ARTICLE AD

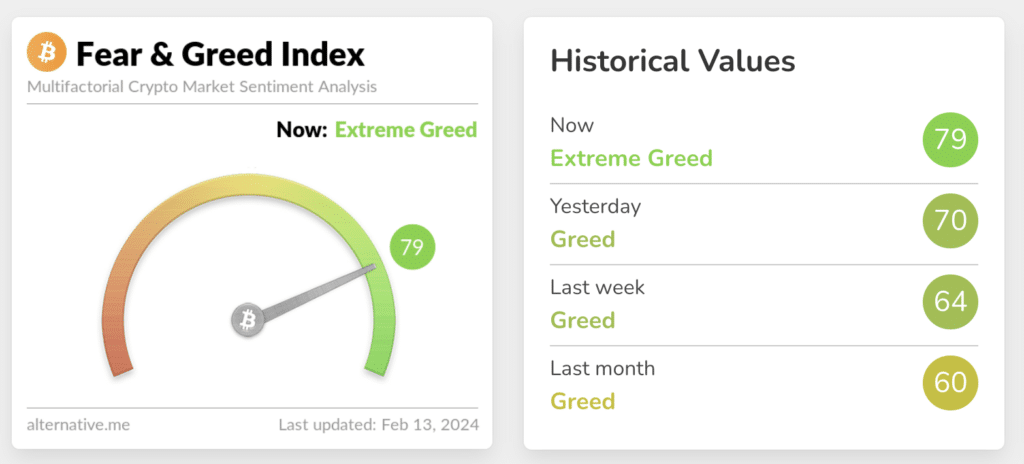

The Fear and Greed index rose to 79 out of 100 points for the first time since Bitcoin (BTC) reached an all-time high of $69,000.

The Fear and Greed index in the crypto market rose to 79 points out of 100, which means market sentiment has shifted to the “extreme greed” sector.

Source: Alternative.me

Source: Alternative.me

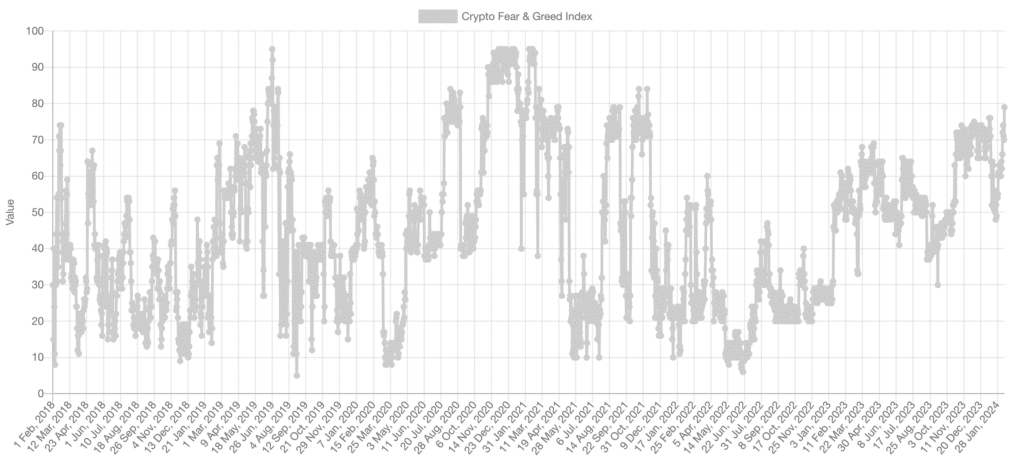

The current value is considered extremely high, last seen in early November 2021 – before Bitcoin reached an all-time high of $69,000.

Source: Alternative.me

Source: Alternative.me

Fear and greed are emotions that often influence investor behavior. Fear is accompanied by massive selling and panic in the market, and greed is accompanied by active buying of cryptocurrencies. The latter can lead to excess demand and artificially inflated coin prices.

In June 2022, after the collapse of the UST stablecoin from Terraform Labs, the indicator dropped to a minimum value of 9 points, showing the extreme fear of crypto investors. At the time of FTX’s bankruptcy filing in November 2022, the index was between 23 and 30 points.

By mid-October 2023, it had recovered to a neutral 52 points, and in November and December – pending the approval of spot Bitcoin ETFs – the index continued to grow in the “greed” zone. On Jan. 9, for the first time in just over two years, sentiment in the crypto market reached the “extreme greed” zone.

Meanwhile, the Bitcoin rate has reached its highest level since November 2021. On Feb. 12, the price of BTC exceeded $50,000. Most of the top 10 crypto assets showed growth in terms of capitalization, according to CoinMarketCap.

9 months ago

53

9 months ago

53