ARTICLE AD

Geopolitical tension and a crypto market lull spurred caution among investors, leading to outflows from investment vehicles last week.

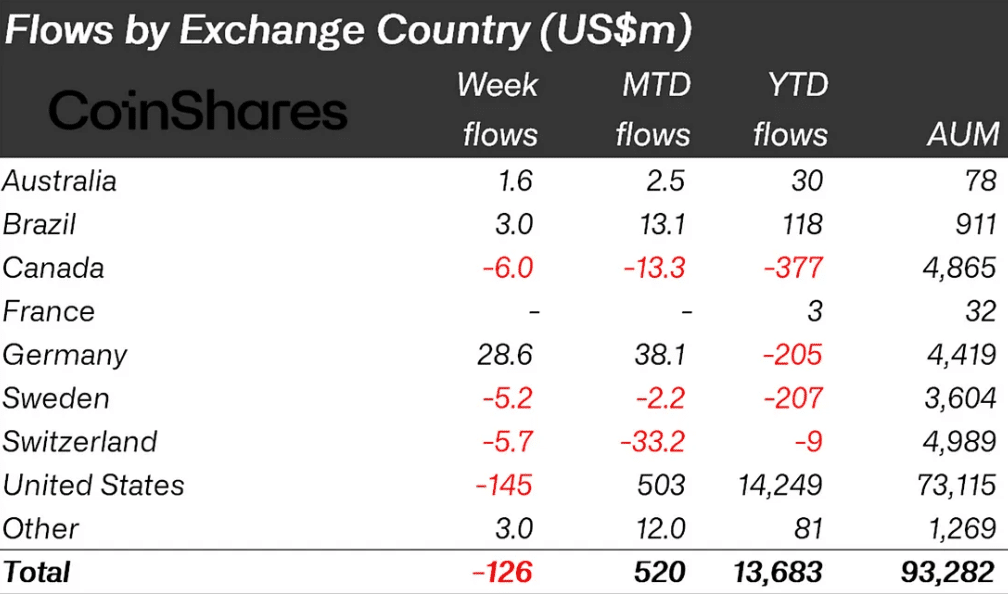

CoinShares reported $126 million in outflows from digital asset investment products. Bitcoin (BTC) declined more than 8% in the past seven days, falling as low as $61,000 on some crypto exchanges, per CoinMarketCap.

Short BTC investors betting on lower prices injected $1.7 million in products and positions to capitalize on a declining market.

Despite outflows, Bitcoin products like spot ETFs sustained inflows of over $555 million month-to-date. General digital asset investment trading volume also experienced an uptick to $21 billion week-on-week, up from $17 billion last week.

However, ETF volumes retraced to 31% of total volume across approved exchanges due to a pullback in investor confidence. The pattern was predominant in the U.S., and this region recorded the largest outflows amounting to $145 million.

Regional digital asset investment product outflows | Source: CoinShare

Regional digital asset investment product outflows | Source: CoinShare

Crypto altcoins capture minor capital, but not Ethereum

While some long-standing altcoin products appealed to investors, Ethereum (ETH) fell out of favor for the fifth consecutive week. Ether investment products saw outflows totaling $29 million. The token also marked an 11% downswing amid a widespread market correction in the past week.

Solana (SOL), once hailed as a so-called ‘Ethereum-killer,’ recorded outflows of $3.6 million. Meanwhile, other products underpinned by veteran virtual assets like Decentraland (MANA), Basic Attention Token, and Lido captured inflows worth $4.9 million, $2.9 million, and $1.8 million, respectively.

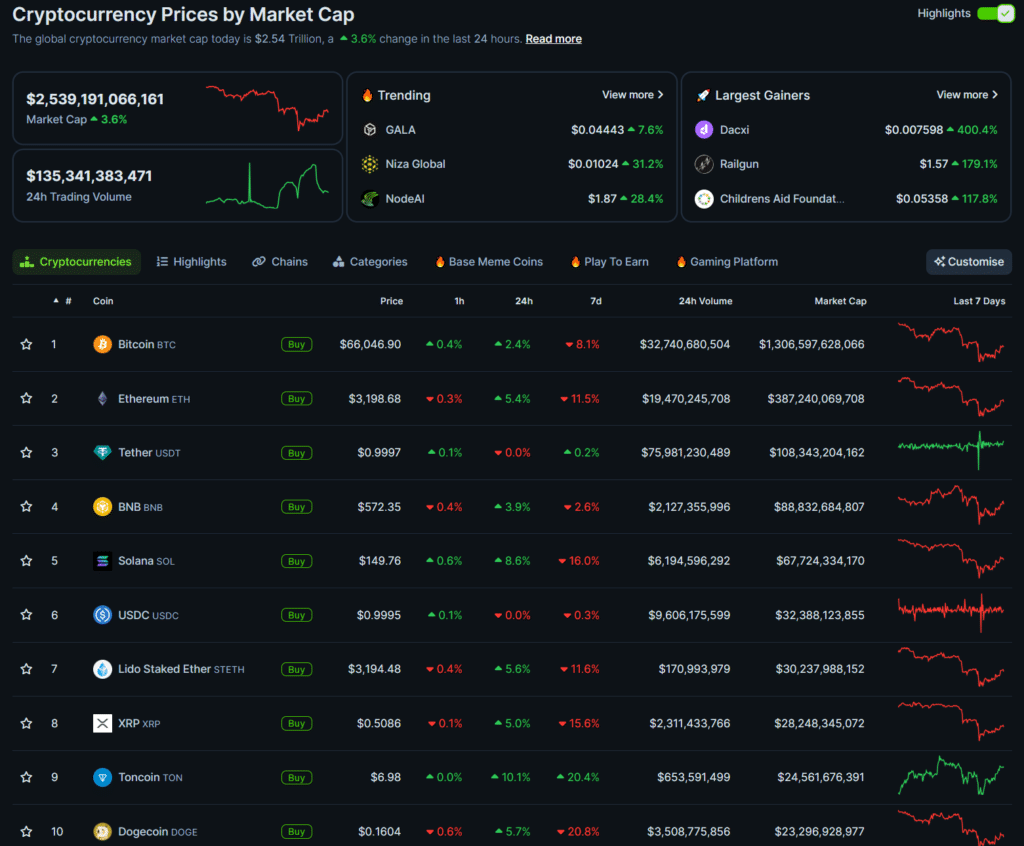

Although markets logged price stagnation and broad retraces across several assets, this week has seen a rebound in positive activity, as CoinGecko said the total crypto market cap jumped 3.6% in the last 24 hours.

Crypto market rebound on April 15 | Source: CoinGecko

Crypto market rebound on April 15 | Source: CoinGecko

7 months ago

40

7 months ago

40