ARTICLE AD

Bitcoin ETFs see record institutional adoption and organic growth, according to ETF experts.

Key Takeaways

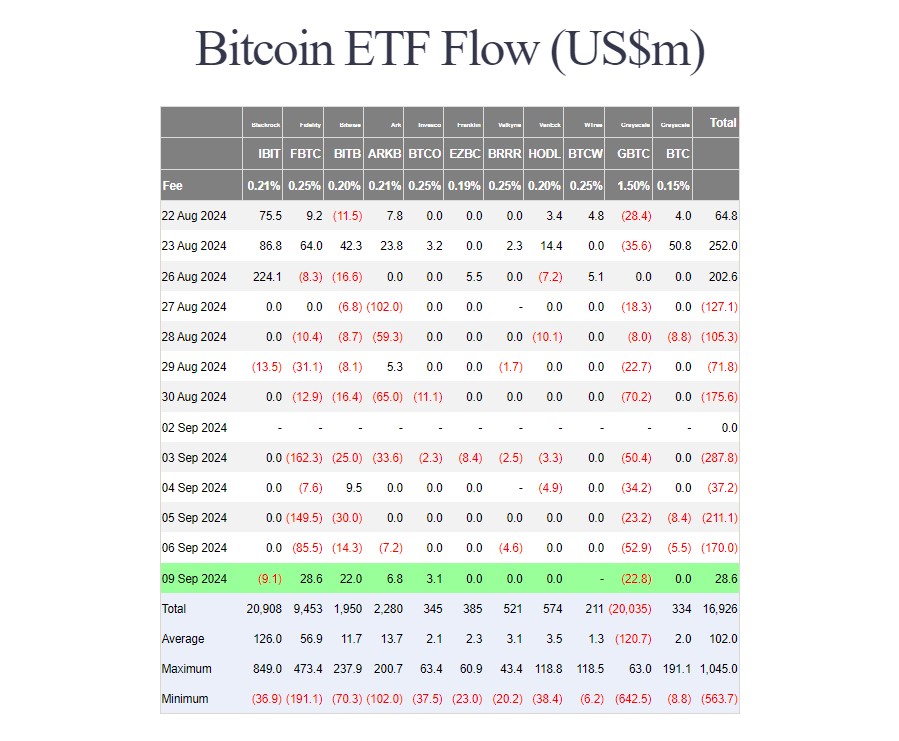

BlackRock's iShares Bitcoin Trust faced a $9 million withdrawal on September 9. US Bitcoin ETFs reversed an 8-day outflow trend with over $28 million in net inflows. <?xml encoding="UTF-8"?>BlackRock’s iShares Bitcoin Trust (IBIT) saw around $9 million in net outflows on September 9, marking its third day of outflows since its January launch. Yet, net flows into US spot Bitcoin exchange-traded funds (ETFs) turned positive, reversing the outflow trend that had been ongoing for the past eight trading days, according to data from Farside Investors.

IBIT’s Monday loss came after the second-ever outflow seen on August 29, followed by a brief period of zero flows in early September.

Source: Farside Investors

Source: Farside InvestorsThe fund has generally attracted consistent inflows, accumulating nearly $21 billion in total with holdings surpassing 350,000 Bitcoin. IBIT reported its first outflow on May 1, with $37 million withdrawn, coinciding with the largest single-day outflow of US spot Bitcoin ETFs.

On Monday, investors poured over $28 million into the Fidelity Wise Origin Bitcoin Fund (FBTC), totaling the fund’s net inflows after 8 trading months to nearly $9.5 billion.

Meanwhile, the Bitwise Bitcoin ETF (BITB) took in $22 million and the ARK 21Shares Bitcoin ETF (ARKB) reported approximately $7 million in net capital. The Invesco Galaxy Bitcoin ETF (BTCO) also captured around $3 million in new investments.

The Grayscale Bitcoin Trust (GBTC) continued to shed assets, losing almost $23 million in Monday trading.

Although the bleeding may have slowed, investors are still withdrawing money from the fund. Roughly $20 billion has left GBTC since it was converted into an ETF, data shows.

As a result, GBTC’s assets under management (AUM) have dropped from over 620,000 Bitcoin (BTC) to around 222,700 BTC, according to updated data from Grayscale. It represents a 60% reduction in BTC holdings since its conversion to an ETF.

Overall, US spot Bitcoin ETFs ended Monday with over $28 million in net inflows.

Investment advisors are driving organic growth in Bitcoin ETFs

Investment advisors are integrating spot Bitcoin ETFs into their portfolios faster than any other ETF in history, said Bitwise Chief Information Officer (CIO) Matt Hougan, responding to recent criticism from researcher Jim Bianco, who pointed out that a mere 10% of US-traded spot Bitcoin ETFs’ AUM are from advisors.

Analyzing BlackRock’s iShares Bitcoin Trust (IBIT), Hougan noted that the $1.45 billion net flow from advisors makes IBIT the second fastest-growing ETF launched in 2024, out of over 300 funds. That contrasts with KLMT, an ESG ETF, which, despite being the largest in terms of assets, sees minimal trading and negligible advisor interest, according to Bitwise CIO.

Supporting Hougan’s points, Bloomberg ETF analyst Eric Balchunas said that the net flow in advisor allocations indeed represents more organic inflows than any other ETF launched this year. He added that over 1,000 institutions now hold Bitcoin ETFs after just two 13F reporting periods, a record he described as “beyond unprecedented.”

The analyst anticipates that institutional holdings in IBIT could double within the next year.

Disclaimer

2 months ago

21

2 months ago

21