ARTICLE AD

A spot Bitcoin ETF from financial giant BlackRock has become one of the top five exchange-traded products (ETPs) in the United States in terms of capital inflows.

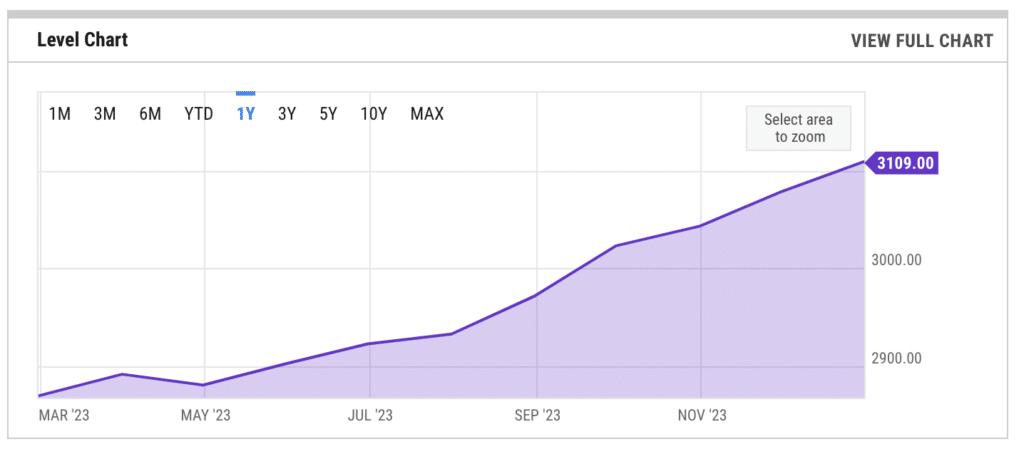

According to data from YCharts, the cryptocurrency fund under the ticker IBIT was in the top 0.16% of 3,109 US ETPs. Experts note that the BlackRock ETF was forced to miss the first seven trading days 2024. The company was awaiting approval from the U.S. Securities and Exchange Commission (SEC).

Source: YCharts

Source: YCharts

Bloomberg senior analyst Eric Balchunas noted that the inflow of funds into IBIT has exceeded $3.19 billion since launch. According to his calculations, BlackRock’s cryptocurrency ETF, by this indicator, entered 0.02% of the largest ETPs in the world. At the same time, the total number of existing exchange products is about 10,000.

Another successful spot Bitcoin ETF is Fidelity Investments’ crypto fund. Since its launch, this investment product has recorded inflows of $2.51 billion.

Analysts note that BlackRock and Fidelity’s crypto funds continue to pull away from other companies’ spot Bitcoin ETFs. In third place regarding the volume of funds received is the investment product from Ark Invest and 21Shares, with an indicator of $697 million, according to SoSo Value.

The only exception is the cryptocurrency ETF of Grayscale Investments. Although this product has lost over $6.1 billion, it remains the most significant asset holder among all crypto funds. The volume of funds under the Grayscale spot Bitcoin ETF management is $20 billion.

11 months ago

63

11 months ago

63