ARTICLE AD

Gold-Backed Tokens Comprise Majority of $1.1B Commodity Crypto Market

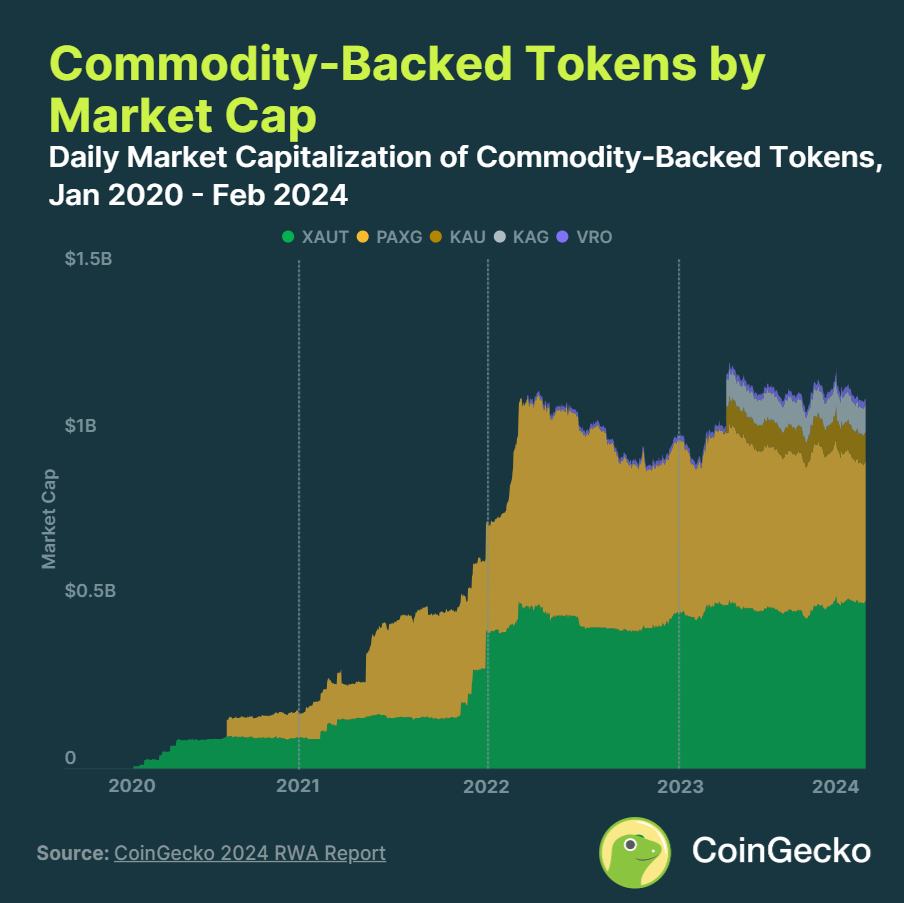

Commodity-backed crypto tokens have reached a $1.1 billion market capitalization, according to “RWA Report 2024: Rise of Real World Assets in Crypto” report by CoinGecko.

The report points out that gold remains the most popular commodity used as backing, with gold-backed tokens like Tether Gold (XAUT) and PAX Gold (PAXG) accounting for 83% of the market cap for commodity crypto tokens. XAUT and PAXG represent ownership of one troy ounce of physical gold stored by the issuer.

“Despite the dominance of tokenized precious metals, tokens backed by other commodities have also been launched,” the report highlights. “For example, the Uranium308 project has released tokenized uranium which is pegged to the price of 1 pound of U3O8 uranium compound.”

While commodity tokens have seen growth, their $1.1 billion market cap is just 0.8% the size of fiat-backed stablecoins. The majority of real-world asset tokens remain US dollar-pegged, with stablecoins like Tether’s USDT, Circle’s USDC, and MakerDAO’s Dai dominating the sector.

USDT continues to dominate the stablecoin market with a 71.4% market share or $96.1 billion in circulation. Meanwhile, USDC’s share dropped after it lost its 1:1 dollar peg during March 2023’s US banking crisis. USDC has failed to recover its former position since then.

The market cap of all stablecoins has grown from $5.2 billion at the start of 2020 to a peak of $150.1 billion in March 2022 before declining. After bottoming out, the stablecoin market cap has begun slowly increasing again, now at $134.6 billion.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing's own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

8 months ago

49

8 months ago

49