ARTICLE AD

Total crypto sent to laundering services dropped significantly in 2023, while Lazarus Group shifted to YoMix for laundering.

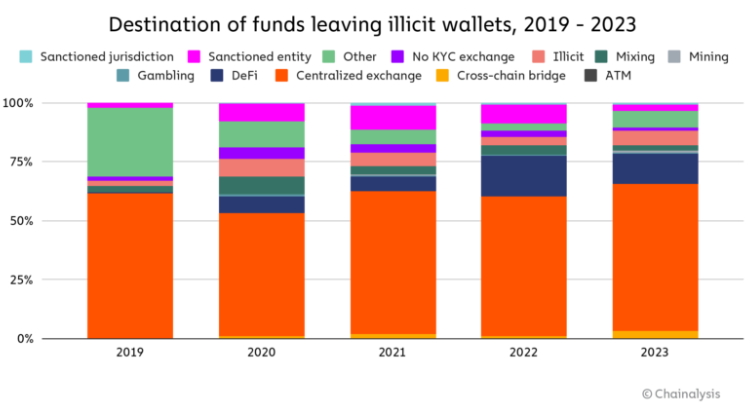

Centralized exchanges continue to be the primary channels for laundering, despite a slight shift in the distribution of illicit funds towards DeFi protocols and gambling services, a Feb. 15 blog post by on-chain security company Chainalysis points out.

However, the use of cross-chain bridges for laundering has surged, particularly among theft-related addresses. The report highlights this as a trend among crypto thieves, facilitating the movement of funds across different blockchains to obscure origins and launder money effectively.

Chainalysis attributes this movement to decentralized finance (DeFi) growth in 2023 while highlighting that DeFi’s inherent transparency generally makes it a poor choice for obfuscating the movement of funds.

The analysis indicates a decrease in the total value of crypto sent to laundering services, dropping from $31.5 billion in 2022 to $22.2 billion last year. This decline surpasses the overall reduction in crypto transactions, highlighting a pronounced decrease in laundering activities.

Image: Chainalysis

Image: ChainalysisMoreover, the report reveals a less concentrated pattern of laundering at individual deposit address levels in 2023, despite a slight increase in concentration at the service level. This suggests a possible strategic spread by criminals across more addresses and services to elude detection and enforcement.

The report also highlights the evolving tactics of sophisticated criminal groups, such as the Lazarus Group, which have moved towards utilizing a wider array of crypto services and protocols. Following the takedown of the mixer Sinbad, YoMix emerged as a prominent tool for laundering, with its use by North Korea-affiliated hackers significantly contributing to its growth.

Overall, Chainalysis assesses that money launderers show an adaptive and sophisticated nature in the crypto space, which puts law enforcement agents in a ‘cat and mouse’ game.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

1 year ago

70

1 year ago

70