ARTICLE AD

Binance's Q1 performance eclipses regulatory woes with robust trading volumes.

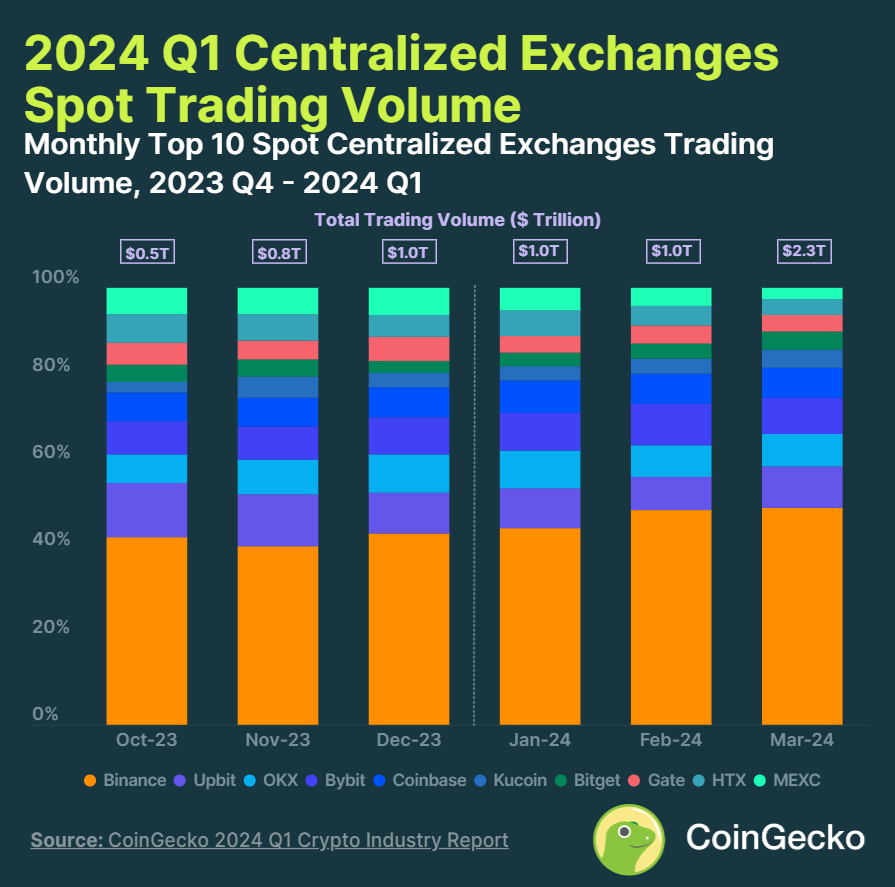

Centralized exchanges registered a crypto trading volume of over $4 trillion in the first quarter, according to a report by data aggregator CoinGecko. Binance recovered its market share gradually during Q1 to reach 49.7% in March, when the exchange registered $1.1 trillion in trading volume, marking a 131% increase from the previous month.

The report highlights that the dominance recovery happened despite Binance facing regulatory challenges in the previous year, and attributes the movement to new listings and project launches that have provided traders with a plethora of opportunities.

Meanwhile, Upbit maintained its status as the second-largest exchange, with a 9.4% market share and a spot trading volume of $216.4 billion, a significant 181.6% growth from February.

Image: CoinGecko

Image: CoinGeckoBybit rounded out the top three, commanding an 8.2% market share and $368 billion quarterly trading volume, which represents a 112% quarter-over-quarter increase, pushing OKX to the fourth position.

Moreover, Bybit grew its market share in Bitcoin trading volume by 7.3% in the yearly period, a report by research firm Kaiko shows.

Kaiko analysts also detail how smaller exchanges on offshore markets have gained momentum in the last year, and the movement is particularly noticeable in Bitcoin markets, where Binance has faced increased competition following the removal of its large-scale Bitcoin zero-fee promotion last year.

OKX, Bullish, MEXC, and Bithumb were other crypto trading platforms which registered significant increases.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

50

7 months ago

50