ARTICLE AD

Bitcoin struggles amid the negative performance of Bitcoin ETF products.

Key Takeaways

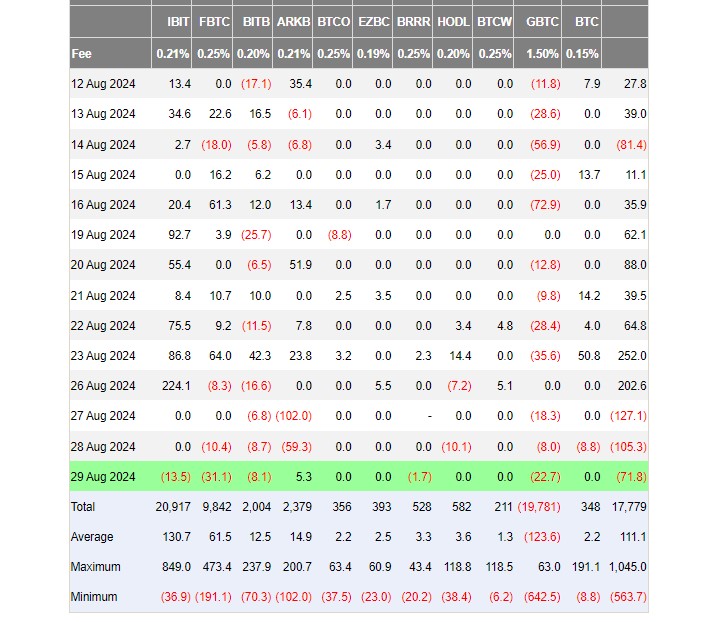

The iShares Bitcoin Trust saw its second outflow since January, reporting $13.5 million withdrawn. US spot Bitcoin ETFs have experienced a three-day streak of net outflows. <?xml encoding="UTF-8"?>Investors pulled $13.5 million from BlackRock’s spot Bitcoin exchange-traded fund (ETF), the iShares Bitcoin Trust, on August 29. The withdrawal marked the fund’s second day of outflows since its January launch, data from Farside Investors shows.

Source: Farside Investors

Source: Farside InvestorsBlackRock’s iShares Bitcoin Trust, trading under the IBIT ticker, has seen consistent net capital almost every single day following its trading debut. As of August 29, IBIT drew almost $21 billion in net inflows, with its Bitcoin holdings exceeding 350,000 Bitcoin (BTC).

The fund experienced its first outflow on May 1, totaling about $37 million. On the same day, US spot Bitcoin ETFs saw their largest daily outflow, with approximately $564 million withdrawn.

So far this week, IBIT reported gains only on Monday, with $224 million in new investments. Thursday’s negative performance came after two days of zero flows.

ARK Invest/21Shares’ Bitcoin ETF was the only fund to report net inflows on Thursday, while competing Bitcoin ETFs managed by Fidelity, Bitwise, Valkyrie, and Grayscale, saw a cumulative net outflow of over $63 million.

Overall, the group of US spot Bitcoin ETFs ended yesterday with nearly $72 million in net outflows, extending its losing streak to three consecutive days.

Bitcoin fails to hold $61,000

The negative performance of US spot Bitcoin ETFs comes amid Bitcoin’s ongoing price stagnation.

Bitcoin’s recent attempt to reclaim a stable position above $61,000 faltered, with the price dropping back below $59,000 during Thursday’s US trading session, according to data from TradingView.

Despite a brief climb, Bitcoin was only marginally up by 0.6% over the past 24 hours. At press time, BTC is trading at around $59,000, down around 10% over the past month.

Meanwhile, Ether struggled, recording a slight decline of 0.5% and barely maintaining above the $2,500 mark.

Disclaimer

2 months ago

38

2 months ago

38