ARTICLE AD

Jack Dorsey’s Block, the payments company riding the wave of digital innovation, reported a stellar Q4 2023, fueled by a 37% year-over-year surge in Bitcoin sales and strong performances from both Cash App and Square.

Bitcoin Bonanza: Sales Skyrocket, Holdings Strengthen

Bitcoin continues to be a bright spot for Block, with total sales reaching a staggering $2.52 billion in Q4. This impressive figure reflects the growing consumer appetite for digital currencies and Block’s strategic positioning in the market.

Notably, Cash App, the company’s mobile payment platform, saw a remarkable 90% increase in BTC sales profits, reaching over $60 million. This robust growth highlights Cash App’s user-friendly interface and its success in catering to the growing demand for convenient crypto access.

Furthermore, Block strategically increased its remeasured Bitcoin holdings to $207 million, demonstrating a commitment to the long-term potential of the digital asset. This prudent move suggests a belief in Bitcoin’s future value and a willingness to leverage its volatility for potential gains.

The Block report disclosed that:

“The year-over-year increase in bitcoin revenue and gross profit was driven by an increase in the average market price of bitcoin as well as a benefit from the price appreciation of our BTC inventory during the quarter.”

Square Stays Steady, Delivers Solid Growth

While Bitcoin steals the spotlight, Square, Block’s financial services platform for small and medium-sized businesses (SMBs), continues to deliver consistent results.

The fourth quarter saw Square generate a healthy gross profit of nearly $830 million, marking an 18% YoY growth. This steady performance underscores Square’s ability to provide essential financial solutions to businesses, solidifying its position as a trusted partner for SMBs.

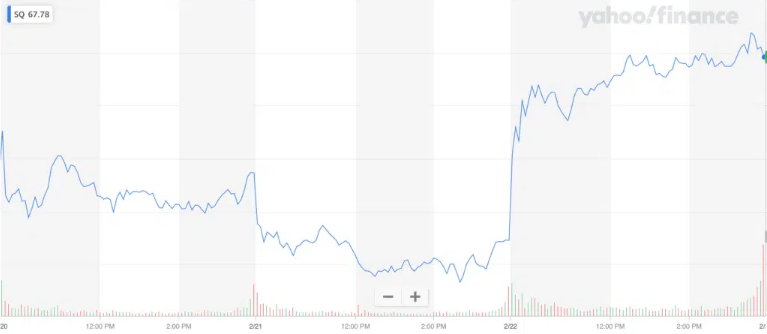

Market Cheers Block’s Success, Share Price Soars

The positive financial results translated to a jubilant market response. Following the earnings release, Block’s stock price experienced a significant jump, closing up 5.40% on Wednesday.

The momentum continued in after-hours trading, with shares gaining an additional 13.23%. This enthusiastic response reflects investor confidence in Block’s ability to capitalize on growth opportunities in the digital payments and cryptocurrency sectors.

Looking Ahead: Navigating Crypto’s Uncertain Waters

While Block’s final quarter performance is undoubtedly impressive, navigating the volatile landscape of cryptocurrency remains a challenge. The inherent price fluctuations and regulatory uncertainties pose risks that require careful management.

Additionally, competition in the digital payments space is fierce, with established players and innovative startups vying for market share.

Featured image from Karolina Grabowska/Pexels, chart from TradingView

1 year ago

64

1 year ago

64