ARTICLE AD

Coinbase Global Inc. experienced a 17% increase this week following positive reassessments of the company’s financial strength by several analysts.

According to Bloomberg, JPMorgan’s analyst Kenneth Worthington reversed his previously negative stance on the company’s shares after Bitcoin’s value spiked over $50,000 earlier this week, reaching its highest level since 2021. Worthington revisited his earlier downgrade from January, moving his recommendation to a neutral position from underweight.

His initial downgrade was based on a belief that Bitcoin ETFs’ excitement might wane, a prediction that did not materialize as these funds have performed well in key trading aspects.

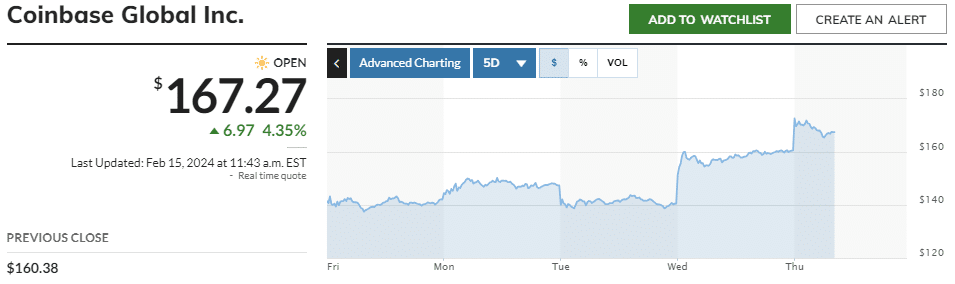

Coinbase Global Inc. five-day stock performance | Source: MarketWatch

Coinbase Global Inc. five-day stock performance | Source: MarketWatch

Another popular analyst, John Todaro from Needham & Co., has projected that Coinbase will report a net income of $103 million for the fourth quarter. Based on a Bloomberg survey, this forecast stands in contrast to the expectations of many other analysts, who had anticipated a loss for the company, around $16 million, or 5 cents per share.

Coinbase’s profitability tends to increase in bull markets due to heightened trading activity from both retail and institutional investors, which raises fee income. The quarter saw Bitcoin’s price escalate by nearly 60%, concluding last year with a 157% increase in the cryptocurrency’s value.

The uptick came ahead of the introduction of spot Bitcoin ETFs. The long-term impact of these ETFs on Coinbase’s business model is still uncertain. The company has previously faced challenges when trading volumes dipped across the industry.

Coinbase has been unprofitable since the crypto winter started in early 2022, following the collapse of Terra Luna and Sam Bankman-Fried’s FTX. This led to the largest exchange in the U.S. laying off hundreds of employees.

9 months ago

53

9 months ago

53