ARTICLE AD

Over 278,000 traders were hit by the crypto sell-off.

Key Takeaways

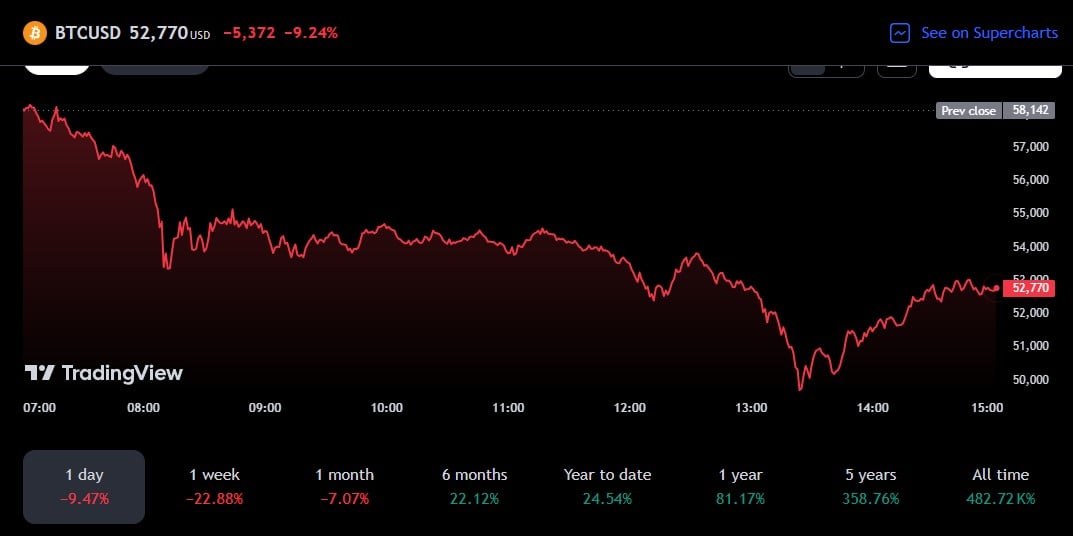

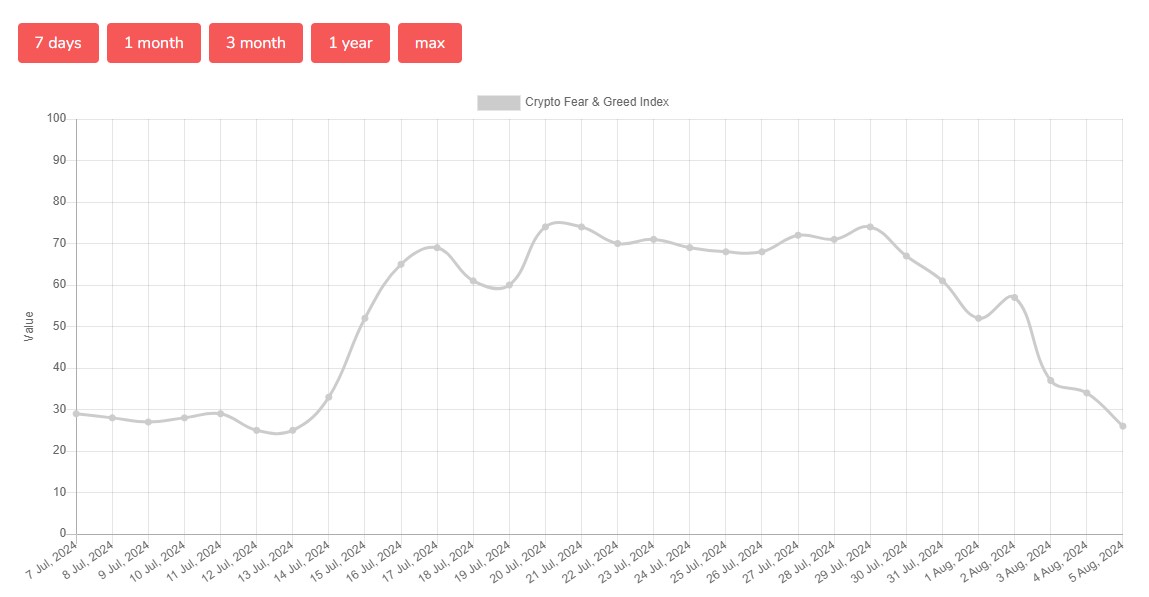

Bitcoin's value dropped by 17%, reaching a five-month low of about $49,700. The Crypto Fear and Greed index reached its lowest level since early July, indicating widespread market fear. <?xml encoding="UTF-8"?>The crypto market has suffered a severe downturn over the past 24 hours, with Bitcoin plunging 17% to a five-month low of approximately $49,700, TradingView’s data shows. The panic sell resulted in over $1 billion in liquidations, according to data from Coinglass.

Source: Coinglass

Source: CoinglassBitcoin, the largest crypto asset, fell to its lowest point since late February before recovering slightly to trade near $53,000. The sell-off triggered a wave of liquidations, with around $900 million in long positions eliminated. Bitcoin traders bore the brunt of the losses, accounting for $360 million in liquidations, followed by Ethereum with $344 million.

Source: TradingView

Source: TradingViewThe sell-off affected over 278,000 traders, including a single liquidation order on Huobi worth $27 million for a BTC/USD trade.

The broader financial market is also experiencing turbulence, with a declining Japanese stock market, growing US recession fears, and reports of speculative crypto sales by Jump Trading contributing to the crypto crash.

Market sentiment has turned sharply negative, with the Crypto Fear and Greed Index plunging into “fear” territory—its lowest level since early July, reflecting heightened anxiety among investors.

Source: Alternative.me

Disclaimer

Source: Alternative.me

Disclaimer

3 months ago

28

3 months ago

28