ARTICLE AD

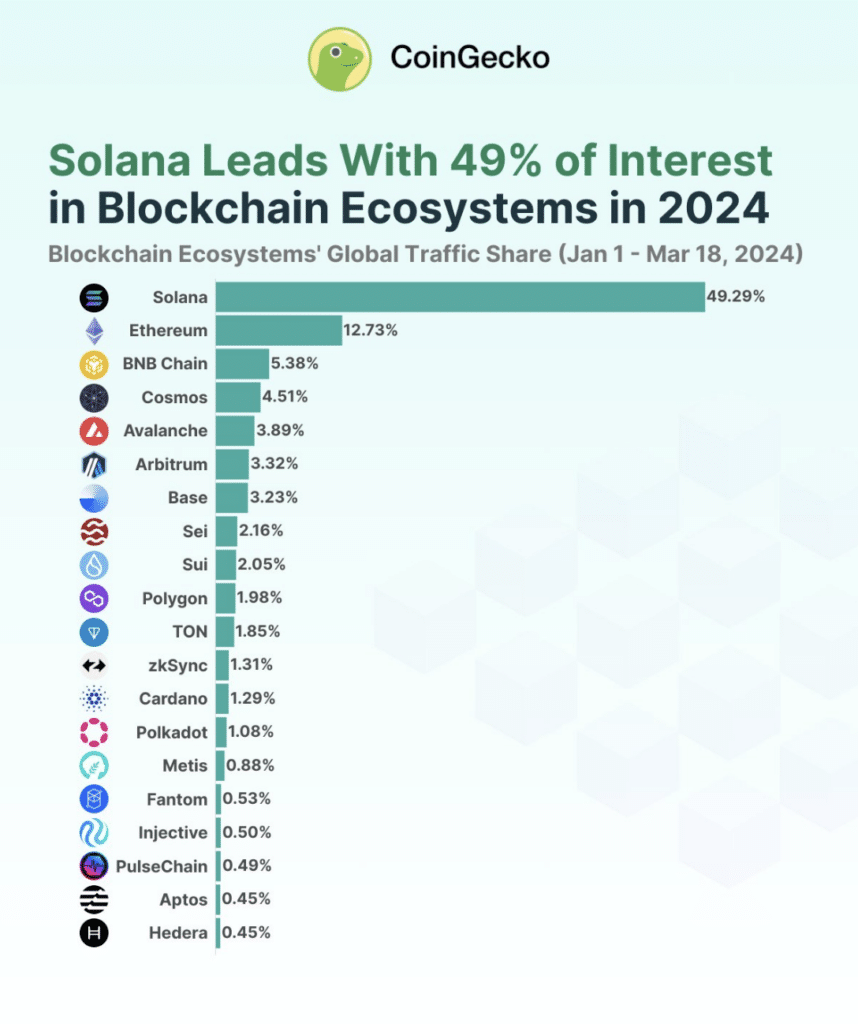

In 2024, Solana accounts for 49.3% of global investor interest in blockchain ecosystems.

Experts from CoinGecko analyzed data on Internet requests between Jan. 1 and March 18, revealing that almost half of investors are interested in Solana. The leadership is fueled by SOL’s growth to highs since 2021, the development of ecosystem projects like Pyth, and the popularity of meme tokens such as Dogwifhat (WIF).

Source: CoinGecko

Source: CoinGecko

Ethereum took second place in the ranking with an indicator of 12.7%, as experts believe that brand awareness and reputation play a role in favor of the ecosystem. However, observation shows investor attention is shifting towards second-layer networks built on Ethereum.

The Binance-supported BNB Chain took third place with 5.4%, with interest mainly due to BNB’s growth. Experts noted that SOL has approached record levels.

Arbitrum and Base became the most popular layer-2 network ecosystems among investors, with 3.3% and 3.2% of investor interest, respectively. Both are built on the Ethereum blockchain. According to CoinGecko experts, investor interest is fueled by leadership in terms of the volume of locked value in the segment in the case of Arbitrum. Behind Base is the largest American crypto exchange, Coinbase.

On March 13, Ethereum developers activated the Dencun hard fork on the mainnet. As a result of the implementation of one of the main components of the update, called EIP-4844, orders of magnitude reduced commissions in layer-2 networks based on Ethereum.

Base was one of the projects that received the most significant benefit from Dencun. Daily transaction volume on the blockchain jumped roughly fivefold as network fees dropped.

8 months ago

48

8 months ago

48