ARTICLE AD

Cardano (ADA) is among the few cryptocurrencies that are still observing loss-taking being the dominant behavior among investors.

Bitcoin & Ethereum See Profit-Taking, While Cardano Is Seeing Capitulation

According to data from the on-chain analytics firm Santiment, Bitcoin (BTC) and Ethereum (ETH) have both been seeing the investors majorly selling at profits, while Cardano has seen the loss-taking outweigh the profit-taking.

The indicator of interest here is the “Ratio of Daily On-Chain Transaction Volume in Profit to Loss,” which, as its name already suggests, tells us about how the loss-taking volume of any asset compares against its profit-taking volume.

This metric works by going through the transaction history of each coin currently being moved on the blockchain to see what price it moved at before this. If the previous transfer price for any coin was less than the spot value it is being sold at now, then its sale is contributing towards the profit-taking volume.

Similarly, the coins of the opposite type (that is, those with last price higher than the latest transfer price) add to the loss-taking volume. The indicator takes the total volume of each type and outputs their ratio.

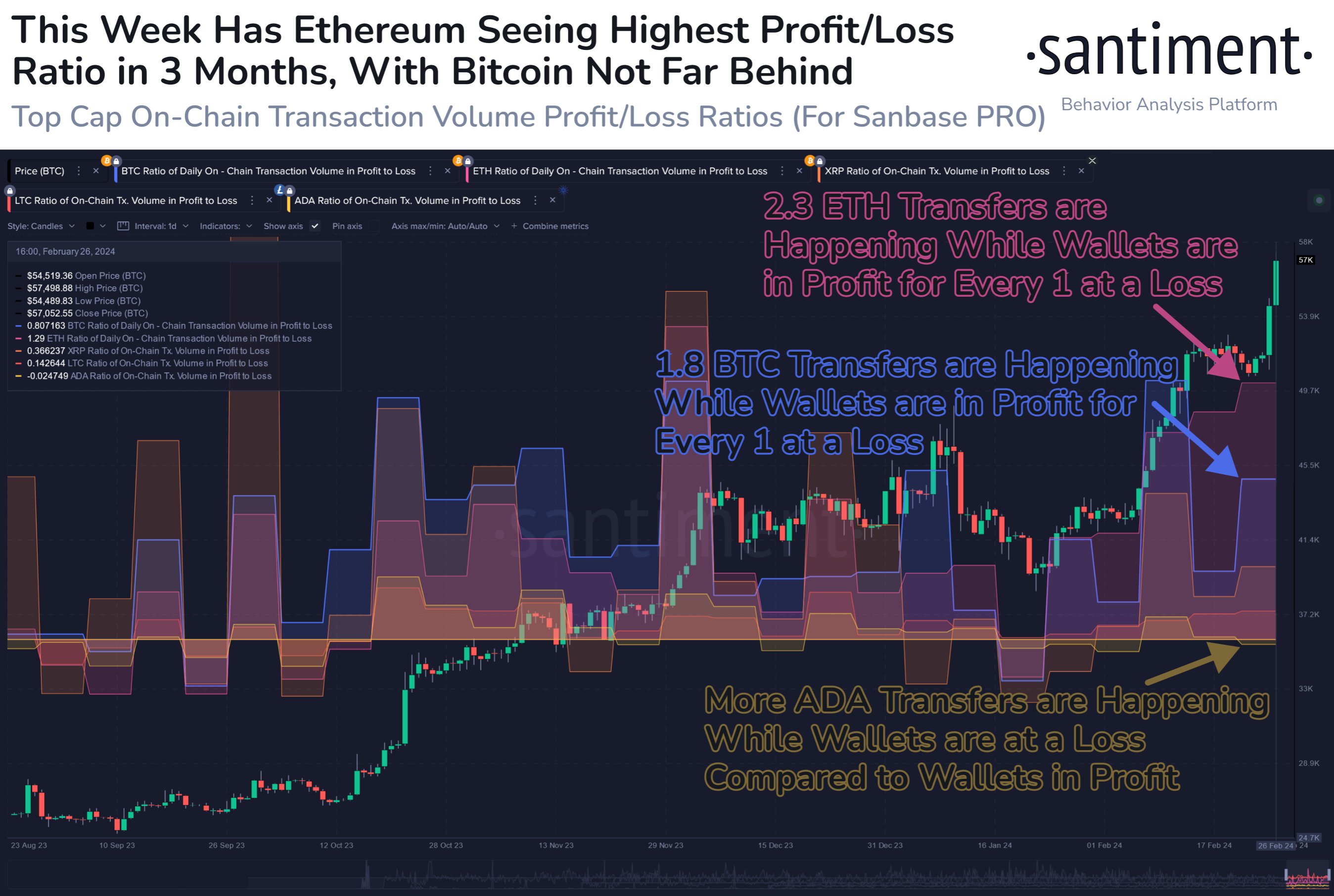

Now, here is a chart that shows the trend in this ratio for a few different top cryptocurrencies over the last few months:

As displayed in the above graph, all of these assets, except for Cardano, have their Ratio of Daily On-Chain Transaction Volume in Profit to Loss sitting at positive values right now.

Such values of the metric imply the profit-taking volume is currently greater than the loss-taking volume for these assets. Ethereum, in particular, seems to have been observing the most aggressive profit-taking spree recently, as the cryptocurrency has been seeing about 2.3 green transactions for every underwater movement.

Bitcoin is seeing the second-highest ratio, with 1.8 profit-taking transactions taking place for every loss-taking transfer. It’s much more balanced for the altcoins, however, as XRP (XRP) and Litecoin (LTC) have only been witnessing minimally higher dominance of profit selling.

Cardano has outright been seeing the loss-taking volume pulling ahead of the profit-taking one, implying that the investors have been going through capitulation. These loss sellers may be ditching the asset in favor of Bitcoin and others, who have offered greener pastures recently.

Historically, the dominance of profit-taking has been something that has led to tops for cryptocurrencies. Loss-taking, on the other hand, has often facilitated bottoms to form as weaker hands flush out in such events and stronger, more resolute investors take their coins.

As such, Cardano has been behind the other top coins in this metric recently may mean that the coin could still have the potential to rise, whereas the others may be nearing possible tops.

ADA Price

While Cardano has performed worse than the likes of Bitcoin and Ethereum recently, its returns have still not been that bad as the asset is up 8% over the past week and trading around $0.63.

Featured image from Shutterstock.com, Santiment.net, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

8 months ago

43

8 months ago

43