ARTICLE AD

Only 152 ETFs traded in the US are part of the "$10 Billion Club", according to Bloomberg analyst Eric Balchunas.

BlackRock’s spot Bitcoin exchange-traded fund (ETF) IBIT now holds over $10 billion in assets under management, according to Bloomberg ETF analyst Eric Balchunas. He highlighted that IBIT was the fastest ETF to surpass this threshold.

There are 152 ETFs, out of 3,400, in the “$10 Billion Club,” including IBIT and Grayscale’s GBTC. Balchunas explained to its followers on X that the first $10 billion is difficult to reach because most of the volume has to come from flows. “In IBIT’s case, 78% of AUM [assets under management] is flows.”

However, surpassing the $10 billion mark for the second time is easier, because “market appreciation is a bigger variable.”

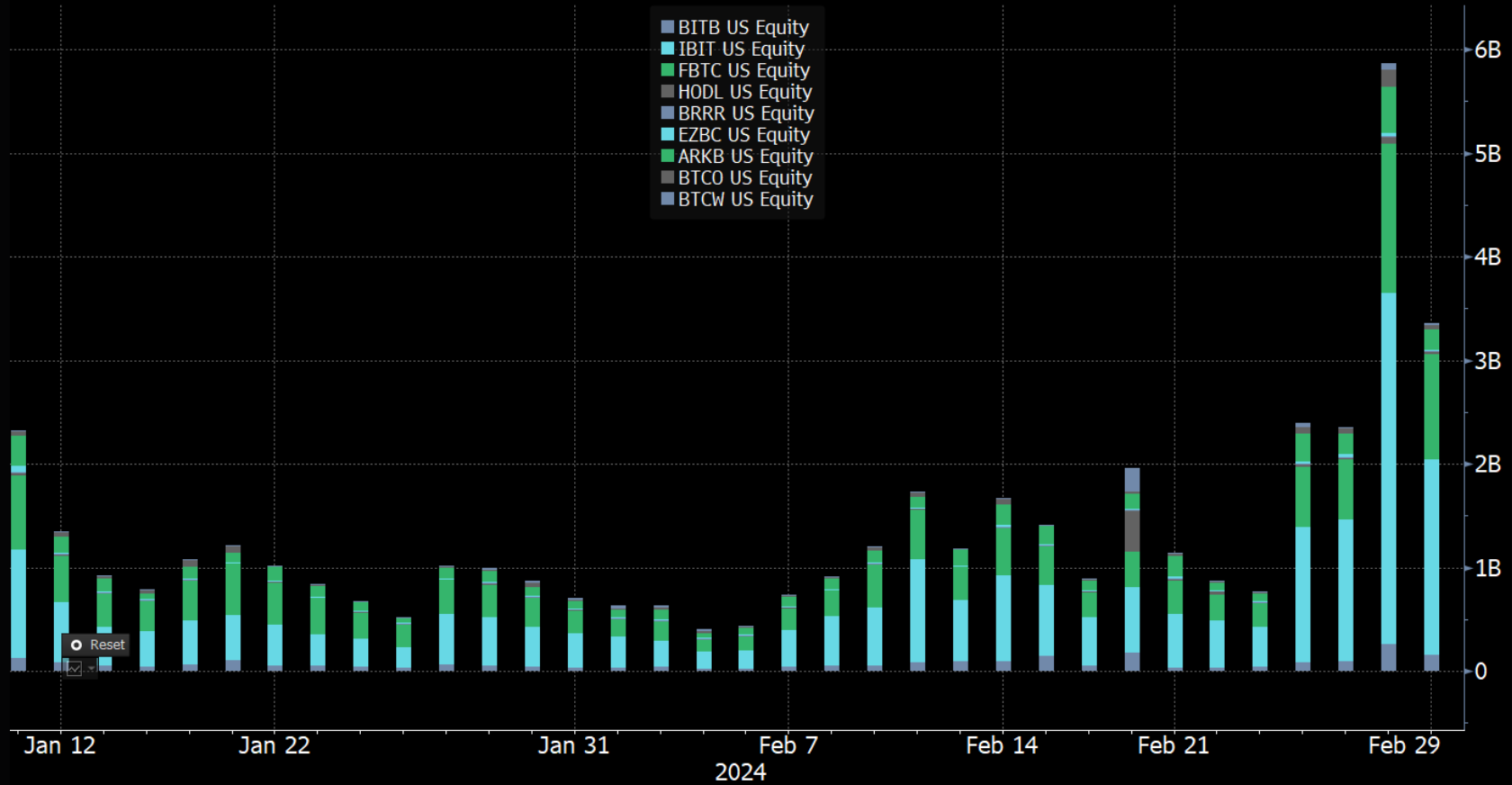

On Feb. 29, the nine spot Bitcoin ETFs traded in the US, excluding GBTC, registered over $3 billion in trading volume. That’s the second-largest daily trading volume of the group, the largest being the previous day, when they registered $6 billion.

Trading volumes of spot Bitcoin ETFs in the US. Image: Bloomberg

Trading volumes of spot Bitcoin ETFs in the US. Image: BloombergBitMEX Research account on X shared that the ten spot Bitcoin ETFs in the US showed $92 million in positive flow on Feb. 29. In Bitcoin, the inflow amount was equivalent to over 1,503 BTC.

IBIT and GBTC offset each other’s flows yesterday, according to the post, with BlackRock’s ETF registering $600 million in inflows, while Grayscale’s registered the same amount in outflows.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

8 months ago

44

8 months ago

44