin. This achievement comes just a week after its trading debut.

The iShares Bitcoin Trust’s (IBIT) composition is predominantly Bitcoin-focused, with 99% of its holdings in the crypto asset, supplemented by nearly $60,000 in fiat currency. This allocation suggests a growing appetite among investors for direct exposure to Bitcoin’s performance.

Ending Wednesday’s trade around $24, IBIT is currently trading 0.42% higher than the spot Bitcoin. Furthermore, IBIT has recorded an average daily trading volume of approximately 14 million shares.

Bloomberg ETF analyst, Eric Balchunas, said that Wednesday was the most successful day so far for spot Bitcoin products, with inflows exceeding $1 billion. Nine ETFs, excluding Grayscale, attracted $3 billion and clocked $5.4 billion in trades within the first four days.

LATEST: Day Four was a good one, the ROLLING NET FLOWS grew to +$1.2b after the Newborn Nine pulled in $914b on Wed, by far their best day yet, overwhelming the $450 out of $GBTC. The 'Nine' have now taken in $3b and traded $5.4b in first four days (abnormally high #s). $IBIT is… pic.twitter.com/mYBLggYlYK

— Eric Balchunas (@EricBalchunas) January 18, 2024

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

1 year ago

79

1 year ago

79