ARTICLE AD

Cardano (ADA), the third-generation blockchain platform, has been mirroring a mountain climber clinging to a precarious ledge. After a brief ascent earlier this month, the price has dipped back down, leaving investors questioning the strength of the current uptick.

While a recent surge in active addresses hints at renewed interest, technical indicators and declining trading volume paint a picture of an uncertain future.

Cardano At A Crossroads

Cardano’s current price action presents a complex picture. The recent uptick offers a glimmer of hope, but the technical indicators and declining volume suggest a possible continuation of the downtrend.

Though its impact is still unknown, the increase in active addresses is a promising indication of possible rekindled interest. It will take time to see if ADA can emerge from the gloomy clouds and start its ascent with greater assurance.

Cardano’s Uphill Battle: Price Struggles For Traction

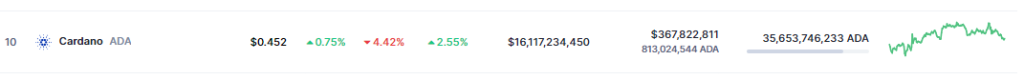

For holders of ADA, May started off with a ray of hope. After a rally of three days, the price increased to $0.46 from $0.45. Nevertheless, a series of losses soon erased these gains, returning the price to the $0.45 region, which is where it was previously. This pattern of stops and starts emphasizes how ADA suffers from a lack of consistent propulsion.

As of today, a small uptick has brought ADA back to the $0.45 zone, offering a temporary respite. But lurking beneath the surface is the persistent bear trend, a fact confirmed by the Relative Strength Index (RSI) hovering just above 40. This metric suggests weak buying pressure and the potential for further price slides.

Source: CoinMarketCap

Source: CoinMarketCap

Making matters worse, a technical indicator known as a “death cross” looms on the horizon. This ominous pattern occurs when the short-term moving average crosses above the long-term average, often signaling a bearish price trend.

With ADA currently trading below both these averages, the threat of a death cross adds another layer of uncertainty to the price trajectory.

Cardano’s Quiet Streets: Trading Volume Dampens Enthusiasm

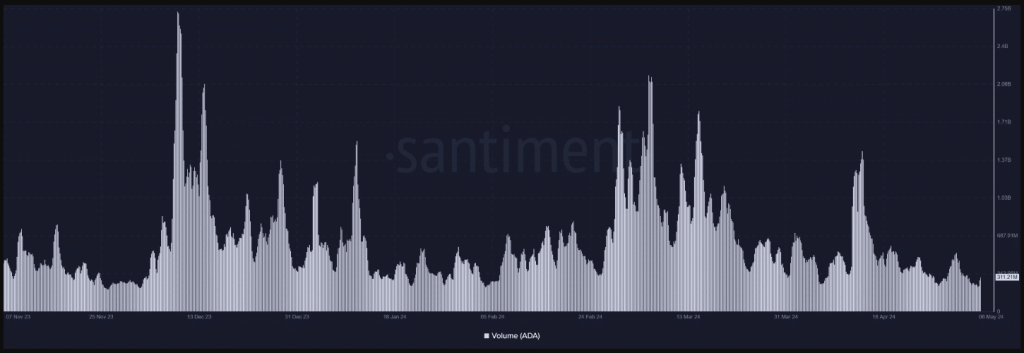

Trading activity on the Cardano network hasn’t exactly been bustling. The volume, which surged to over $400 million at the beginning of May, has since dwindled to around $275 million. This significant drop suggests a decline in investor interest, which can act as a drag on price increases.

Source: Santiment

Source: Santiment

Typically, a healthy increase in volume accompanies sustained price hikes, indicating strong buying and selling activity. In Cardano’s case, the muted volume paints a concerning picture of a market lacking conviction.

Active Addresses Show Tentative Rise

A lone bright spot emerges in the form of Cardano’s active addresses. This metric tracks the number of unique addresses participating in transactions on the network. There’s been a recent uptick in seven-day active addresses, with the number rising from around 155,000 to over 160,000.

While this increase is encouraging, some analysts believe it might not be substantial enough to significantly impact trading activity and trigger a sustained price reversal.

Featured image from InspiredPencil, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

6 months ago

15

6 months ago

15