ARTICLE AD

Record inflows into digital assets highlight shifting investor interest from traditional safe-haven assets like gold.

Key Takeaways

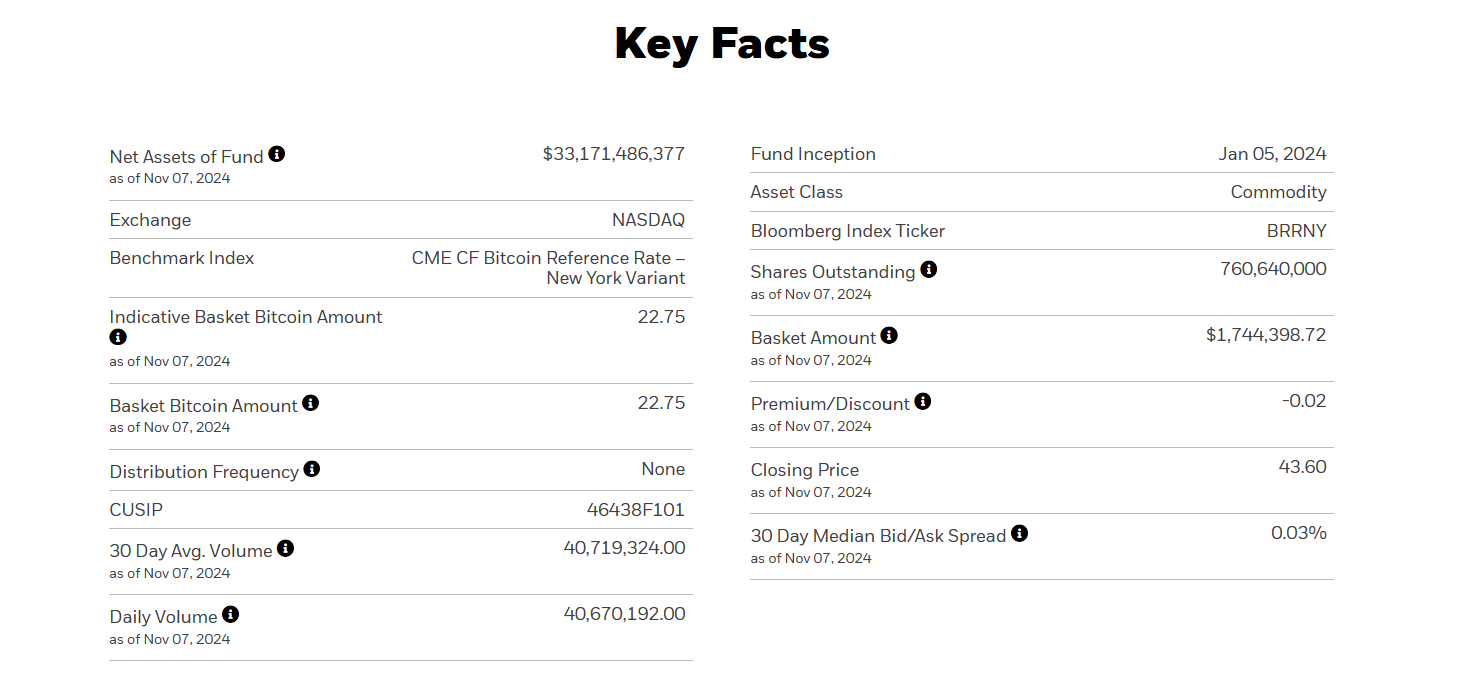

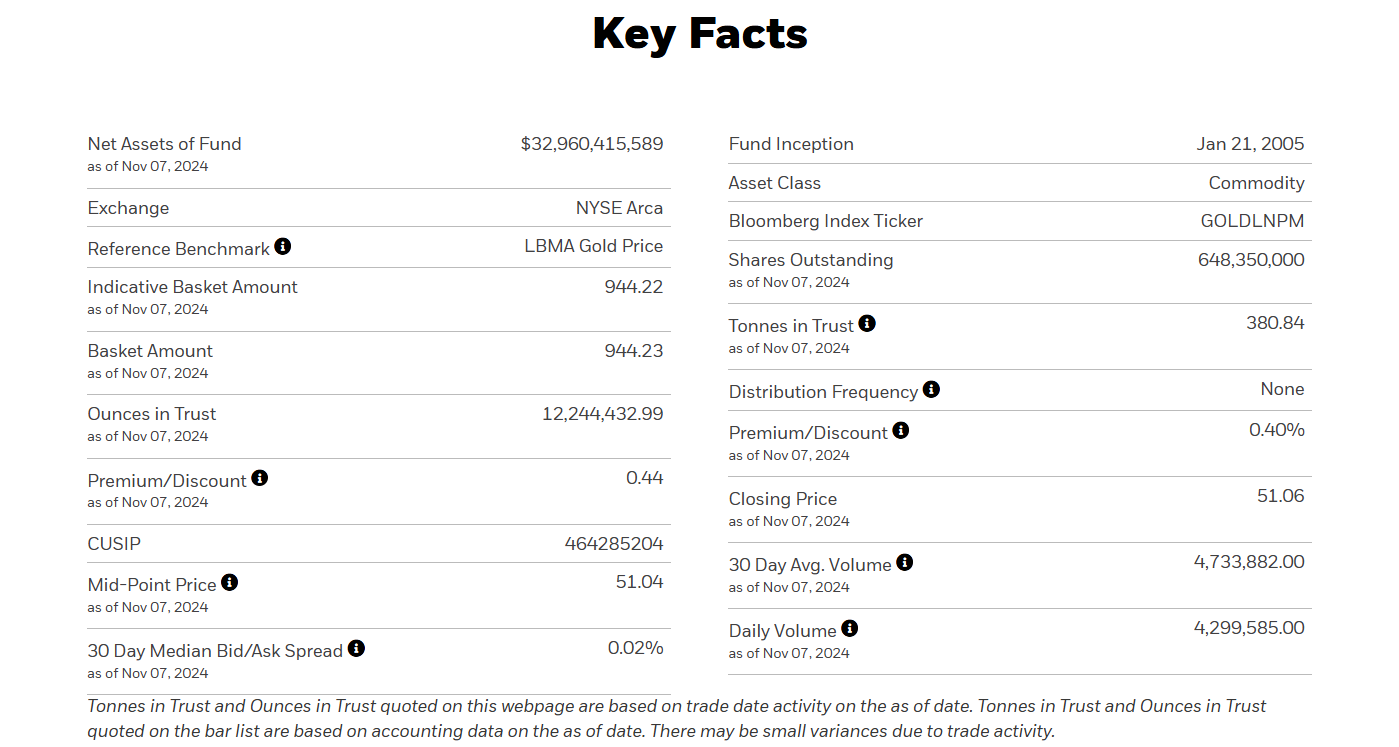

BlackRock's iShares Bitcoin Trust (IBIT) has exceeded its iShares Gold Trust in assets under management. IBIT reached $33.1 billion, attracting massive capital since its launch in early 2024. <?xml encoding="UTF-8"?>BlackRock’s iShares Bitcoin Trust (IBIT) has surpassed its Gold ETF counterpart, the iShares Gold Trust (IAU), in assets under management (AUM). IBIT has amassed around $33.1 billion in AUM, overtaking IAU, which currently holds about $32.9 billion worth of assets.

iShares Bitcoin Trust ETF

iShares Bitcoin Trust ETF iShares Gold Trust

iShares Gold TrustIBIT, launched in early 2024, accumulated more than $10 billion in assets within its first two months of trading, a milestone that took the first gold ETF approximately two years to achieve.

According to data tracked by Farside Investors, IBIT has logged over $27 billion in net inflows since its launch, with a record $1.1 billion added in a single day on November 7.

The surge in IBIT’s assets can be attributed to several factors, including strong demand from retail and institutional investors. The recent rise in Bitcoin prices has also fueled this growth; Bitcoin hit a new all-time high of $76,800 yesterday, CoinGecko data shows.

Bitcoin ETFs’ success over gold ETFs is particularly noteworthy since gold has historically served as a safe-haven asset. The increasing interest in Bitcoin suggests a shift in sentiment as more individuals and institutions consider the leading crypto asset as an alternative or a complement to traditional assets like gold.

Disclaimer

2 weeks ago

8

2 weeks ago

8