ARTICLE AD

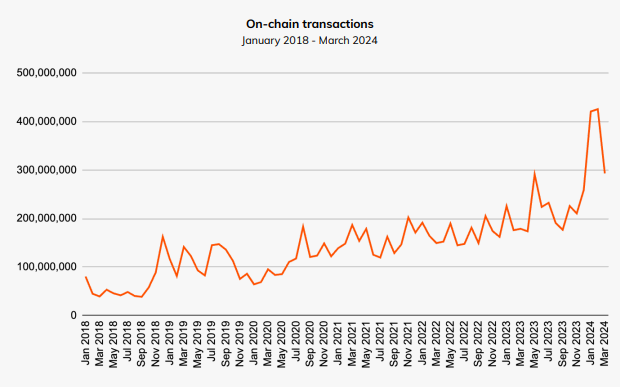

Chainalysis data shows crypto use climbing despite market volatility.

On-chain wallet activity data suggest that investors are more active now than in the previous cycles, suggesting growing market confidence, Chainalysis highlights in its “The 2024 Crypto Spring Report.” The transfer activity during the recent market surge surpassed the peak seen in late 2020 and 2021, and the number of wallets holding a positive balance continues to rise linearly, now boasting over 400 million wallets actively engaged with crypto.

“Though one wallet does not imply one user, as institutions and individuals can have multiple wallets, the volume of growth suggests that cryptocurrency use is growing,” pointed out the report.

Image: Chainalysis

Image: ChainalysisAs the adoption of crypto continues to climb, organizations are prompted to reassess their operational models to fully leverage blockchain technology’s unique opportunities. This is particularly crucial for financial institutions that are integrating crypto into mainstream financial services, underscored Chainalysis.

The mainstreaming of crypto also presents a mix of challenges and opportunities for government agencies and the public sector. The expansion of crypto’s utility increases the risk of its potential misuse. Chainalysis is dedicated to providing comprehensive data and intelligence tools to empower law enforcement agencies to maintain the integrity and security of the crypto ecosystem.

“The transition from winter to spring is not just a revival of fortunes but a significant step towards a future where blockchain technology and crypto assets are integral to our financial and operational landscapes,” adds the report.

Scalability boost

The report also touches on the importance of scalability solutions like the Bitcoin Lightning Network and Ethereum’s layer-2 scaling solutions, which have seen significant growth and are essential for the mass adoption of crypto.

The number of open channels on Lightning Network tripled in one year, reaching 6,000 channels on January 1, 2024. Meanwhile, Ethereum layer-2 blockchains surpassed the mainnet in daily transactions, and the total value locked in Ethereum-to-L2 bridges was at $18.1 billion as of March.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

35

7 months ago

35