ARTICLE AD

The firm constantly raises its iShares Bitcoin Trust stake through its investment funds.

Photo: Leonardo Munoz

Key Takeaways

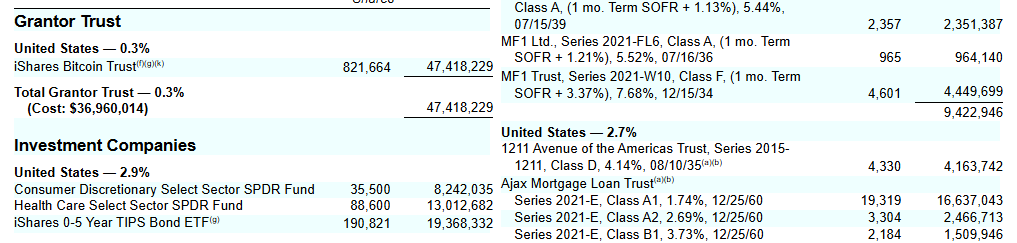

BlackRock's Global Allocation Fund increased its holdings in IBIT by 91% to 821,664 shares as of January 31. The BlackRock Strategic Income Opportunities Fund also holds a significant number of IBIT shares, valued at $77 million. <?xml encoding="UTF-8"?>BlackRock’s Global Allocation Fund has increased its holdings in the iShares Bitcoin Trust (IBIT) by 91% to 821,664 shares valued at around $47 million as of January 31, according to a Thursday SEC filing.

The globally diversified investment strategy, designed to maximize total return while managing risk, added 390,894 IBIT units to its portfolio between November 2024 and January 2025.

The fund has steadily expanded its IBIT holdings from 43,000 shares in April 2024 to 198,874 shares in July 2024.

Apart from the Global Allocation Fund, BlackRock previously disclosed holding $78 million in IBIT shares across two investment funds—the Strategic Income Opportunities (BSIIX) and the Strategic Global Bond (MAWIX).

According to the firm’s most recent disclosure, the BSIIX fund owned 2,140,095 IBIT shares worth approximately $77 million, while the MAWIX fund maintained 40,682 shares valued at about $1.4 million, as of September 30.

BlackRock’s Bitcoin Trust has drawn massive investments from hedge funds, pension funds, and institutional investors since its launch.

Mubadala Investment, the Abu Dhabi sovereign wealth fund, reported last month that it had purchased almost $437 million worth of IBIT shares during the first quarter of 2024, representing one of the first significant investments in crypto assets by a major sovereign wealth fund.

The State of Wisconsin Investment Board (SWIB) also doubled down on IBIT, revealing a $321 million investment by the end of 2024.

As of March 25, BlackRock’s Bitcoin fund had around $49,5 billion in assets under management, according to the fund’s official website.

Disclaimer

3 days ago

7

3 days ago

7