ARTICLE AD

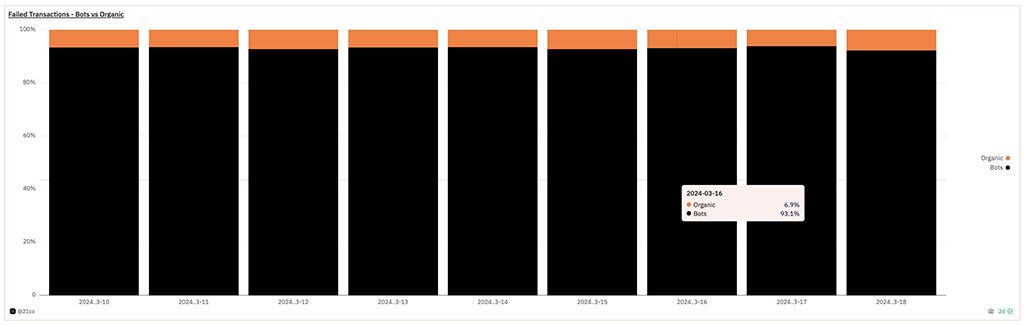

Interestingly, the number of failed transactions from normal users was below 7%. That indicates that bots have overwhelmed Solana’s ecosystem.

Solana (SOL) is on track to be the most dominant blockchain network based on user interest in Q1 2024. According to Coingecko’s data, the heart of meme mania now commands 49% of global blockchain traffic share, followed by Ethereum (ETH) and BNB Chain. However, the scramble for a piece of meme coin activity has tipped wide usage of trading bots to snipe out gems and automate various activities. Consequently, Solana native and Telegram bots have recorded spiked usage that comes with a hefty cost to the network.

Bots Responsible for 93% of Failed Solana Transactions

According to Tom Wan, an on-chain analyst and researcher at 21Co, bots accounted for 93% of all Solana failed transactions recorded on March 16.

Photo: Tom Wan / X

Interestingly, the number of failed transactions from normal users was below 7%. That indicates that bots have overwhelmed Solana’s ecosystem. A look at one of the widely used Solana native bots, BonkBot, also showed a surge in user activity, trading volume, and overall fees in mid-March.

As per Dune Analytics data, total cumulative users crossed 200K in mid-March, with SOL-SLERF and SOL-BOME dominating trading pairs. Another popular multi-chain bot, Banana Gun bot, also recorded all-time high volumes and user activity in mid-March. Over the same period, trading activity spiked, with the Solana ecosystem dominating at $69M in volume.

Like BonkBot, memecoin pairs topped the trading activity in Banana Gun bot. As such, this could explain why the surge in bots activity was linked to the Solana meme frenzy.

Tom Wan recommended two measures to the Solana team to alleviate the bot spamming. First, better logic should be created to prevent block leaders from dropping organic transactions. Secondly, better incentives should be used to disincentivize bots from spamming the network.

In the meantime, SOL traded below $200 and faced a crucial bearish order block (OB) on the 4-hour chart at $185.01 – $191.60. At press time, BTC struggled to reclaim $68K. Hence, SOL’s move above the order block could determine bullish intentions to reclaim the $200 psychological level if BTC surges beyond $68K.

8 months ago

42

8 months ago

42