ARTICLE AD

Circle has announced its decision to halt support for the USD Coin (USDC) on the Tron blockchain.

The firm emphasized that this move is part of its commitment to maintaining USDC as a trusted, transparent, and safe currency.

Effective immediately, Circle will stop minting USDC on Tron, planning to phase out support for the blockchain network by February 2025. This decision affects Circle Mint business customers, though they can still transfer USDC to other blockchains until the specified date.

1/ We are discontinuing USDC on the TRON blockchain in a phased transition. Effective immediately, we will no longer mint USDC on TRON. Transfers and redemptions of USDC on TRON will continue to operate normally through February 2025. Read the details: https://t.co/kw9A3ZUpWH

— Circle (@circle) February 21, 2024Retail users and those not directly affiliated with Circle are advised to transfer their Tron-based USDC to exchanges where the stablecoin is supported on other blockchain networks.

The company’s choice to discontinue Tron support is not accompanied by a specific reason. However, Circle mentioned that it continuously evaluates the suitability of all blockchains within its risk management framework. The discontinuation is described as the outcome of a comprehensive, company-wide approach that involves various departments, including compliance and business organization.

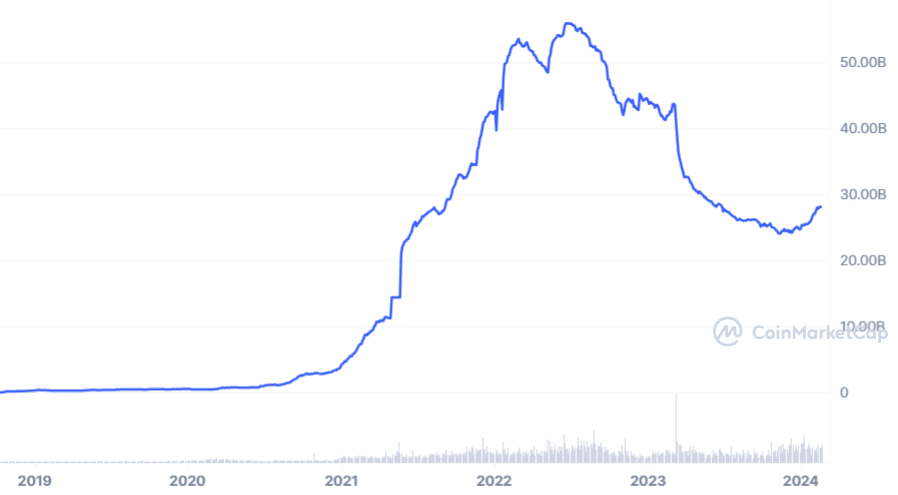

Stablecoins like USDC are cryptocurrencies pegged to fiat currencies, such as the U.S. dollar, and backed by a reserve of assets. USDC is the world’s second-largest stablecoin, with a market capitalization of over $28 billion, as per data from CoinMarketCap. This figure places it among the top 10 cryptocurrencies globally despite a nearly 36% drop in market cap over the past year.

Circle’s USDC market cap | Source: CoinMarketCap

Circle’s USDC market cap | Source: CoinMarketCap

Data indicates that the distribution of USDC across various blockchains is highly skewed towards Ethereum, with more than $22 billion of its total circulating supply hosted there. Solana comes next, holding $1.4 billion, followed by Polygon with $530 million. Tron, by comparison, accounts for a relatively modest $313 million of USDC’s total market presence.

The decision comes after a tumultuous first quarter of 2023 for USDC, marked by bank runs and a banking crisis affecting several large financial institutions, including Silicon Valley Bank. More than a year later, Circle is focusing on expansion in Europe, seeking key licenses to increase its market presence.

Circle’s move to go public in the United States was disclosed last month, highlighting the significant market position of its USDC stablecoin. This announcement came amidst previous denials from Circle regarding service provision to Tron founder Justin Sun, following allegations by the Campaign for Accountability of potential compromise due to integration with the Tron network.

The Campaign for Accountability has linked the Tron network to various international law enforcement actions involving organized crime and sanctioned entities.

Furthermore, the Securities and Exchange Commission initiated a lawsuit against Sun and the Tron Foundation in March 2023, accusing them of issuing unregistered securities and engaging in manipulative trading practices, allegations that Sun refutes.

9 months ago

50

9 months ago

50